GEM-CAR FAQ

Personalize or Modify Your Account Charter

The account chart is in fact the list of accounting accounts for making transactions. When you look at your financial reports such as the balance sheet, income statement, and trial balance, you want to have a record of your income, expenses, etc. The account charter is the skeleton or foundation of your business. We usually work on it at the beginning and then hardly touch it anymore. Your accountant is the best person to help you define your account charter. Have it validated by the accountant who will close the year. We want to avoid the latter telling us at the end of the year: “if I had known earlier, I would have had you put this expense in this other account”.

A number of accounts are included in your software. It's up to you to rename the code if it does not correspond to that of your accounting or, change the name to adapt it to your own situation, if the system allows you to do so.

When creating a new GEM-CAR, we include a standard account charter. You can modify it based on the list of accounts that your accountant will have proposed to you. Example: You would like to clearly identify the bank with which your transactions are carried out, National Bank, Caisse Desjardins, etc. To do this, go to the Accounting section and click on Charter of accounts . As long as you have not made any transactions, you can export your account chart to Excel, change it or have it modified by your accountant and reimport it into GEM-CAR. See: How to import a chart of accounts?

Let's imagine your expenses: You want to know your telephone, office, salary, etc. expenses. Each of these expenses corresponds to an account in your account charter. Here is a practical example, to know how much your office supplies cost you, you with the choice of the following accounts: Purchase of pencils, purchase of erasers, purchase of paper clips, etc., or simply the Office supplies account .

More details on opening balances: What is an opening balance used for?

Summary definition of terms:

ASSET It is an asset that has a value at a given time. For example, your car, your bank account, your accounts receivable, your accounting software... Standard: The code of this account must start with 1, and is normally DEBTOR

