GEM-BOOKS FAQ

Transaction with Manual Taxes in GEM-BOOKS

You can set up tax rules to facilitate your operations and calculate taxes automatically when creating sales, purchases, transactions, etc.

Sometimes, you'll receive invoices that don't correspond to your tax rules. There are two ways of dealing with this:

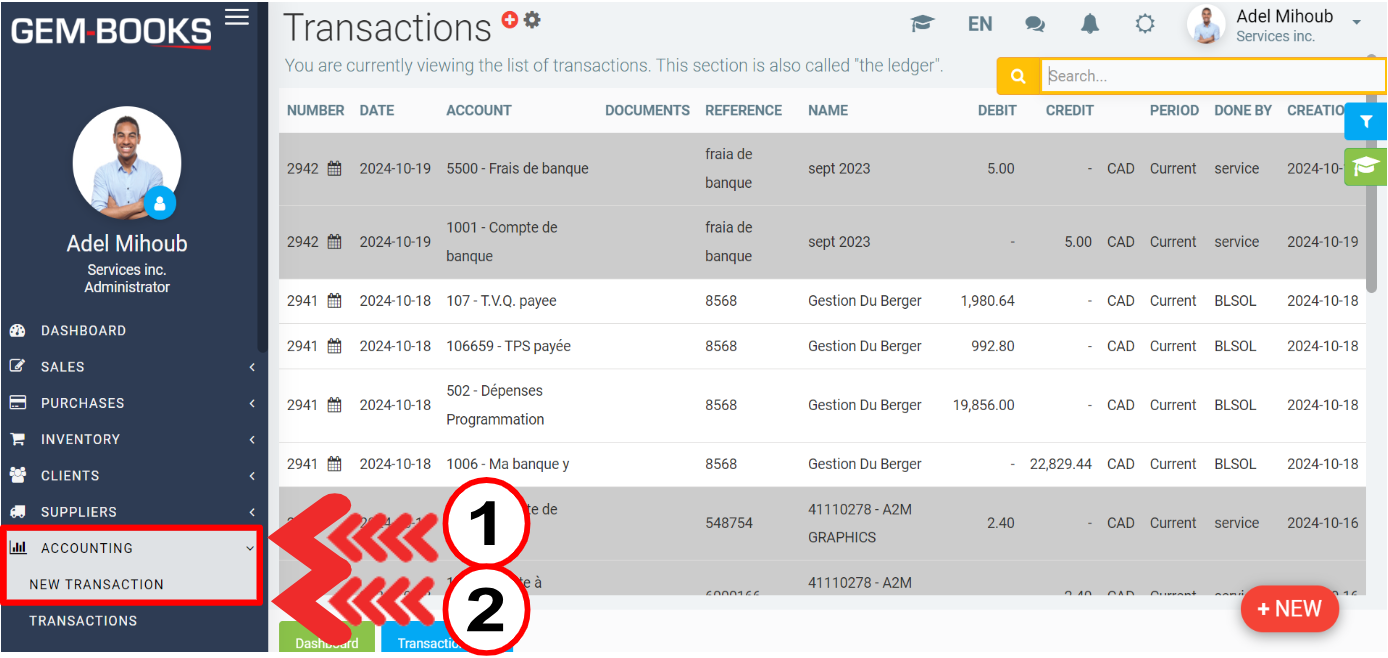

Option 1: Manual transaction

You can simply enter the transaction via the Accounting > New transaction menu.

At this point, enter the transaction in the standard way, for example, by specifying the date, the invoice number and then selecting the customer (if necessary).

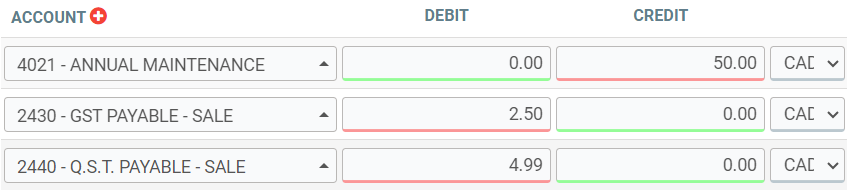

By default, when you select the INCOME account, the taxes configured according to your tax rules will be automatically applied.

Here's an example if I put $50 on a taxable account.

When the income account is modified, the taxes are automatically adjusted.

