GEM-CAR FAQ

Payroll Configuration - How to Manage a Pension

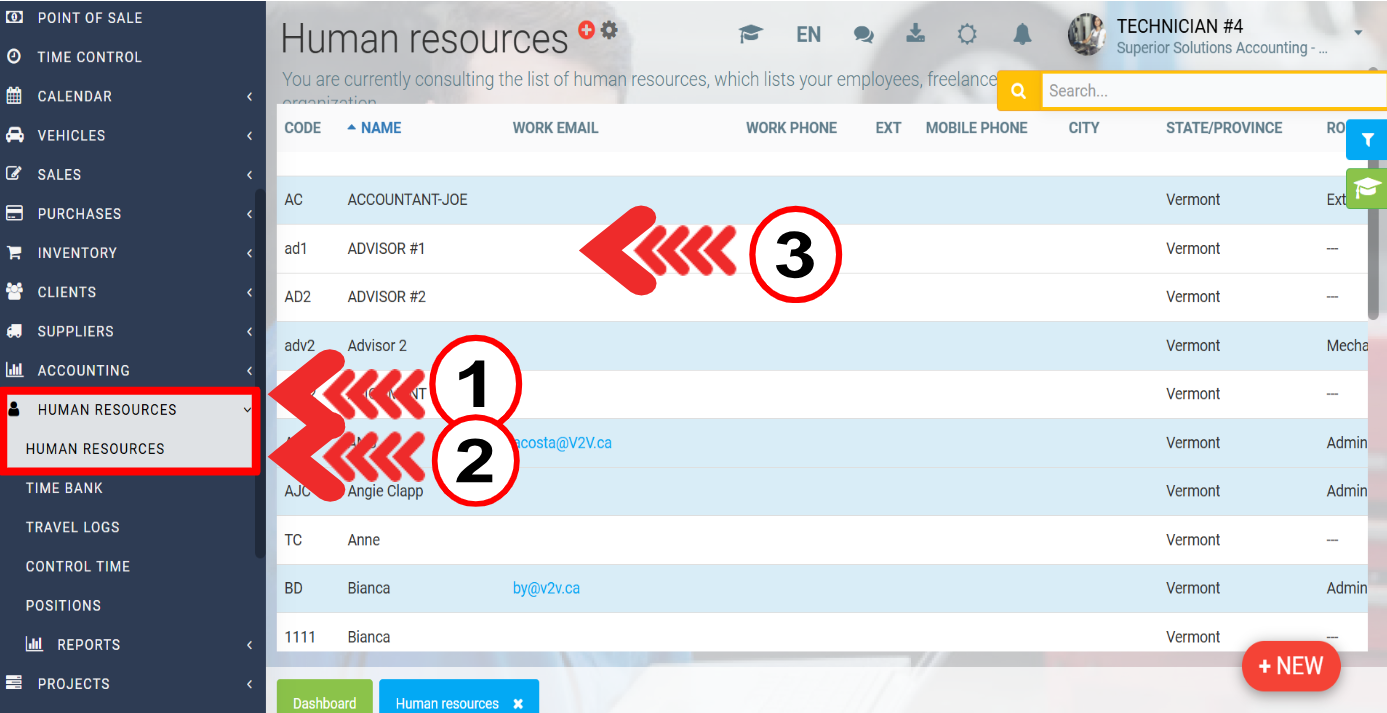

In the payment configuration, go to Human Resources > Human Resources and select the desired file.

