GEM-CAR FAQ

Pay - Adding other Revenues

Other Income refers to anything that is not paid at an hourly rate.

This can include mileage, uniform allowances, or other similar items.

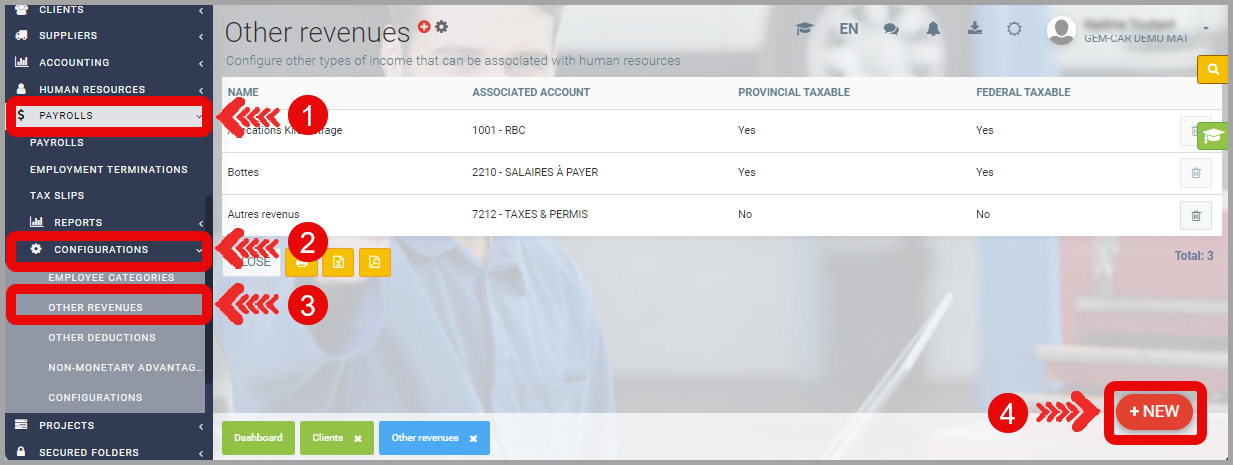

1) Configuring Other Income

You can decide whether the employee pays tax on this type of INCOME and which accounting account it is associated with.

From the main menu on the left of the application, click on Payroll > Configurations > Other Incomes > +New or select one of the Other Incomes from the list to modify it.

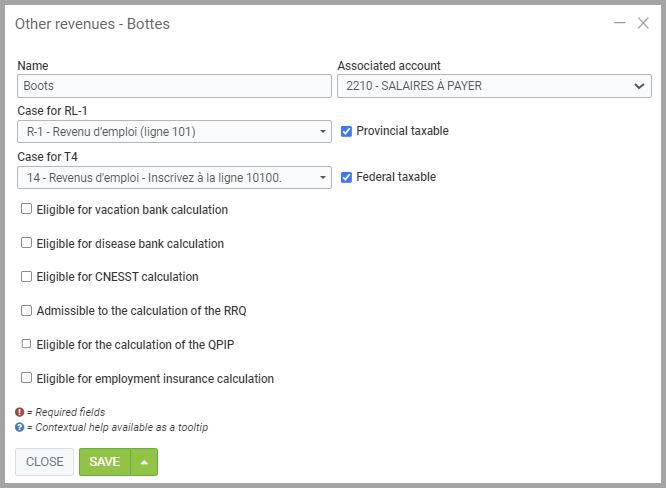

Identify the account from which the money will be taken to pay your employees for this income.

Decide if the employee pays tax on this income. For example, mileage is generally non-taxable. It is also possible to configure a box for T4 and RL-1 slips for each type of income. If these boxes are left empty, the income will be considered regular income when generating these reports.