On the other hand, if you manually modify the amount of the tax accounts, they will stop being modified automatically when the income account is modified.

So, in the event that the tax amount doesn't match the invoice you have on hand, you can easily enter it there by hand, or delete it with the trash can at the end of the line if you don't need to.

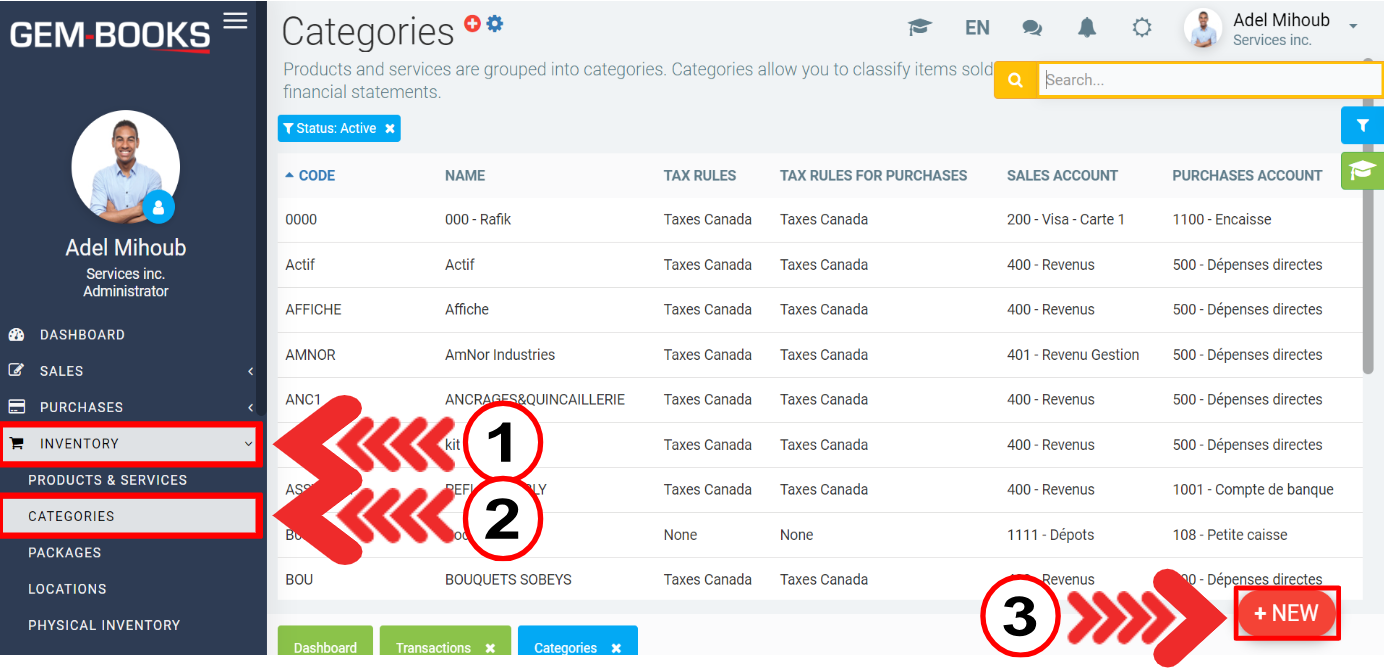

Option 2: Adjustment product

If you need to use the sales or purchasing module to generate documents, you'll need to create a tax adjustment product.

To do this, start by creating a category of products and services called “GST/GST” and one called “QST/QST”.

Click on Inventory > Categories > +New.

