GEM-CAR FAQ

Employee Categories

This section defines, for example, the possible categories of employees in your company, for example, sales, administration, production, etc.

Each employee category can be associated with a different expense account, commission account, and benefits account.

By default, GEM-CAR has created a category Employee, if you don't want to pay your salaries in separate accounts, you can simply associate the right accounts to this employee category.

You will also notice that the trash can at the end of each line is blocked if ever an employee having access to payroll has this type of category associated in his file. If you want to delete it, you will have to remove the association from the employee's file.

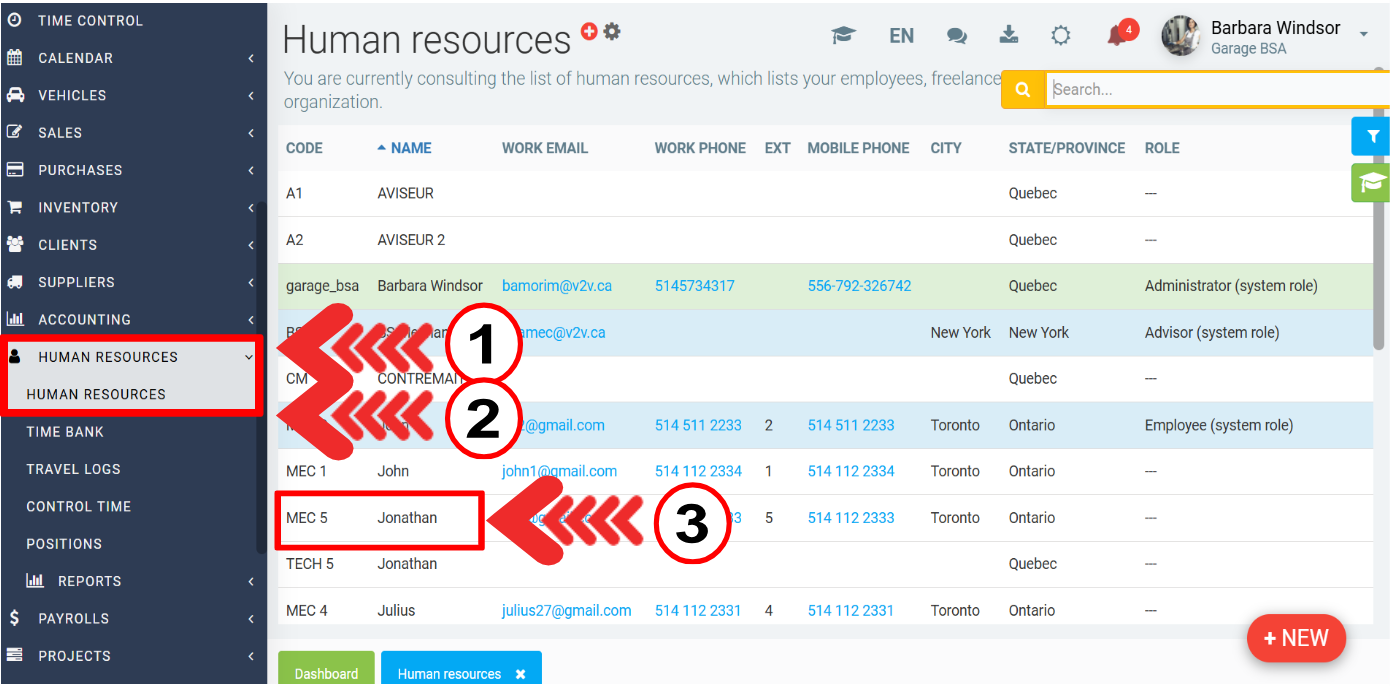

Click on Human Resources > Human Resources and select a file.