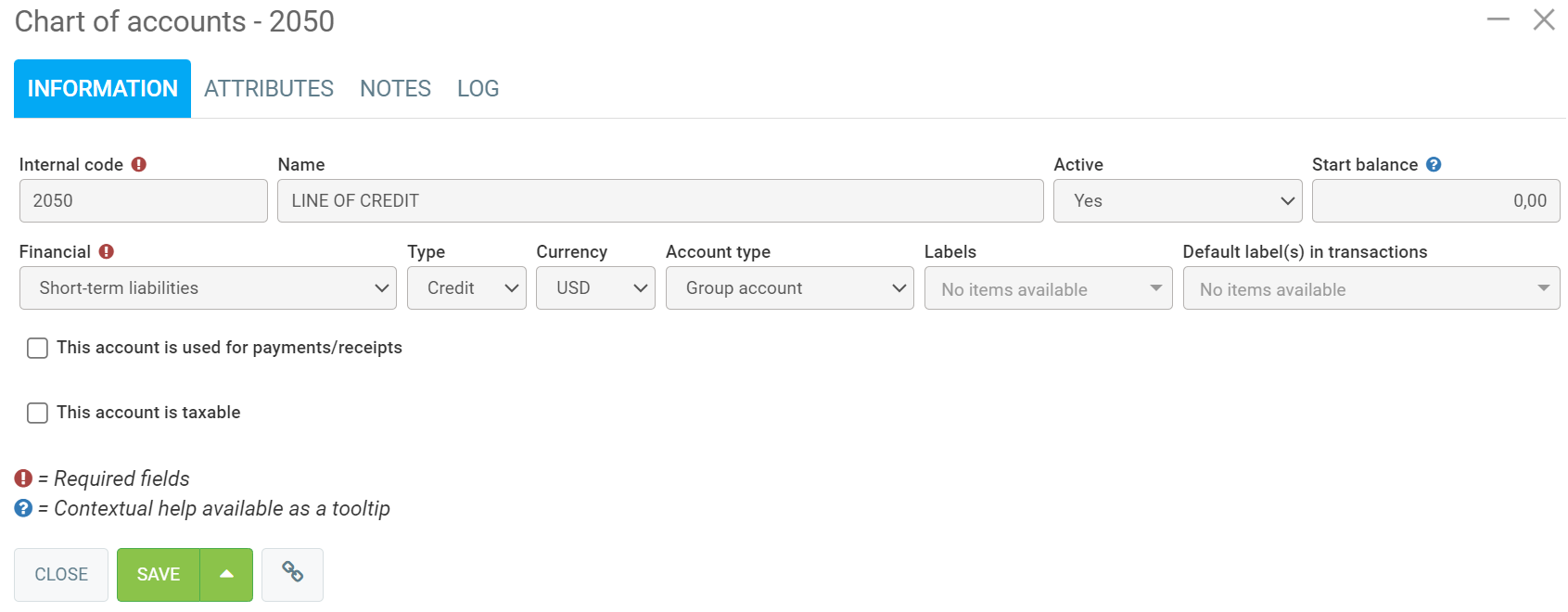

PASSIVE This is what we owe. For example, a line of credit , debt, etc. Standard: The code for this account must start with 2, and is normally CREDITOR

CAPITAL As for capital, it’s what you’re worth. For example, profit, share capital, etc. If we sell all our assets and pay all our liabilities, capital is what we are left with. You will therefore find the following equation: ASSET=LIABILITY+CAPITAL Standard: The code of this account must start with 3, and is normally CREDITOR

INCOME Includes all miscellaneous sales positions. Standard: The code for this account must start with 4, and is normally CREDITOR

EXPENSES Expenses need no description, it's the easiest thing to do in a business. Standard: The code for this account must start with 5, and is normally DEBTOR. Any account on your charter is either normally in credit or normally in debit. It is simply an accounting convention. You should not try to find a logical explanation if you are not familiar with this convention.

COST OF GOODS SOLD (COGS) If the expense account you are creating is an expense directly related to your cost of goods sold, indicate “Cost of goods sold” as the account type. This way, under revenue, you will see your cost of goods sold and gross profit.

- DEBIT The asset and expense accounts are normally debit.

- CREDIT The liability, income and capital accounts are normally credit accounts.

SHORT TERM Normally achievable within the following year (Ex: Bank account)

LONG TERM Normally achievable in more than a year (Ex: Furniture). Always by convention, put short-term accounts before long-term ones.

BANK ACCOUNT In the event that your account is a bank account on which you draw checks.

TAXABLE Check if the account normally affects QST and GST. (An additional field will appear. If the taxable percentage for this account is not 100%, please enter the percentage here. Taxes will therefore be applied according to the percentage entered here.)

Setting up an entertainment expense ledger code with taxes at 50%.

In order to configure your account chart to determine the accounts to which your tax rules must be automatically applied with a %.

In summary :

- Check the “Taxable?” so that taxes are automatically applied to transactions made with this account,

- Use the percentages to apply the correct distribution; Ex representation costs at 50%,

- Excluded from box 101 of the tax report.

For Account Types, here are your choices.

Change the account types via the left menu under Accounting > Charter of accounts.

