GEM-CAR FAQ

How to do your Bank Conciliation

You enter transactions that affect the bank. A good way to monitor your bookkeeping is to verify that the transactions you have entered into GEM-CAR match your bank statement. Also called bank reconciliation, it is not limited to your bank accounts, but also to your credit cards, petty cash, bank account in foreign currencies if you wish.

Every month, an account statement is produced by your financial institution. With this statement, you will be able to accurately compare the transactions recorded in GEM-CAR and those which are not yet recorded, such as bank charges.

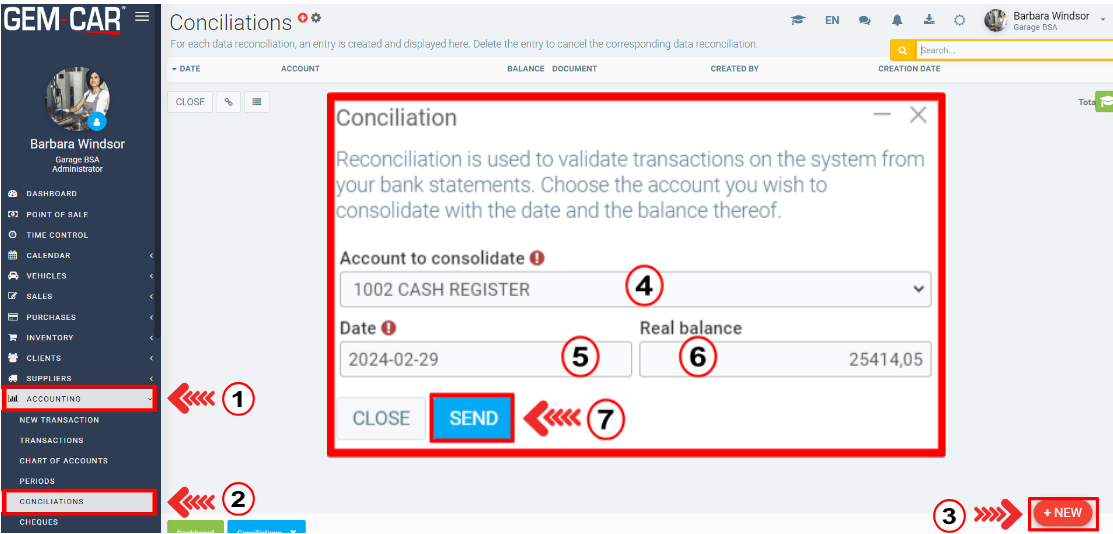

- In the Accounting menu, click on Conciliation.

- Create a new one

- Select the bank account from the statement you have on hand. Enter the date, usually the end of the month and the balance in the account.

Go to the module, enter the date and bank balance on the statement and GEM-CAR will show you all the transactions made with GEM-CAR, which were not passed to the bank. Track your banking status and click on GEM-CAR transactions made at the bank.

At the end, you will only be left with transactions that have not yet gone through the bank, which is called IN CIRCULATION.

If, during the process, you click on a transaction by mistake, you will find it under the CHECKED button. You can return a CHECKED transaction to CIRCULATION simply by clicking on it.

At the end of the process, validate that your theoretical and actual balance are correct.

Your balance on the computer $1,230

Outstanding transactions $620

Your theoretical bank balance $610

If the actual bank balance on your statement balances with your theoretical balance, everything is perfect, otherwise you must find the error. If you want to exit conciliation for any reason without saving anything, click on the X to exit and nothing will be saved.

If you are finished, CLOSE AND PRINT will offer to print the reconciled transactions. UNLESS EVERYTHING BALANCES, PRINT THIS REPORT to be able to know what you really checked, then if everything balances, print your reconciliation. You can also use this module to check that you have received supporting documents for any expense item .

- Here is the exact description of the fields:

Date: Date on which you requested your conciliation

Last ID used: The last entry made at the time of the reconciliation

Computer balance: Balance on the computer on the balance sheet

Outstanding debit: Deposits not passed to the bank

Credit in circulation: Checks not passed to the bank

Theoretical balance: What should be on your banking statement

Actual balance: What you have entered as balance on your bank statement

Difference between the theoretical balance and what you wrote as balance on your bank statement, therefore, what does not balance.

NOTE: Transactions in a closed period will not appear to you. If you make transactions that you date within the interval of a closed reconciliation, you unbalance the latter. In other words, be careful not to add transactions that are part of a reconciled period.

NOTE: you must save the conciliation as a PDF file.

Posted

1 year

ago

by

Olivier Brunel

#434

405 views

Edited

5 months

ago