GEM-CAR FAQ

Restaurant Bill with Tips

Note: Gratuities are not taxable.

You can claim half of the taxes in an entertainment expense.

GEM-CAR already has this function in the accounting account.

This means that if you enter an entertainment expense transaction, it will automatically split the taxes in half on the transaction.

The taxable percentage tells GEM-CAR to split the taxes 50% to help you compose your transaction.

It will not split the taxes on your transaction in half when you write it to the general ledger.

For example, if the GST on the invoice is $12.90, GEM-CAR will suggest $6.45.

In other words, if you manually enter $12.90 in the transaction, GEM-CAR will post the same amount to the general ledger.

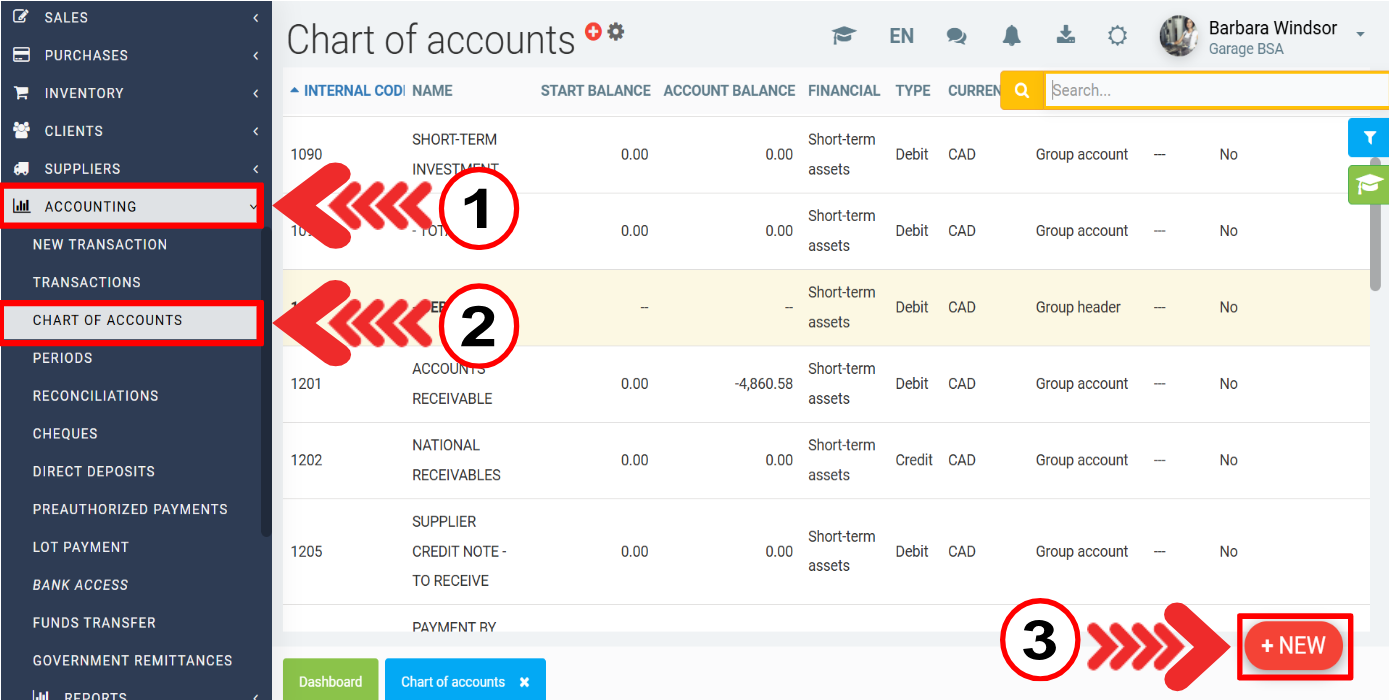

Click on Accounting > Chart of Accounts > +New.

