GEM-BOOKS FAQ

Why open a balance sheet?

When you start using GEM-BOOKS for your bookkeeping, you will need to request a trial balance report on your old software and enter that data into GEM-BOOKS in order to start with the same numbers.

The import of your starting balances will therefore be done in two steps:

1- Starting balances of accounts (Charter of accounts)

2- Starting balances of customers/suppliers (Transactions)

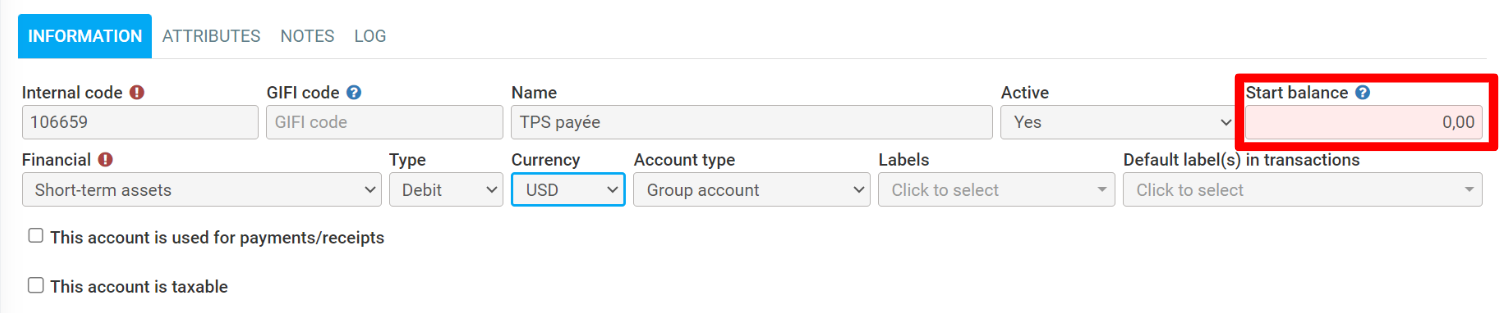

For the first step , you can enter the starting balances of each accounting account in their file. The accounts are accessible from the Accounting menu, Charter of accounts.

On your old software, print a trial balance. Then, for each account, enter the amount in the Starting Account Balance field.

If the balance is credit, please enter a negative amount, if the balance is debit, please enter a positive amount. Repeat the operation for each of your accounts, except accounts receivable and payable. These 2 accounts will be processed in the next step.

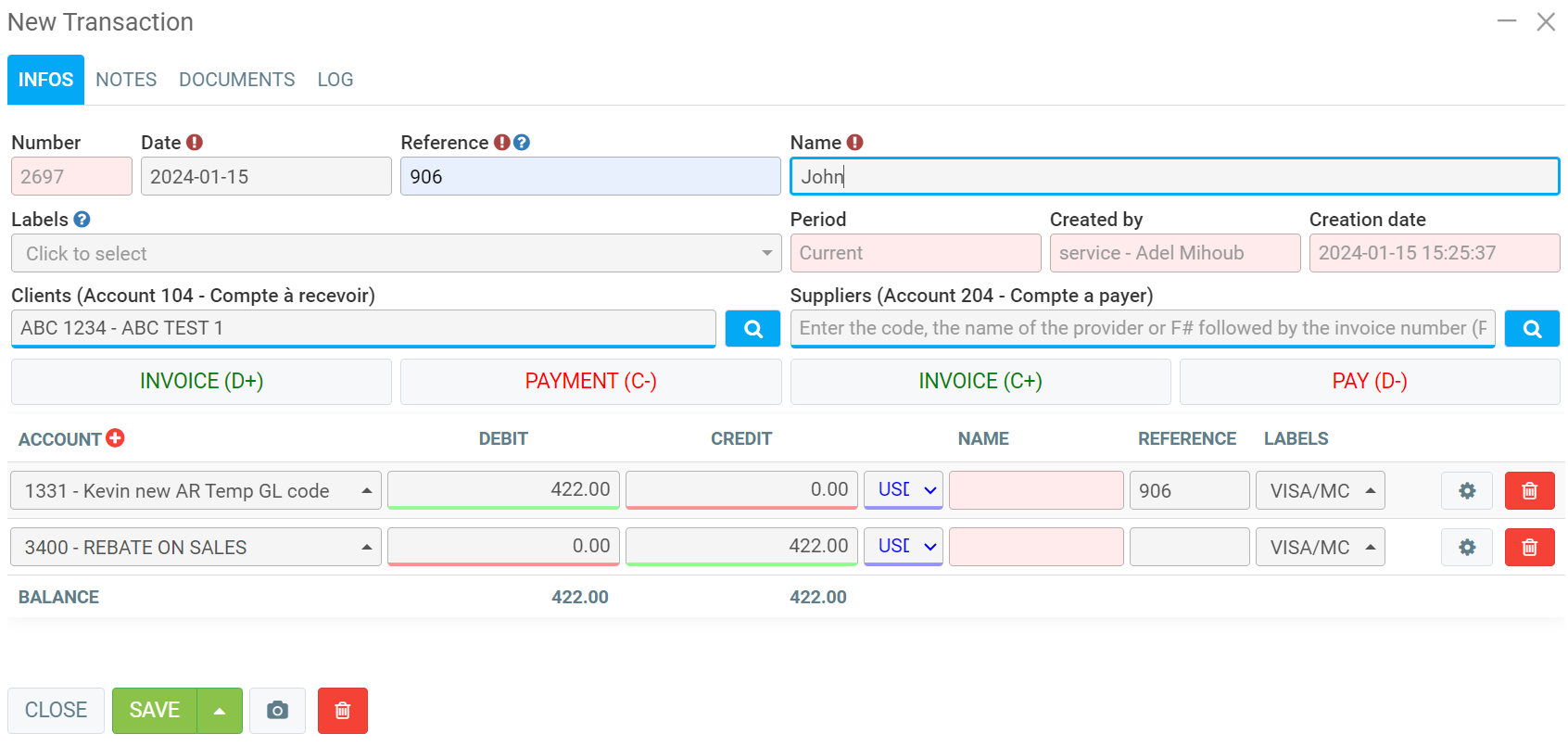

For the second step, you will need to enter a starting balance for each of your suppliers and customers.

To do this, simply create a new invoice type transaction for the customer concerned and instead of using an income account (or expenses in the case of a supplier), choose the adjustments account which by default is account 9999.

You can print an (official) account age from your old software to see all the current transactions that you need to enter in Active.

The final transaction will look like this:

- The receivable (or payable) account with the customer's (or supplier's) opening balance reflecting the total amounts due.

- The adjustments account with the balance balance.

When you have completed these two steps, your accounting will be at the same level from an accounting point of view as your old software.

Posted

10 months

ago

by

Olivier Brunel

#1213

208 views

Edited

10 months

ago