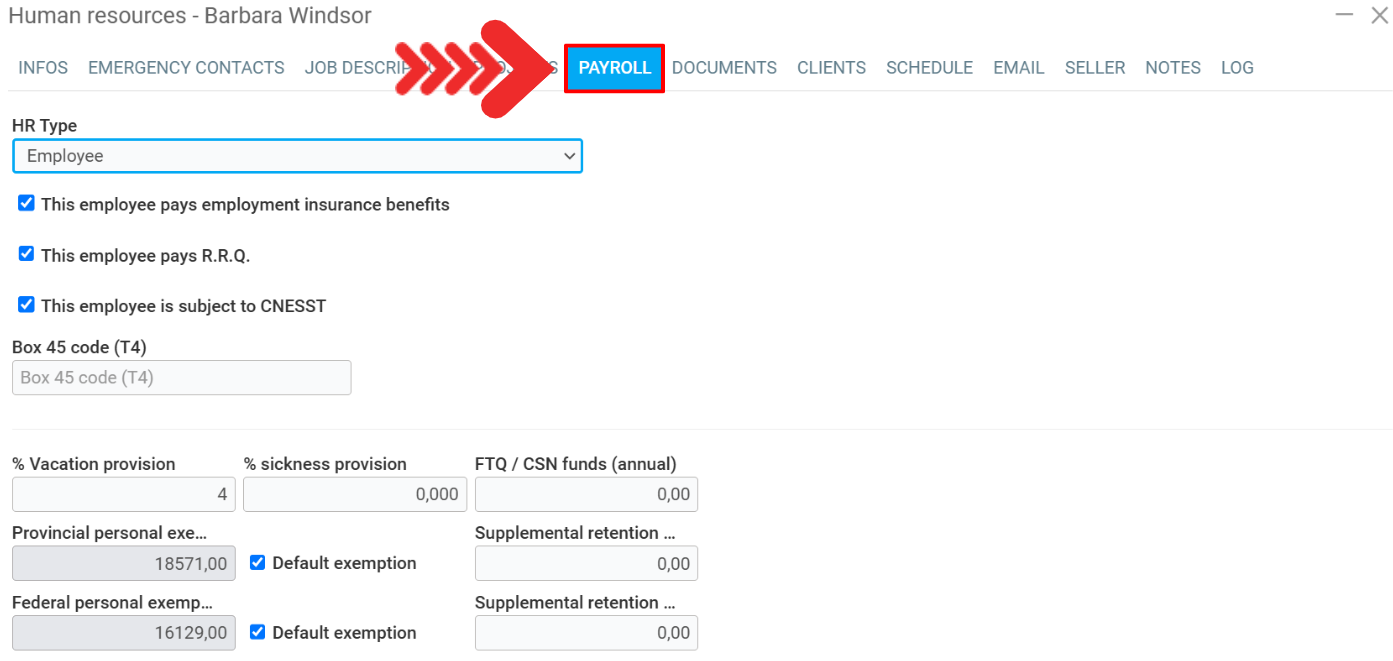

Then click on the Payroll tab.

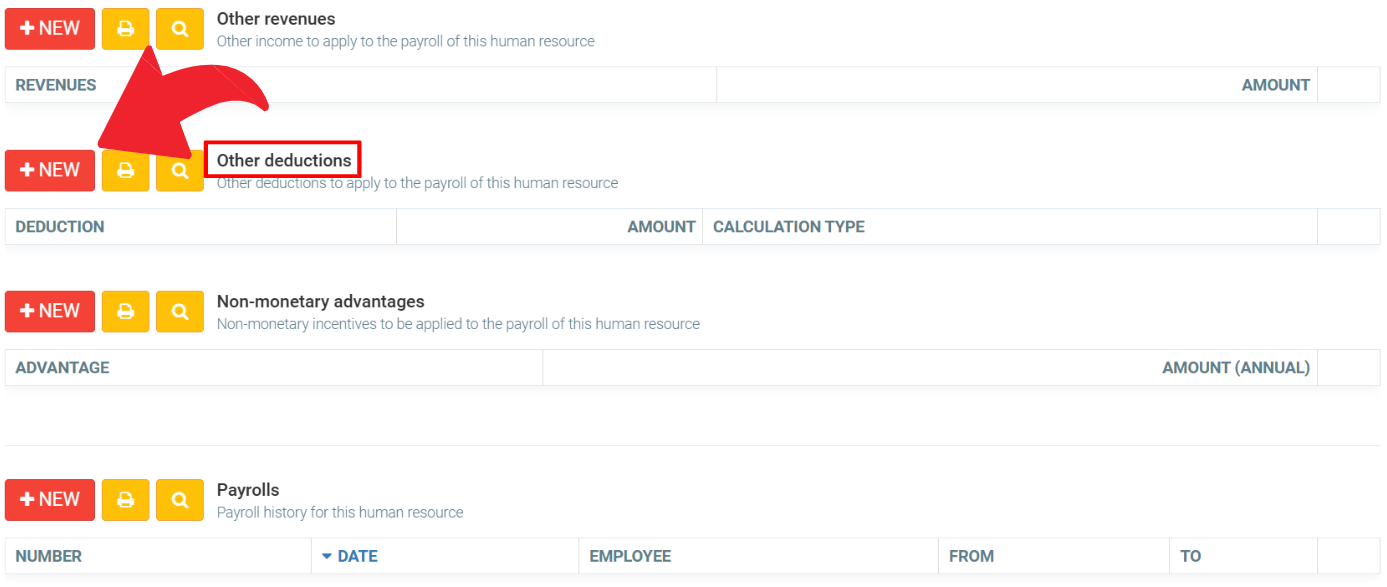

Other types of deductions

As with other types of income, it is possible to set up additional deductions, such as alimony* or RRSPs. For a deduction, it is possible to configure whether it is calculated annually, by the hour, or on a percentage of gross salary. When configuring the payroll of a human resource in the next step, you can enter the amount in money or as a percentage, depending on the configuration specified here. There is also a checkbox to indicate when the employer is the one paying the amount instead of the human resource.

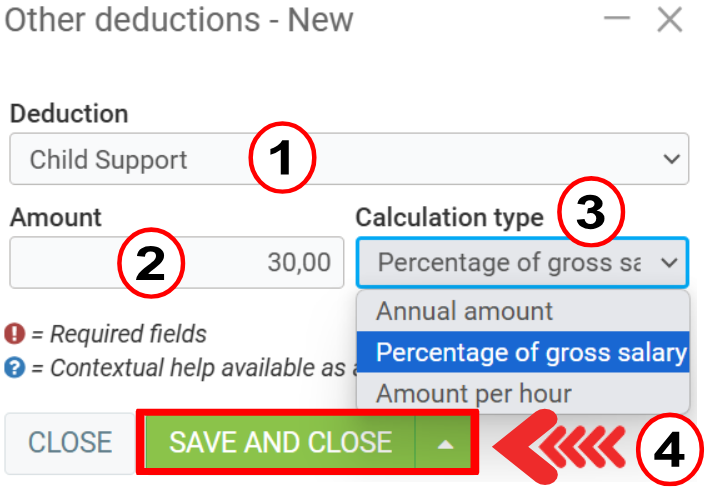

When you click on +New, you must fill in the following fields:

- Deduction

- Amount

- Calculation type (Annual amount, Percentage of gross salary or Amount per hour)

Click on Save and Close.

For a fixed-amount support payment deducted from each paycheck, use Annual amount. If you want $200 taken from each pay, enter $5200 for a bi-weekly pay.

Note: If you provide a company vehicle, remember to return the taxes on the personal benefit portion.

Posted

8 months

ago

by

Bianca da Silveira De Amorim

#2339

251 views

Edited

8 months

ago