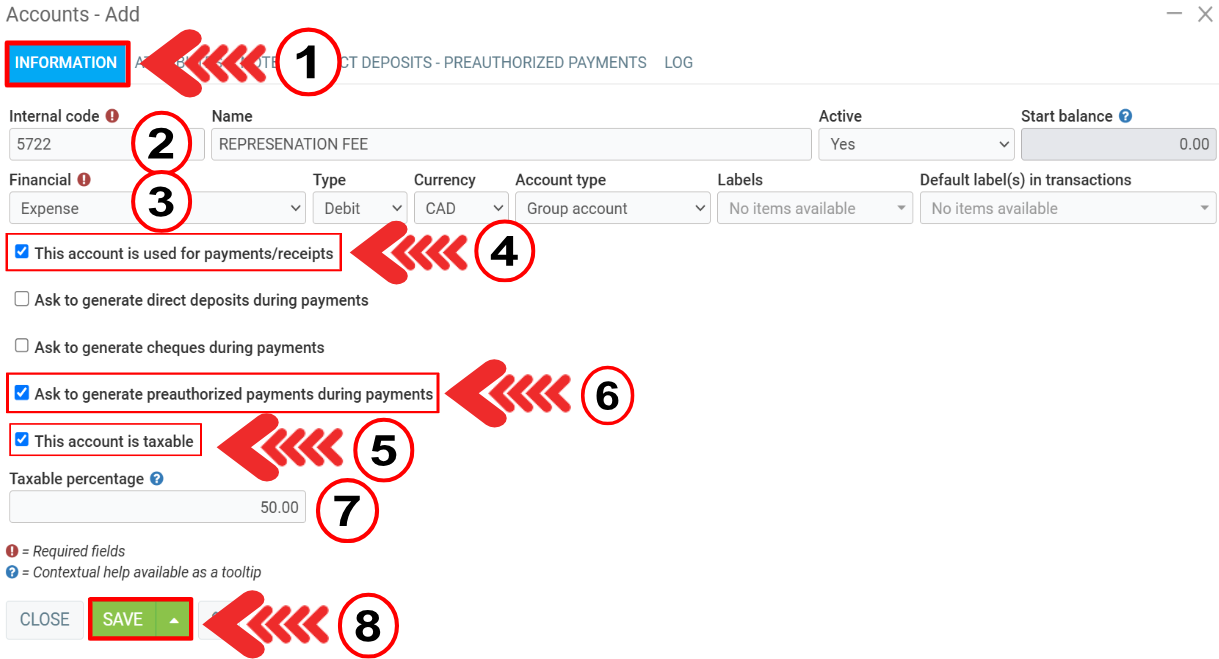

In the Information tab, enter the following information:

- Internal code

- Name

- Financial

Check the boxes:

- This account is used for payments/receipts

- This account is taxable

- Ask to generate preauthorized payments during payments

Click on Save.

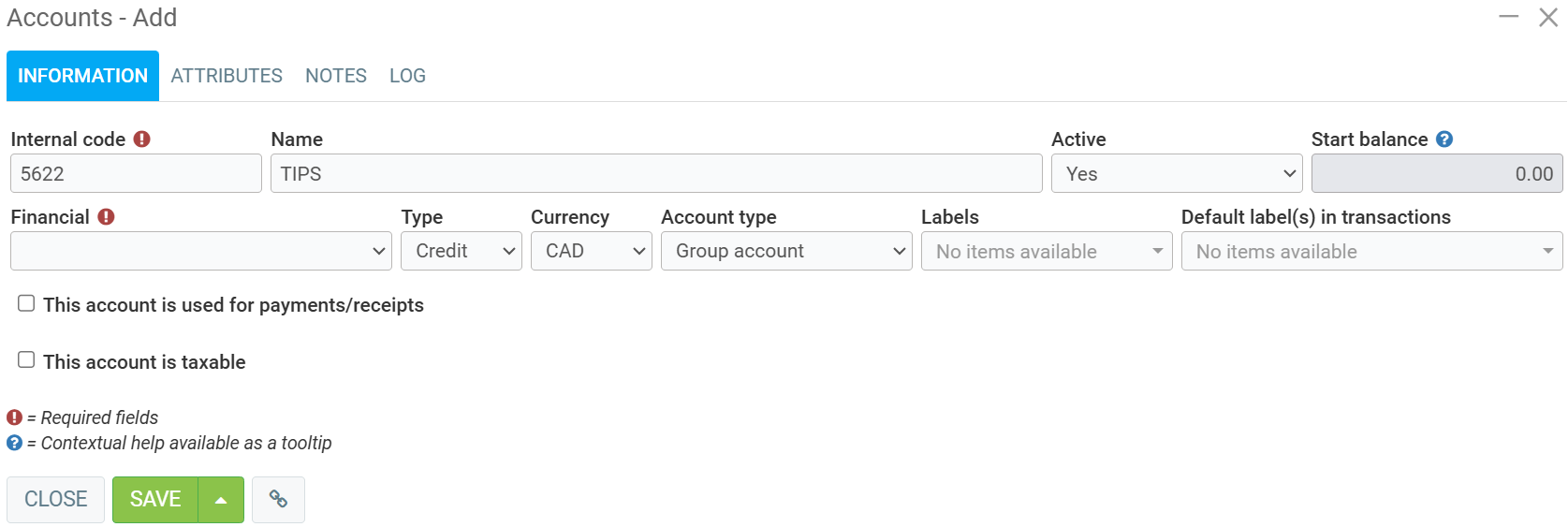

We also suggest that you set up a tax-free expense account for tips.

Let's take the example of a restaurant invoice with credit card receipt.

After entering the invoice date and number, select a generic supplier and click on invoice (C+).

Enter the total charged to the credit card.

Other articles on the subject:

Find the Transactions Marked as Favorites

Transaction Modification History

Examples of Common Transactions

Posted

6 months

ago

by

Bianca da Silveira De Amorim

#2121

25 views