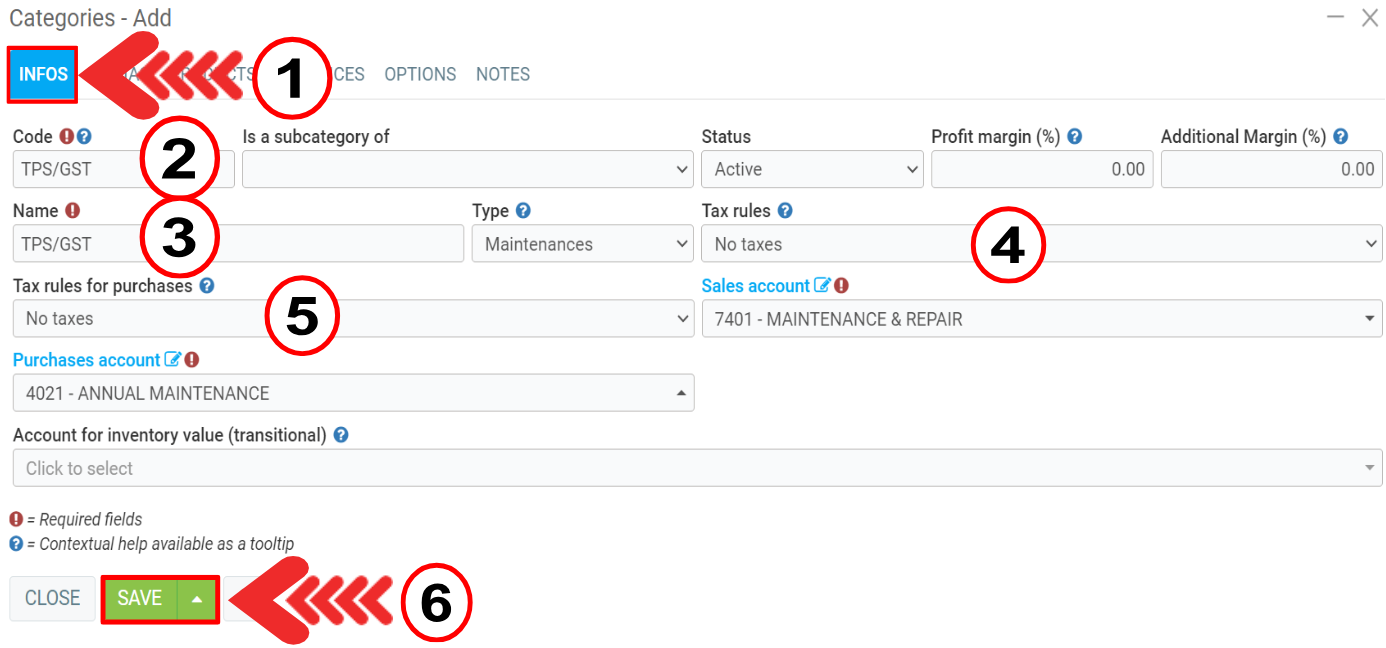

In the Info tab, enter the Code and Name.

In both categories, use the tax rule None, and choose your GST and QST accounts from the affected accounts at the bottom of the list.

Click on Save.

