GEM-CAR FAQ

Financial Indicators - Debt/ Equity Ratio

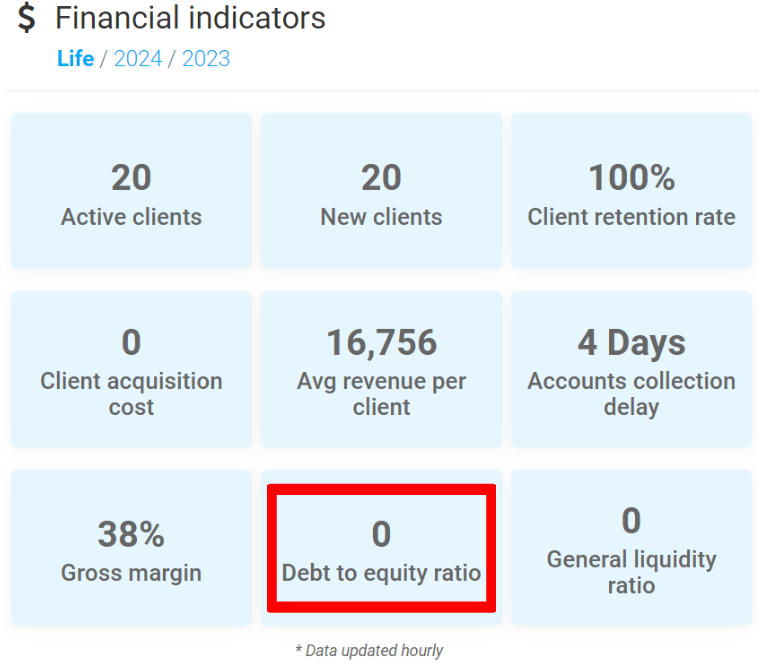

On the Dashboard, there's a box containing the Financial Indicators.

Interpreting the debt/equity ratio

Also known as the debt/equity ratio, the debt/equity ratio refers to a company's level of indebtedness compared to its invested capital. The higher a company's debt level, the higher its ratio.

Note that a low ratio is not necessarily positive. While it may characterize a healthy company that has reached a certain level of maturity and accumulated a significant amount of capital, it may also demonstrate excessive caution on the part of the company and an aversion to risk-taking. In this context, the company's growth could be mitigated.

A ratio of around 2-2.5 is considered good in most cases. It means that 2/3 of the company's investments come from borrowings, while the remaining 1/3 comes from the company's own capital.

A ratio of 5-6-7 means a higher level of indebtedness, which may give cause for concern in some cases. However, a company is not necessarily in difficulty when it reaches this ratio. It's important to take the ratio in context, and see why the company has such a high level of debt.

Factors that need to be taken into consideration when analyzing a ratio that at first glance appears high include the sector of activity, the possible and probable spin-offs following major investments, etc.

In order to better assess the significance of a debt/equity ratio for a company, comparative analysis is particularly relevant.

The benefits of calculating a long-term debt/equity ratio

The long-term debt/equity ratio is interesting because it takes into account only long-term debt, and not working capital lines or amounts owed to suppliers, for example. This is particularly useful for assessing the health of companies that keep large quantities in stock, for example. In their case, operating loans are repaid as they come due. Banking institutions can choose whether to consider total or long-term debt.

Usefulness of this ratio for banks

The debt/equity ratio is being used less and less by banks. Although it allows us to observe a company's financial progress, it neglects to take into account the company's profits or losses, as the case may be.

Want more information?

Financial Indicators - General Liquidity Ratio

Posted

10 months

ago

by

Olivier Brunel

#685

198 views

Edited

8 months

ago