GEM-BOOKS FAQ

How Accounting Periods Work

Please note: the terms “fiscal year”, “financial year” and “financial year” all refer to the period of time, usually one year, at the end of which an administration closes its accounts and prepares its annual financial statements. Fiscal years do not necessarily end in December. Sometimes, they end in the month in which the company was founded.

A financial year is divided into accounting periods. Each company has its own way of doing things. Some prefer to close their periods monthly, others quarterly, and others once a year.

How to Close an Accounting Period

Before closing a period, it is generally necessary to ensure that :

- your bank reconciliation is complete,

- your official accounts receivable age is correct,

- your official accounts payable age is correct,

- your balance sheet is correct,

- your income statement is correct.

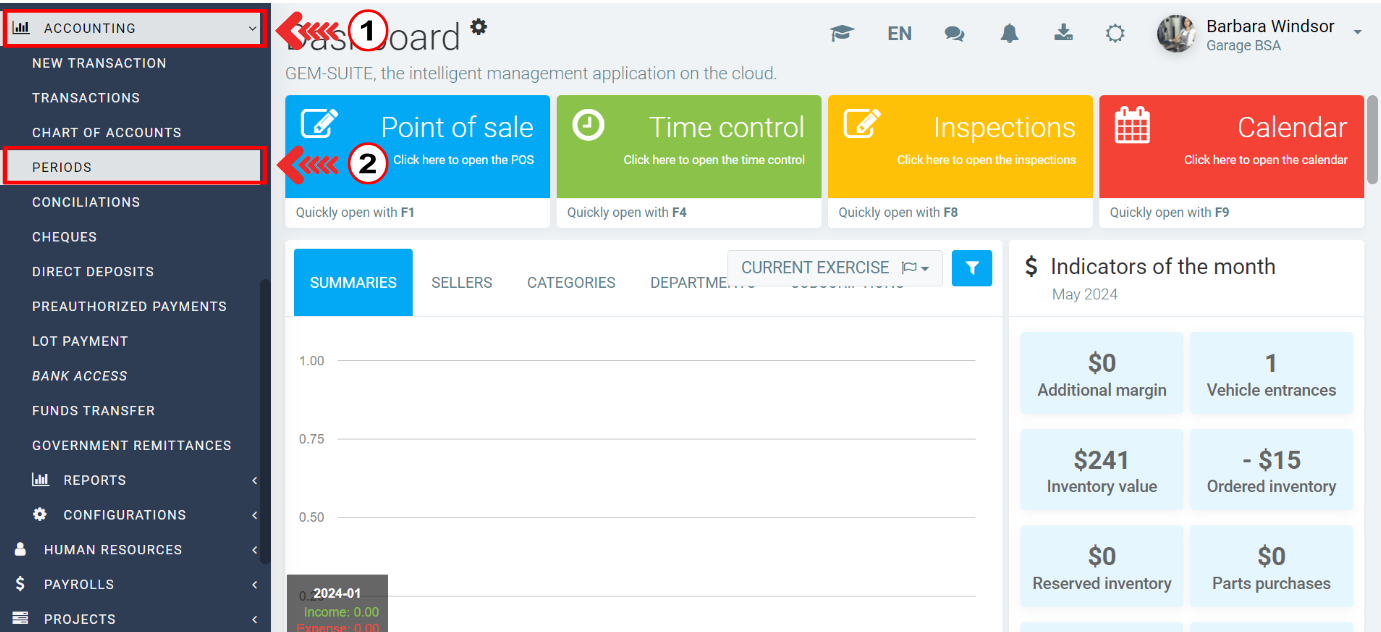

To close a period in GEM-BOOKS, go to the menu on the left and click on Accounting > Periods.

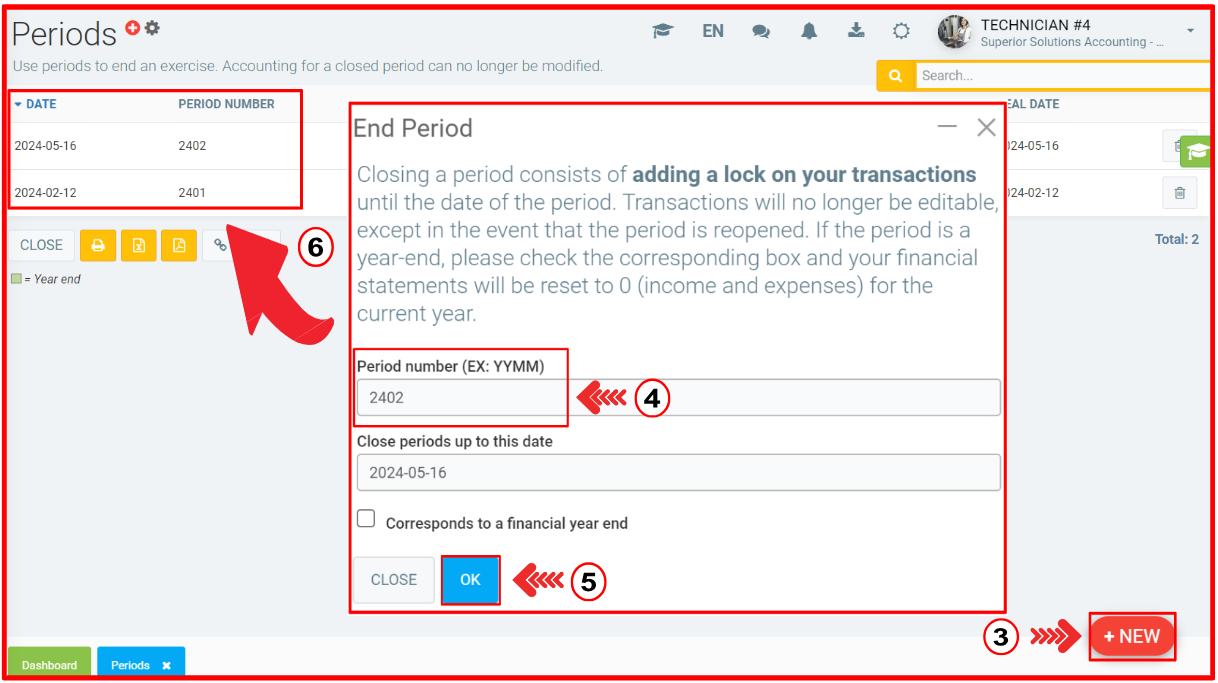

To close a period, click on the +New button at bottom right.

A dialog box entitled End period will appear.

Enter the period number. This number generally follows that of the previous period. Unlike other accounting programs, GEM-BOOKS keeps your data for years. So it's a good idea to name your periods in a way that will be easy to recognize later. For example, “1801” for the period ending in January 2018.

Choose the date on which you want to close the period (often the last day of the month).

If this is the end of your fiscal year, check the ''Corresponds to a financial year end'' box.

Click on Ok to close the period.

It will appear in your list of closed periods.

Posted

8 months

ago

by

Bianca da Silveira De Amorim

#2355

249 views