GEM-CAR FAQ

Financial Indicators - General Liquidity Ratio

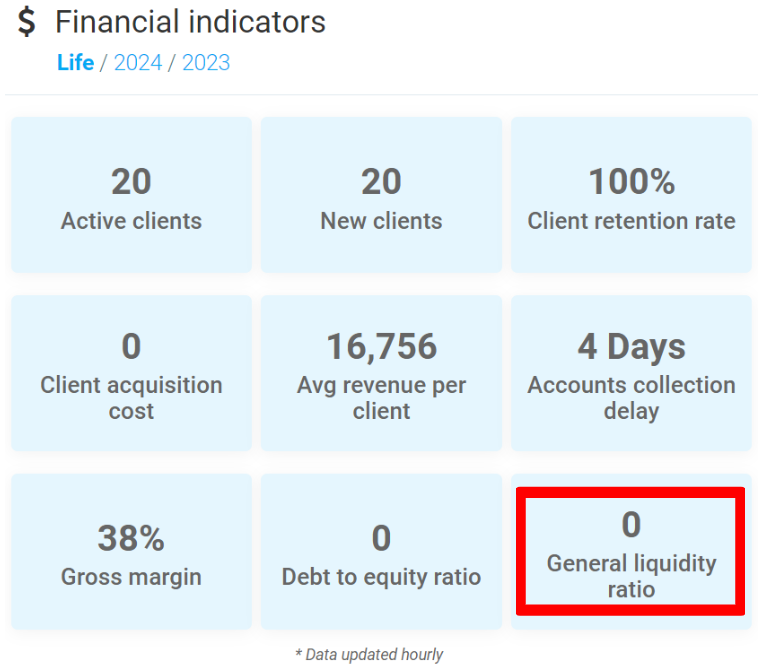

On the Dashboard, there's a box containing the Financial Indicators.

The current ratio shows whether a company has sufficient liquidity to meet its short-term obligations. According to the experts, it should be calculated more than once a year, to avoid discovering problems when it's too late to remedy them. Calculating this ratio also shows whether the company has sufficient funds to seize new business opportunities and obtain better credit.

The ratio should normally be 1, 2 or slightly higher, but may exceptionally fall below this threshold. A ratio that is too high may mean that the company is not making efficient use of its assets. On the other hand, a ratio that is considered high may enable the company to cope with uncertainties, or to expand or make a major purchase.

The current ratio is calculated as follows:

Current assets / Current liabilities = Liquidity ratio

Here's an example:

120,000 current assets / $70,000 current liabilities = Ratio of 1.7

Want more information?

Posted

10 months

ago

by

Olivier Brunel

#683

171 views

Edited

8 months

ago