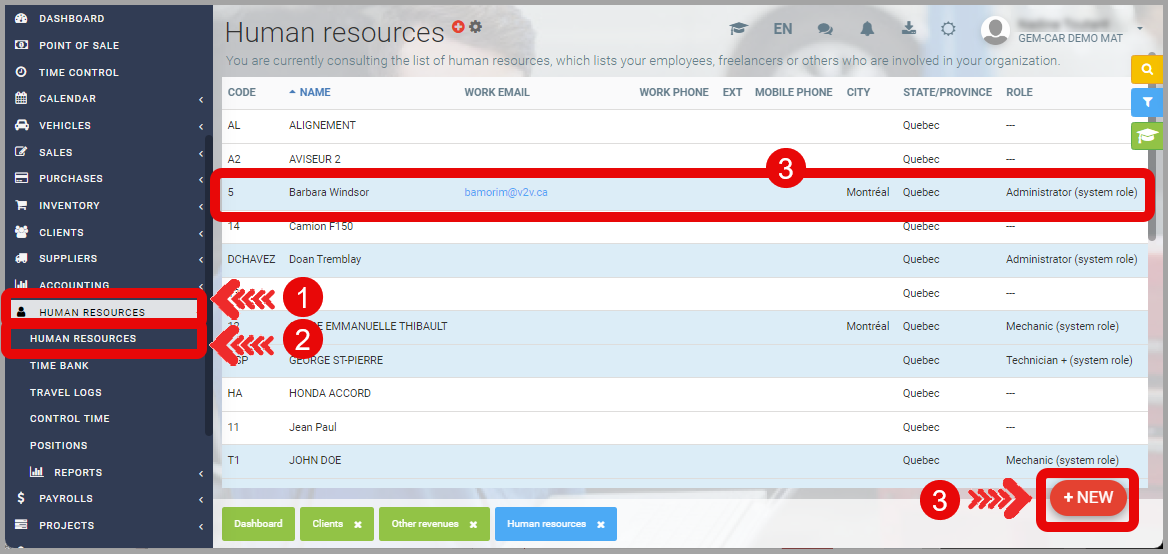

2) Adding Other Income to an Employee

From the main menu on the left of the application, click on Human Resources > Human Resources > +New or select the human resource you wish to modify.

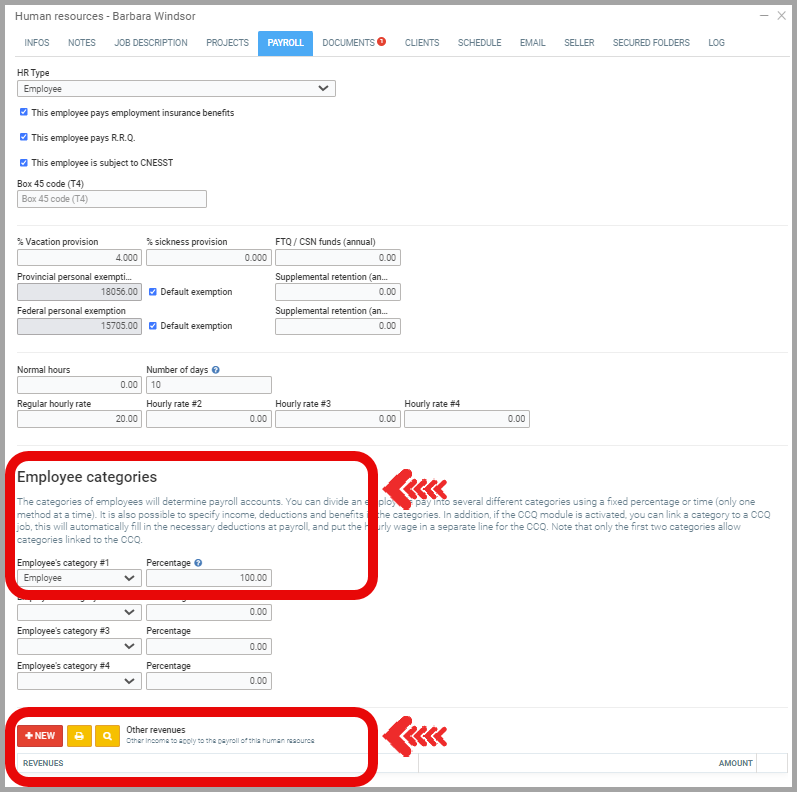

Under the Payroll tab, for Other Income, click on +New.

Note: Remember to consider that Other Income may already apply based on the Employee Category. If an Other Income such as boot allowance already applies to the category (we will see how to apply an Other Income to a category in point 3) and you add it additionally to the resource, it will apply twice.

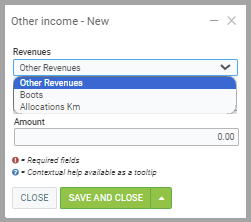

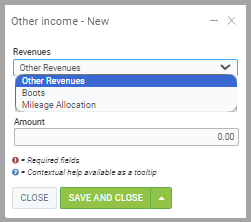

To add the income, select the income from the drop-down menu. The incomes displayed are those created following the steps in point 1. Enter the amount you want to add for each period.