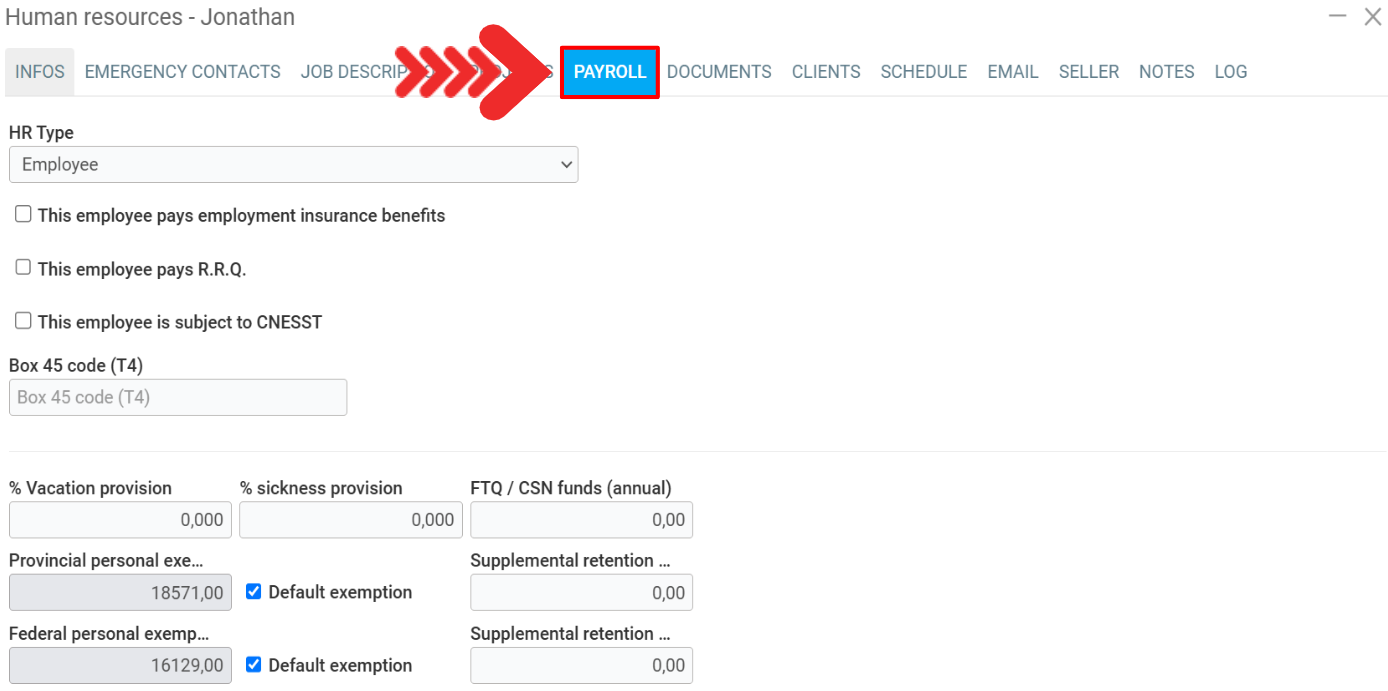

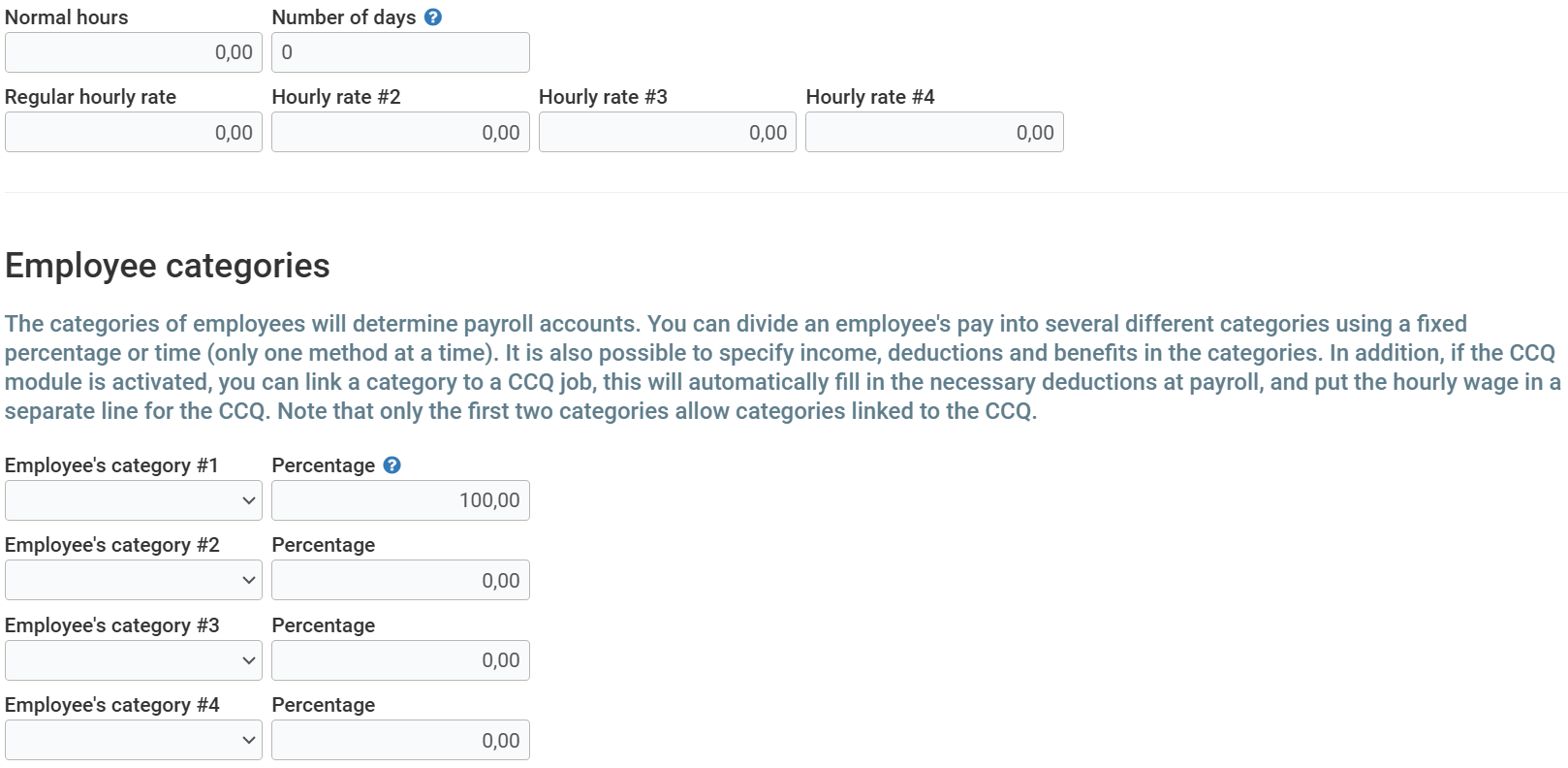

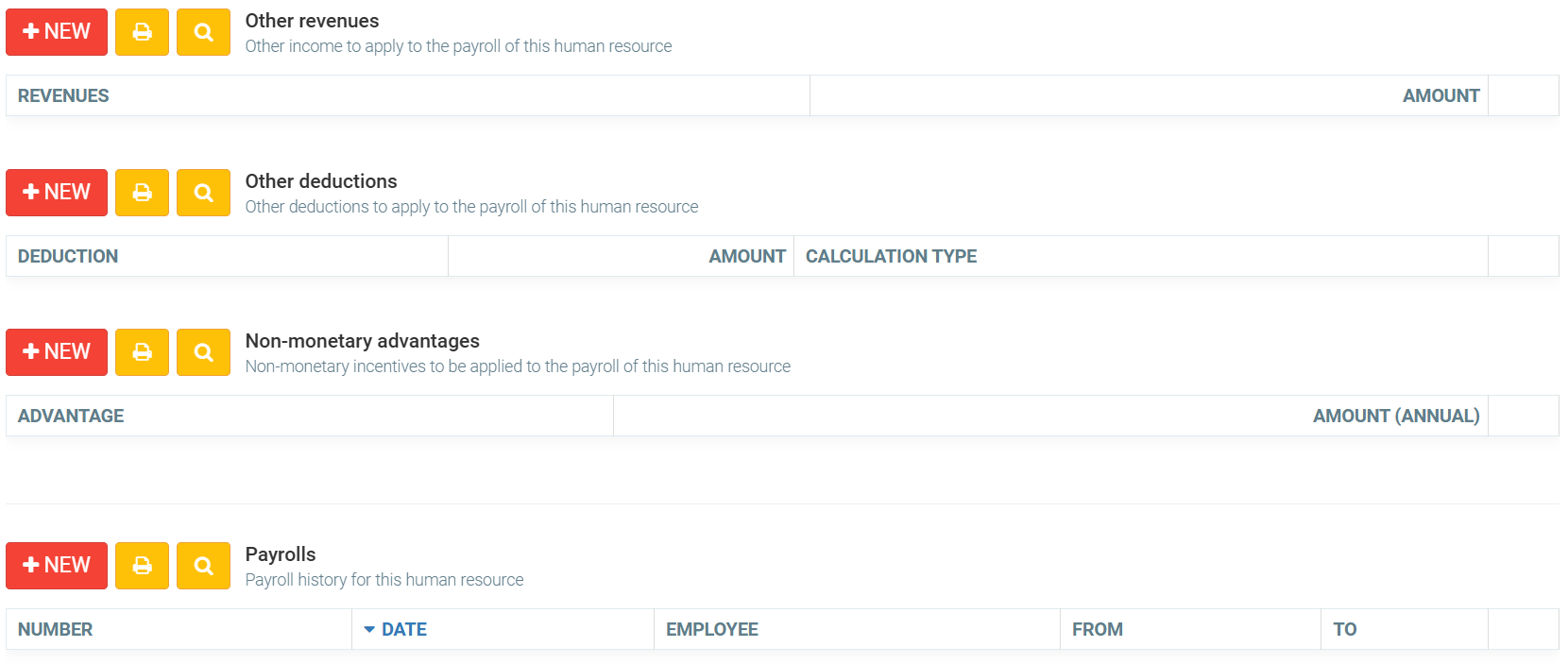

In addition, under the tab Payroll of this section, you can configure Payrolls, Other revenues, Other deductions, Non-monetary advantages for this category of employee. This will make sure that all human resources having this category of employee will have these configurations automatically.

This is especially handy when you have multiple employees with the same income/deductions to set up, it allows you to set it up once here, and not have to do the next step in each HR record.

