GEM-CAR FAQ

Management of Currencies and Taxes

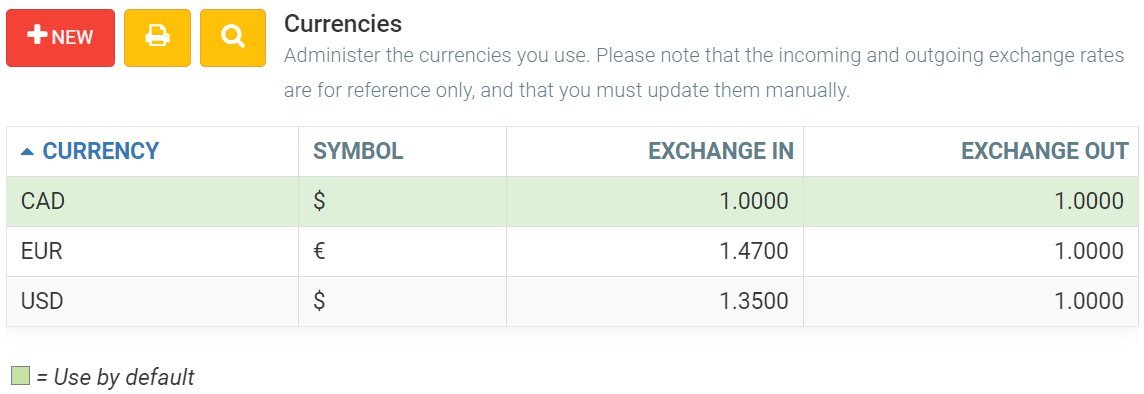

By default, the system creates the currency CAD and USD in your system. The currencies can be modified following these steps.

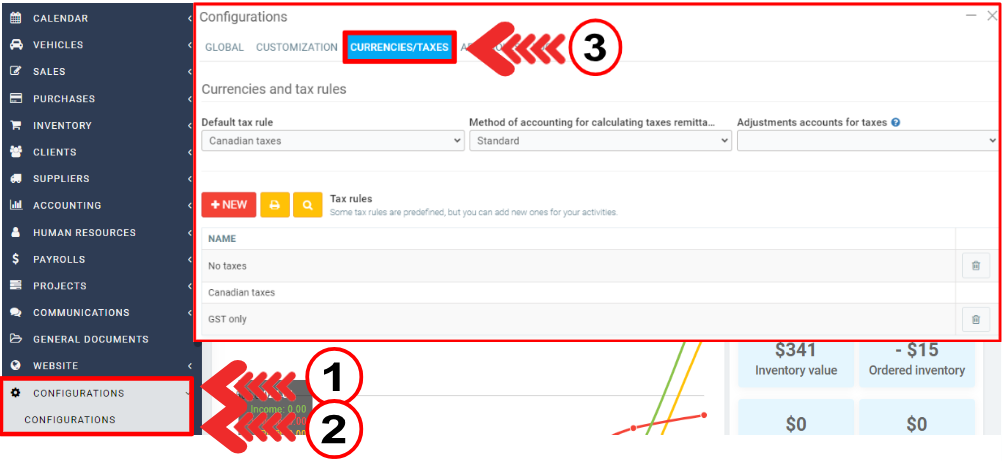

On the left menu, click on Configurations > Configurations > Currencies/Taxes.

A currency includes the following information:

- the Name of the currency

- the Symbol

- the Exchange rate in/out (*Note that the rate is not automatically updated by the software, you must manage it manually).

You can have only one currency specified as your default currency, and it must have a rate of 1.00 because the other rates will be based on it.

Note: incoming currency represents money coming into the company (invoice to customer), and outgoing currency is the money going out of the company (payment to suppliers).

Currencies can be used in several locations in the software, for example, during a sale or a purchase, or when configuring an account in the chart of accounts.

Moreover, you can configure your suppliers or customers to use a default currency, which could be different from yours, during sales or purchases.

The currency used in the various transactions will be reflected in several reports in the system, including inventory reports, which define the value of the merchandise according to the rate of the currency at the time of purchase of the product, and in accounting reports such as the age of the accounts.

Note: the conversions in the Accounting reports are estimates, as they are based on the exchange rate entered in the software. If you want to make a currency exchange with your bank, you will have to make the transaction from one account to another manually.

Other articles on the subject:

Chart of Accounts - Import File Headers Legend

How to Import a Chart of Accounts

How to Do Your Bank Reconciliation

Posted

1 year

ago

by

Olivier Brunel

#281

359 views

Edited

1 year

ago