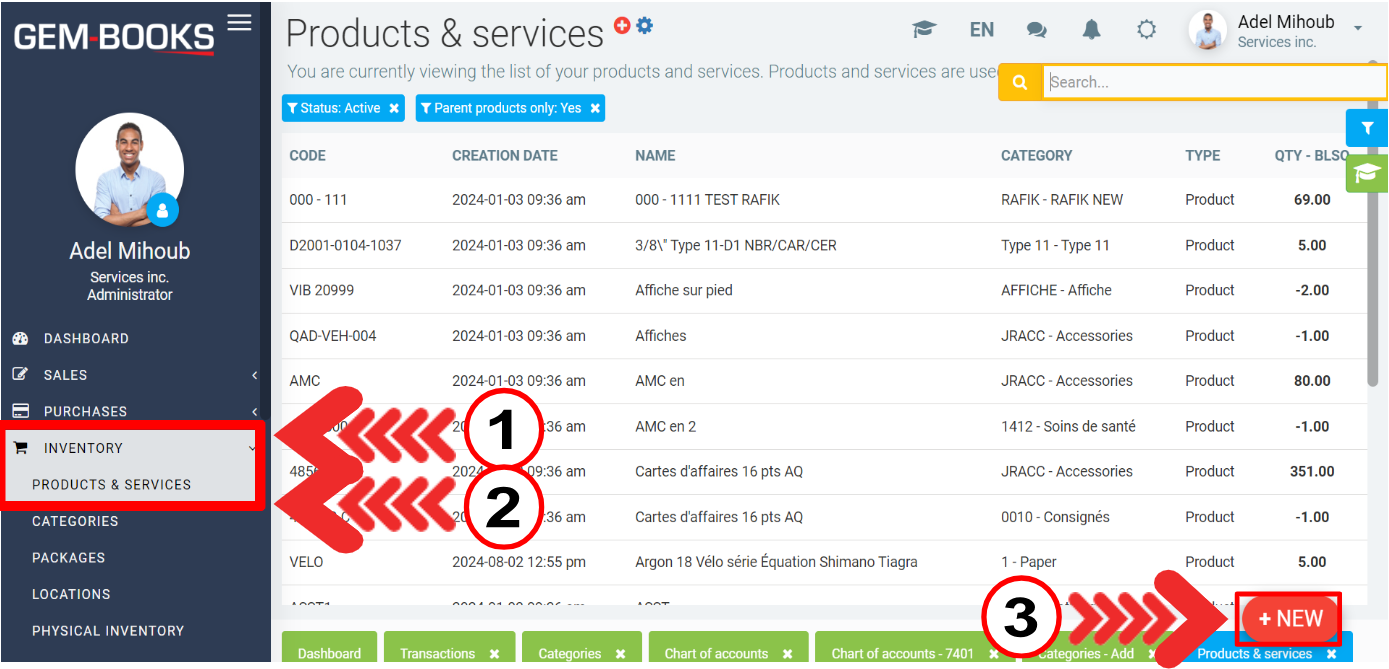

Then click on Inventory > Products and services > +New.

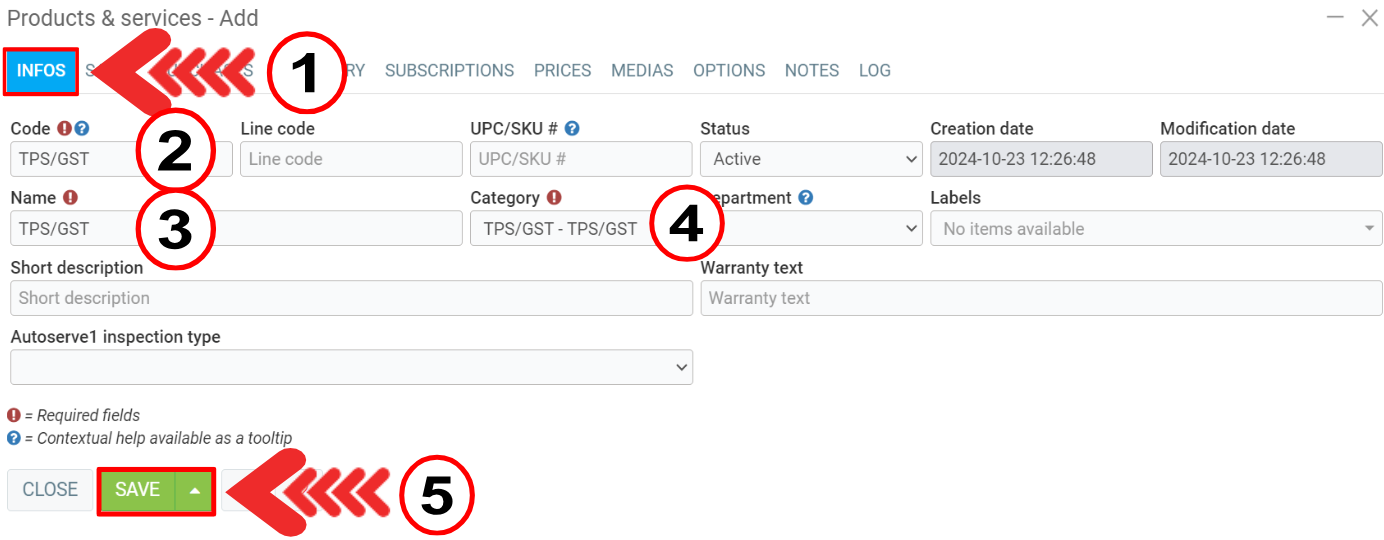

In the Info tab , create a “GST/GST” product linked to the “GST/GST” category and another “TVQ/QST” product linked to the “TVQ/QST” category.

Click on Save.

Now, in your sales and purchases, you can add this product to directly modify the GL account and display the amount on the invoice or purchase order.

Other articles on the subject:

Retrieve your Favorite Transactions in GEM-BOOKS

Examples of Common Transactions in GEM-BOOKS

Purchases To Be Entered Manually in Accounting

Transaction Modification History in GEM-BOOKS

Posted

3 months

ago

by

Bianca da Silveira De Amorim

#2109

45 views

Edited

3 months

ago