You are now ready to make payroll in GEM-CAR! Open the Payrolls menu and click on the +New at the bottom of the list. If the window opens, it means that your configurations have been completed, if an error message appears, it means that a configuration has not been correctly completed, the error will specify where the problem is. When naming your payroll, we recommend something like 1801 for the first payroll of 2018, 1904 for the 4th payroll of 2019, etc.

AA - Payroll numbers 1 to 26

When you make payroll, a transaction of this type will be created automatically for you.

DEBIT

SALARY EXPENSE BY EMPLOYEE CATEGORY

SALARY EXPENSE BY EMPLOYEE CATEGORY

BENEFITS (employer's expenses) BY EMPLOYEE CATEGORY

BENEFITS (employer's expenses) BY EMPLOYEE CATEGORY

CREDIT

CSST TO BE PAID

QUEBEC INCOME TO BE PAID (Including provincial tax, QPP, HSF, QPIP)

CANADA INCOME PAYABLE (Including Federal Tax, Unemployment Insurance)

SALARY TO BE PAID (grouping all salaries)

MISCELLANEOUS TO BE PAID (Optional - if you have put FTP, Pension, etc)

Also, for each of your employees who are paid by check and for all other employees who receive direct deposit, there will be this transaction:

DEBIT

SALARY TO BE PAID

CREDIT

BANK

Posted

11 months

ago

by

Olivier Brunel

#312

196 views

Edited

2 months

ago