GEM-CAR FAQ

General Ledger Advance

General Ledger Advance

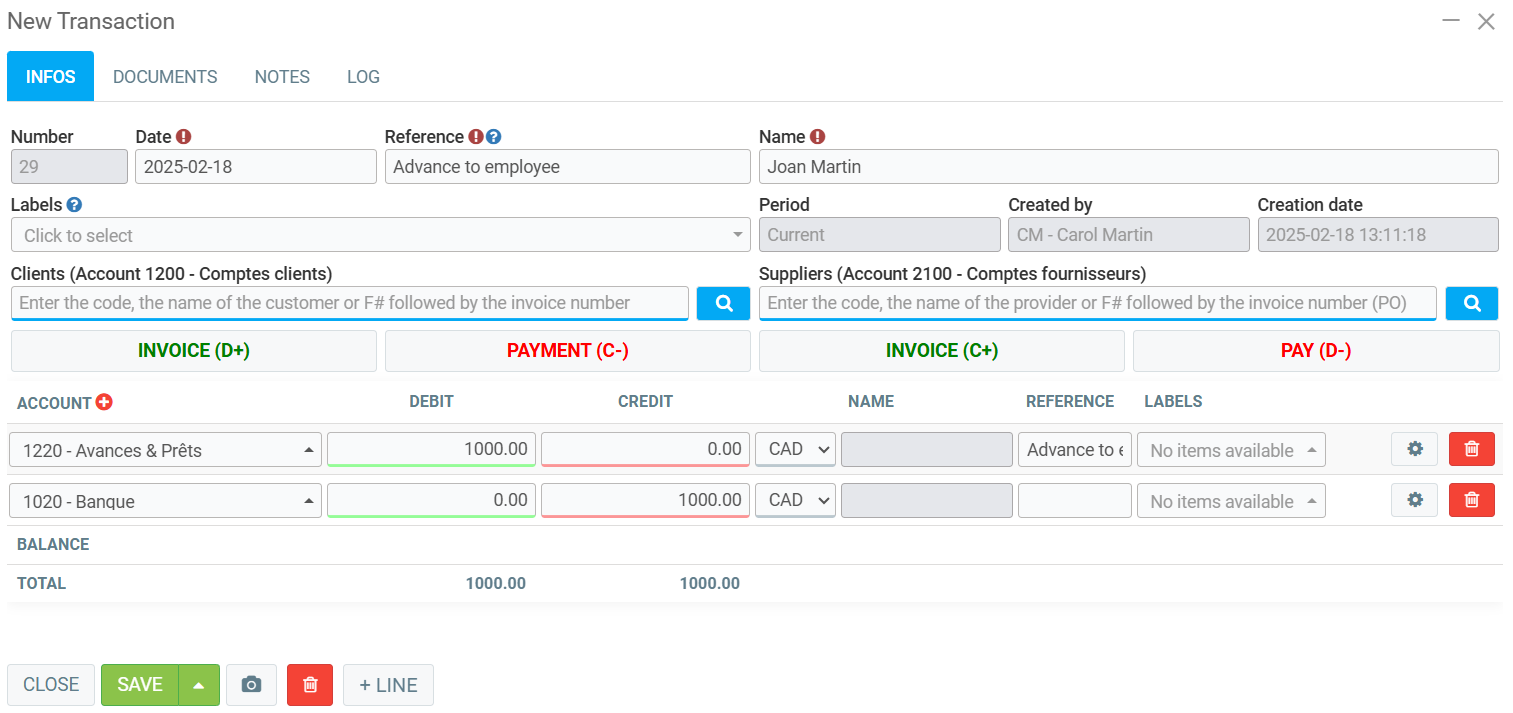

Click on Accounting > New transaction.

Select an asset account (e.g. 1055 - Advance to employee) and make it non-taxable.

- Make a deposit or cheque

- Make a general ledger entry

- In the reference, enter the employee and payroll number (optional),

- Enter a label: to track advances by employee with a single GL code. Alternatively, create a GL for advances by employee.

- Enter the transaction

Click on Save and Close.

Validating the Advance Transaction

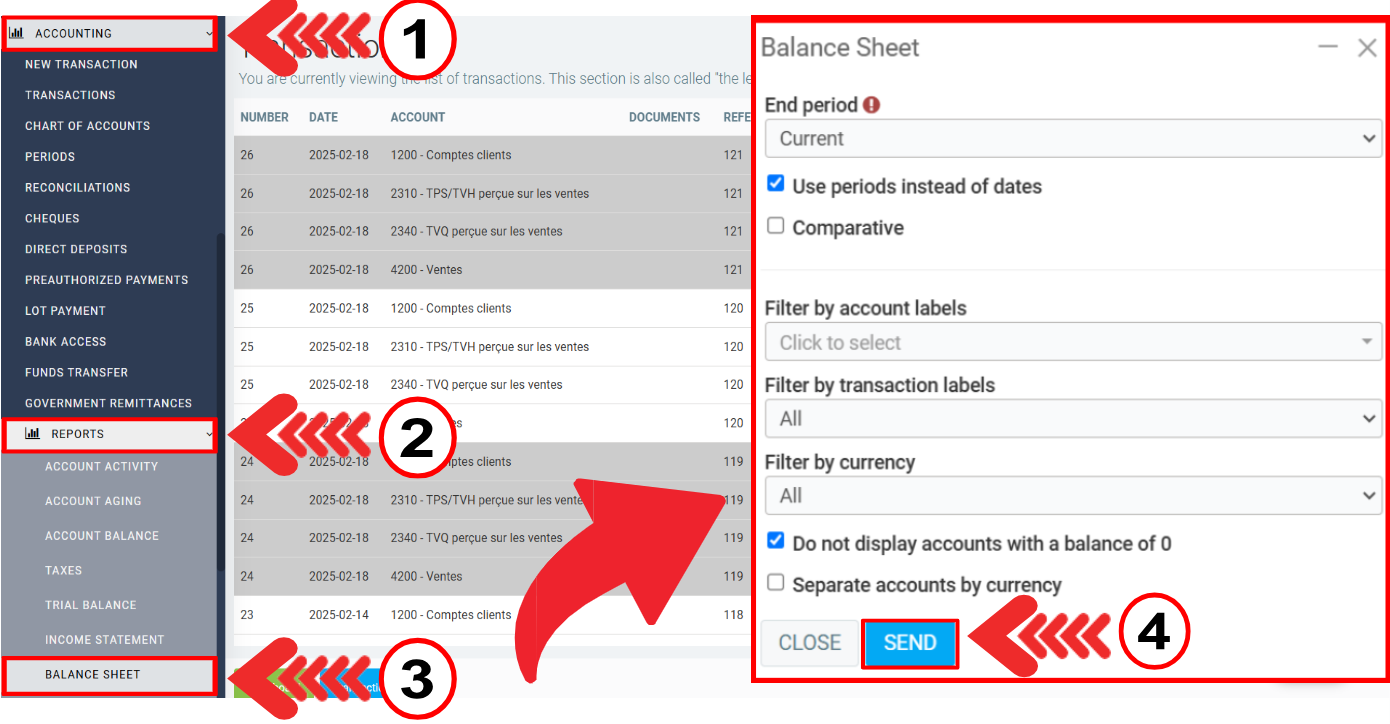

Go to Accounting > Report > Balance sheet. In the balance sheet window, click on Send.

The advance should be reflected in the balance sheet as an asset, as shown below:

Posted

1 year

ago

by

Olivier Brunel

#822

400 views

Edited

8 months

ago