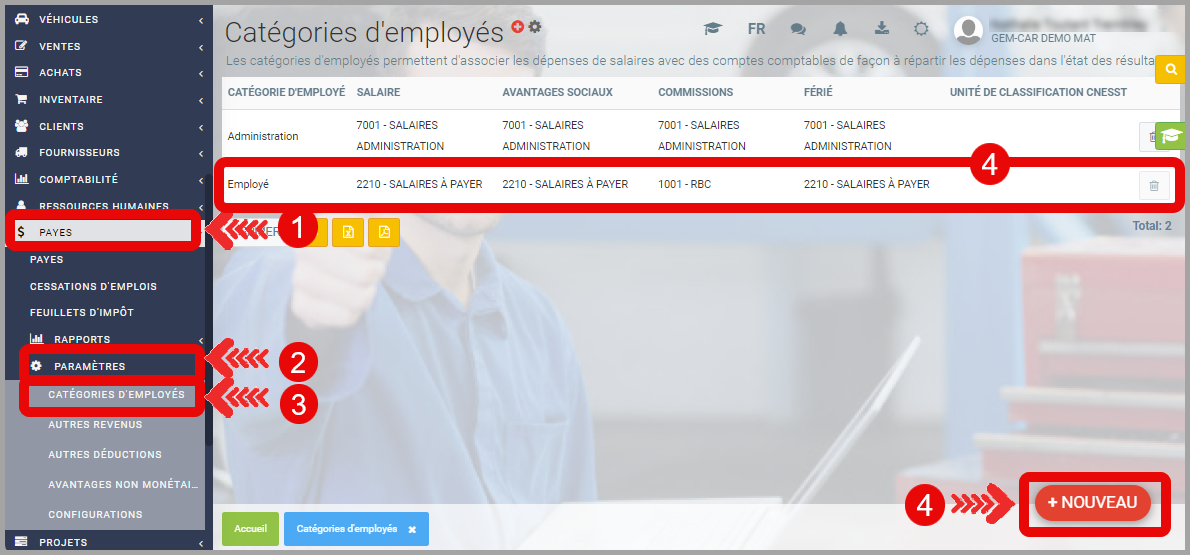

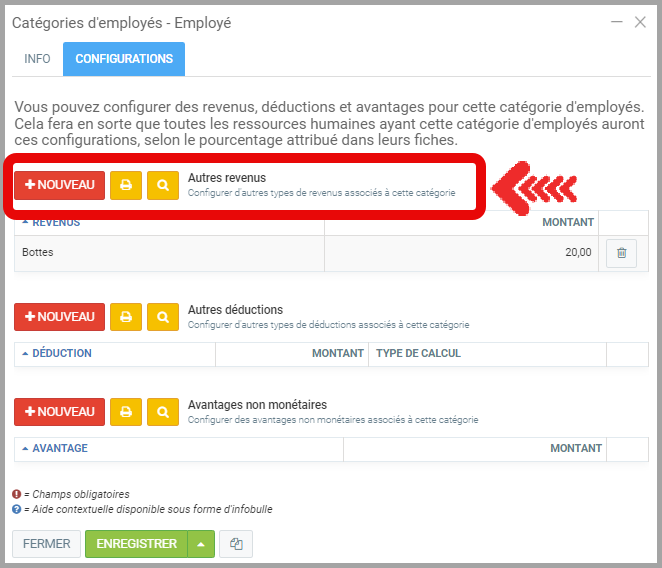

3) Adding Other Income to an Entire Category of Employees

From the main menu on the left of the application, click on Payroll > Settings > Employee Categories > +New or select the category you wish to modify.

Under the Settings tab, for Other Income, click on +New.

To add the income, select the income from the drop-down menu. The incomes displayed are those created following the steps in point 1. Enter the amount you want to add for each period.

4) Advances

Advances can also be considered as another type of income. They should be added in the same way as Other Income. Refer to the following articles for more details.

Advance by General Ledger

Advance to an Employee by Payroll

Validation of the Advance Transaction

Learn More?

Configuring Human Resources for Payroll

Creating Employee Categories

Payroll Configuration

Paying Employees

Configurations for Paying Sales Commissions

Posted

1 year

ago

by

Victor Elie

#830

472 views

Edited

1 year

ago