GEM-CAR FAQ

Produce Electronic Statements (in XML Format)

Before generating your tax slips, make sure you have your preparer number, employer identification number, and sequential number for schedule 1 electronic format.

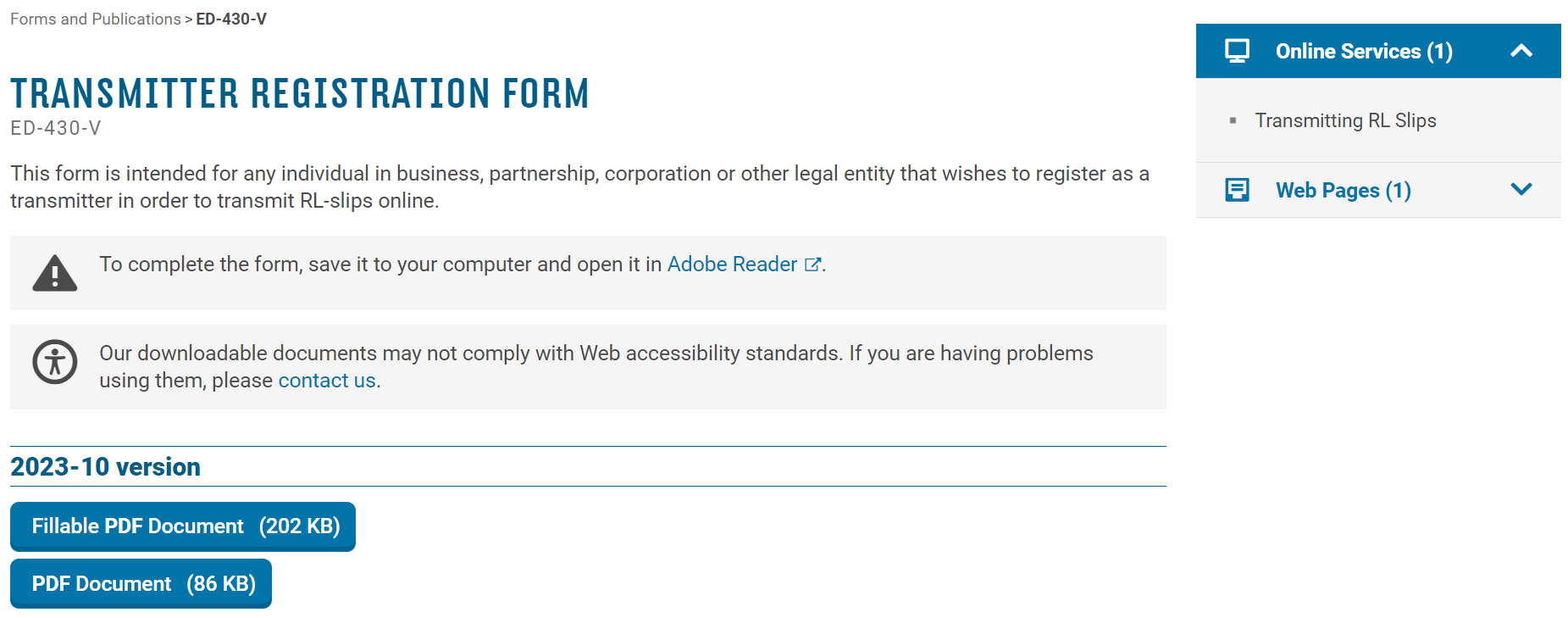

If you do not have this information, please follow the steps to obtain by clicking here.

Once you have this information, please enter it in the section provided in the Configurations > Configurations > Payroll tab.

![]()

Then, you can go to the Payroll > Tax slips menu to generate your Schedule 1 and T4 slips in paper (PDF) and electronic (XML) formats.

For more information on the procedure, please consult the following FAQ: How to produce your employees' T4 and Schedule 1 slips.

The document that will be generated for you will be a compressed (ZIP) file containing one compressed (ZIP) file per employee and several totals documents. Here is an example of what the ZIP contains:

Taxes (ZIP)

- Employee 1 (Zip)

- T4 (PDF)

- T4 (XML/Electronic)

- R1 (PDF)

- R1 (XML/Electronic)

Employee 2 (Zip)

- T4 (PDF)

- T4 (XML/Electronic)

- R1 (PDF)

- R1 (XML/Electronic)

- R1 Summary (PDF)

- Summary T4 (PDF)

- R1E Summary (XML/Electronic)

- T619 (XML/Electronic)

For Schedule 1 reporting, you will need the file named R1E Summary in XML format, which contains all of your employee's Schedule 1.

For T4 reporting, you will need the file named T619 in XML format, which contains all of your employees' T4s.

Posted

1 year

ago

by

Olivier Brunel

#819

437 views

Edited

1 year

ago