GEM-BOOKS FAQ

How to Produce a CCQ Payroll

The same procedure applies for producing a CCQ pay as for a standard pay. With the exception of the new CCQ deductions and revenues added to the list. Start by consulting the standard pay FAQ and then come back here: Generate a Payroll for One or All of My Employees?

In the previous pay selection filter, the only difference is the presence of the Add AECQ annual payment (CCQ pay only) option. Once a year, it's necessary to make your annual AECQ payment, so when that time comes, activate this option when you run the payroll.

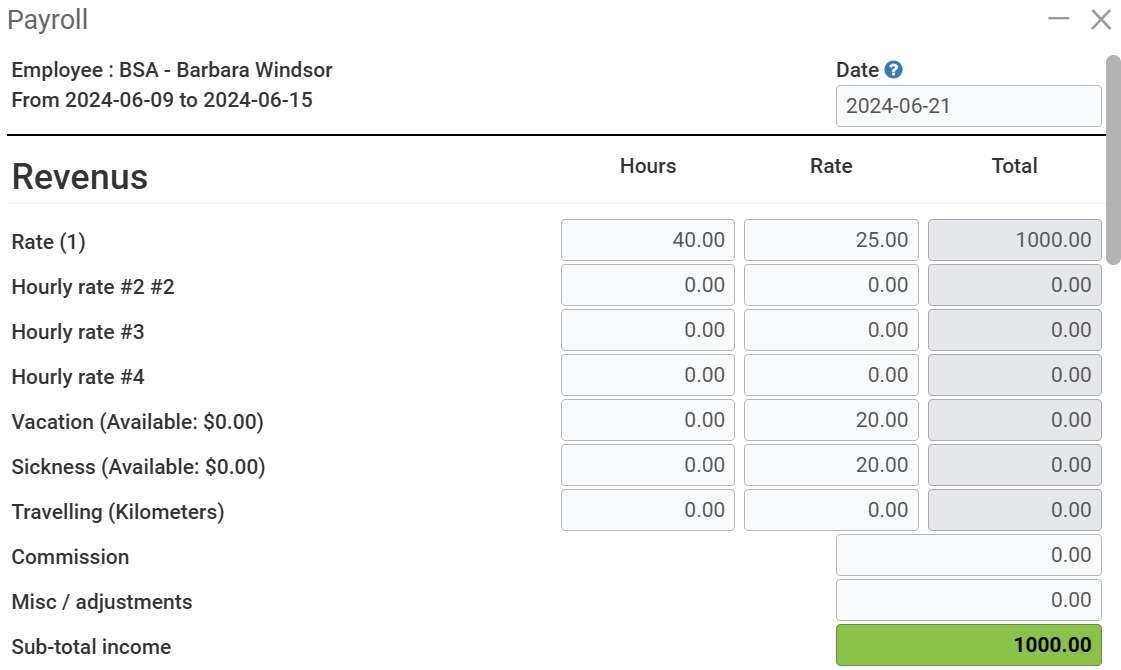

Next, in the payroll screen, you'll notice that some fields are highlighted in green. These are the fields reserved for CCQ payrolls. They will only be displayed if the employee has a CCQ-related category. The first block is the Revenus block:

This is where you specify the number of hours worked by the employee.