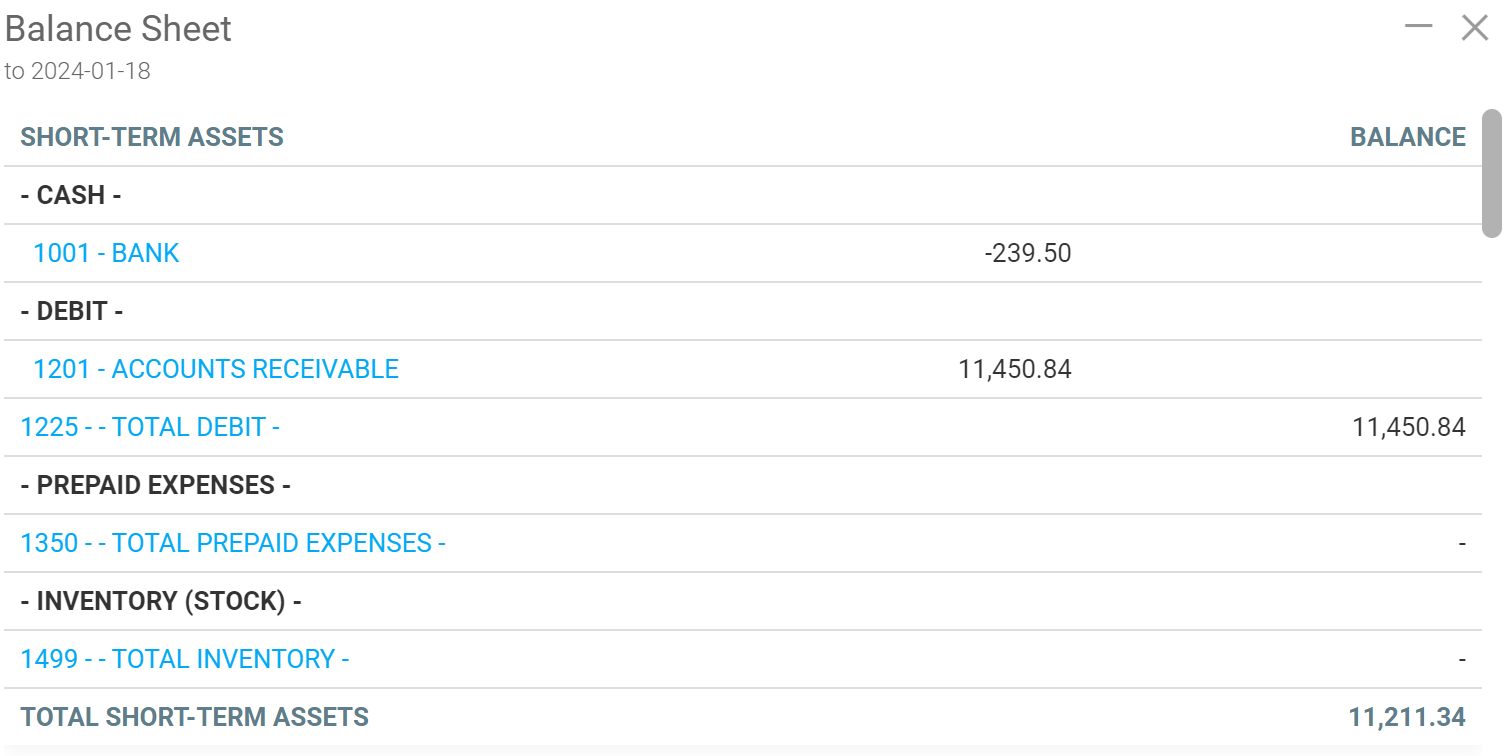

To view the presentation and usefulness of the account types, go to the Accounting > Report > Balance sheet menu and click on “Send” to view.

For each GL code, you can associate an “Account types” whose types will be presented and detailed in the window below.

In the example, accounts 1010 and 1020 are Subgroup Accounts, they are written with an indent.

Account 1040 is instead a Subgroup Total account , it indicates the sum of the subgroup accounts above it.

This type of account cannot be used in a transaction.

Subgroup account

Accounts 1010 and 1020 are “Subgroup Accounts”, they are written with an indent in blue.

They can be used in a compatible transaction.

Subgroup total

Account 1040 is more of a “Subgroup Total” account, it shows the sum of the subgroup accounts above it and displays the total.

This type of account cannot be used in a transaction.

Header account

It serves as the title of a group of accounts and is in bold. This type of account cannot be used in an accounting transaction.

The word Taxes in bold is a Group Header type account . This type of account cannot be used in a transaction. Accounts 2210 and 2240 are Group Accounts , i.e. normal accounts, but since they are preceded by a Group Header type account , they are placed indented. Finally, account 2260 is a Group Total type account , it displays the group total. This type of account cannot be used in a transaction.

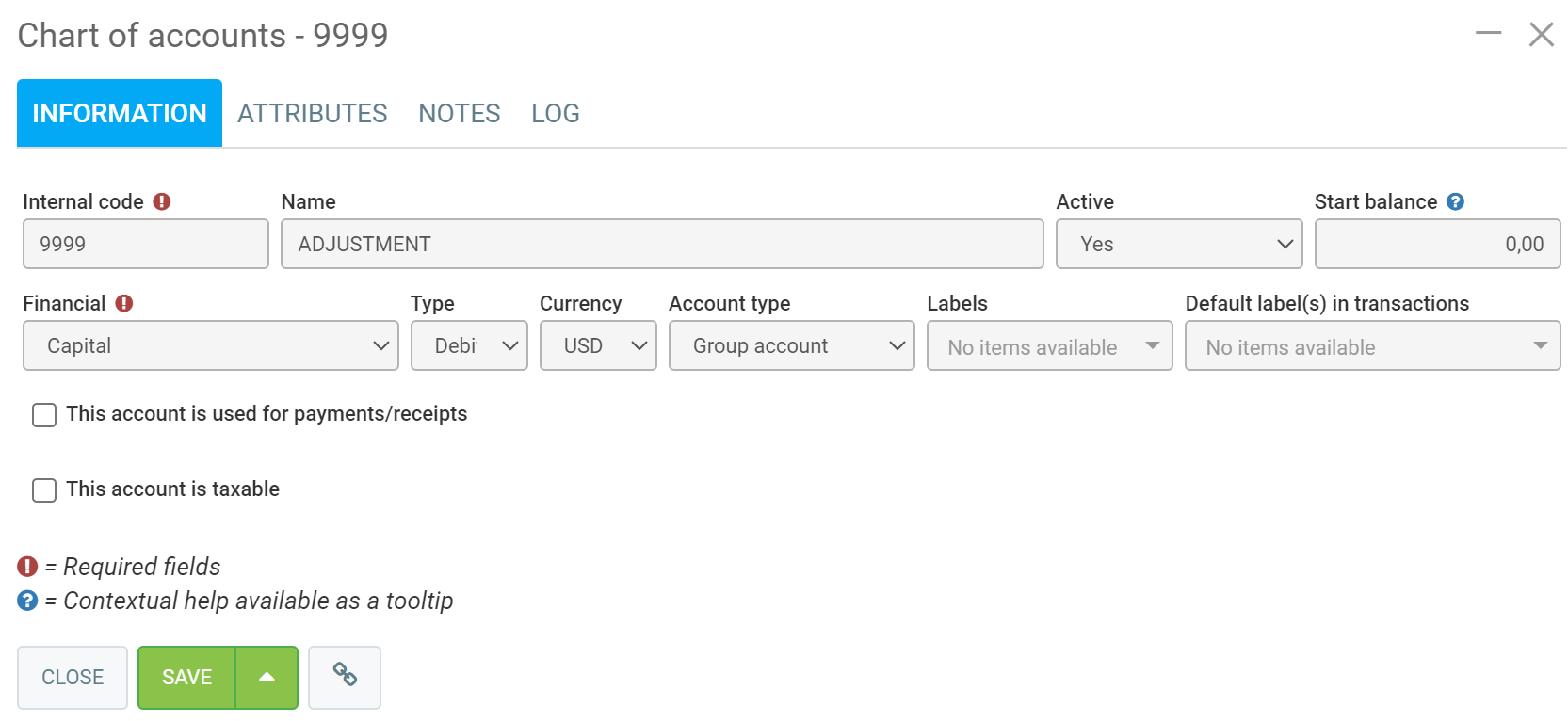

You will notice a last account, coded 999999, either adjustment or transitional. It is your choice to have such an account, but I suggest you have an account whose function is not well defined. When you are faced with a transaction for which you do not know which account to allocate, use this account temporarily while you ask your accountant what you should have done. An adjustment account also serves as a temporary account during the initial import. We suggest using the account of "Adjustments" which we encode with the letters AJ when importing.

Small note for the profit accounts.

- Profits not distributed

- Current profits

- Net profit

The one that is configured in GEM-CAR is the account that you will use to accumulate operating profits, in short, the one that will accumulate your profits. We suggest using the current Profit account which we encode with the letters BF when importing.

IMPORTANT: As soon as your account chart is to your liking (and that of the accountant), immediately define the main accounting accounts in the Accounting > Configurations > Configurations menu. Same thing if you have modules activated like employee payroll CCQ employee payroll.

Example of usual accounts - Line of credit

Posted

11 months

ago

by

Olivier Brunel

#440

202 views

Edited

8 months

ago