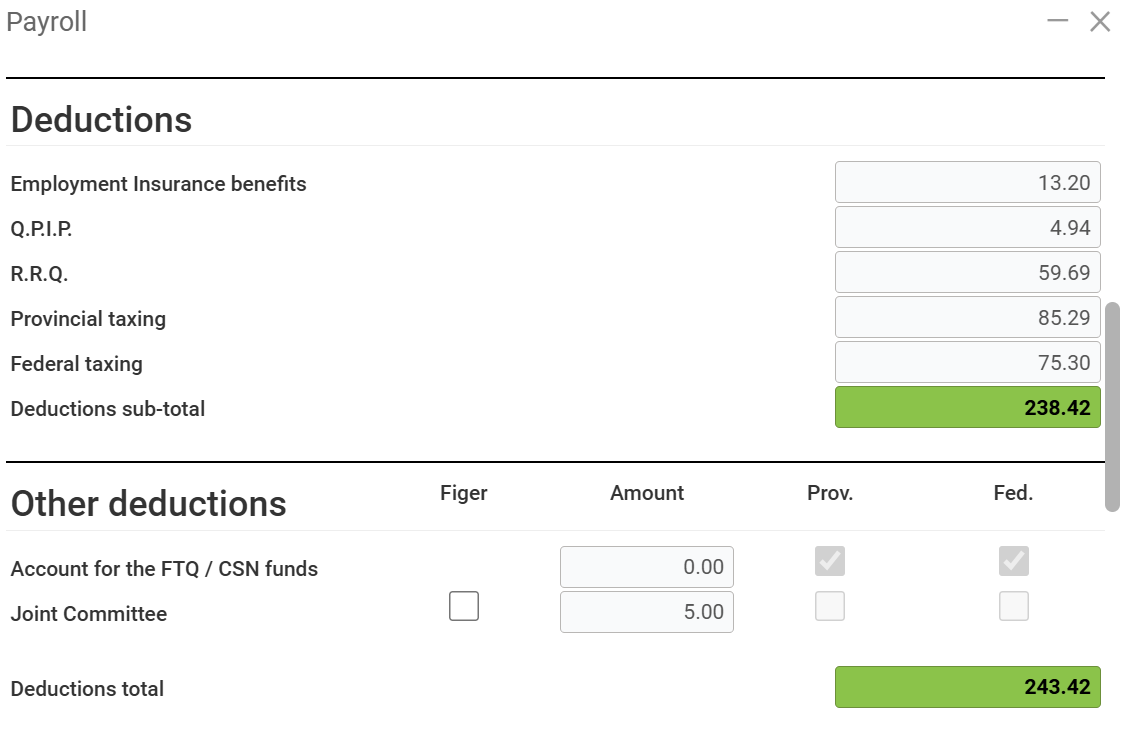

The second block is the Deductions, and the third block is the Other Deductions.

All these deductions come from the CCQ, according to the parameters of the employee category.

No values can be modified here.

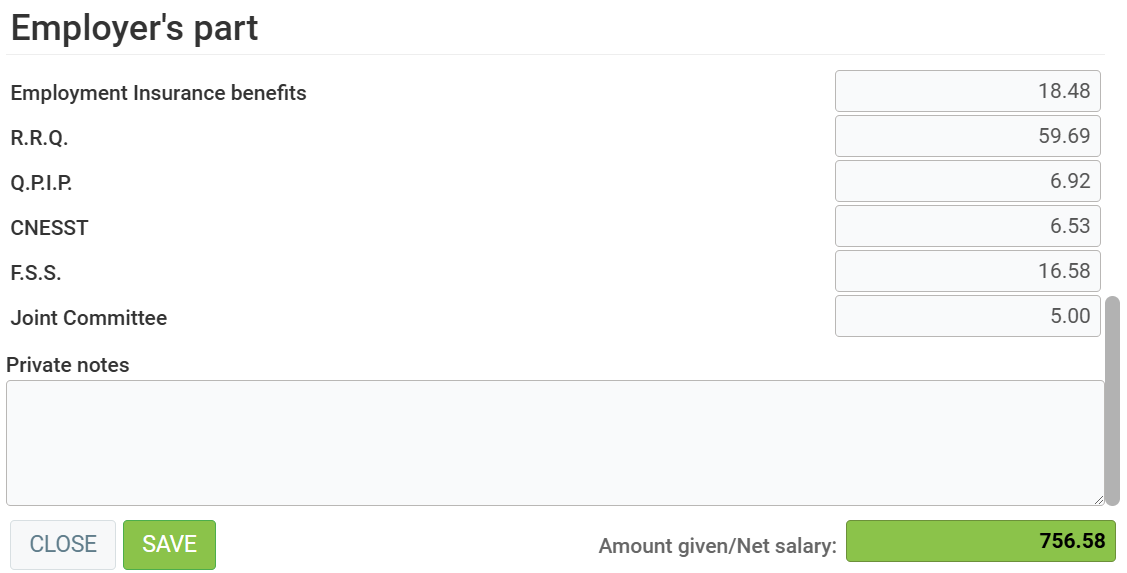

The final block is the Employer's part.

Once again, these values cannot be modified.

The rest of the pay procedure is the same as for standard pays, so please refer to the pay mentioned at the beginning of this FAQ.

Later, you'll need to know Consult the Monthly CCQ Report and Send the Remittance?

Posted

3 weeks

ago

by

Bianca da Silveira De Amorim

#2341

13 views

Edited

3 weeks

ago