GEM-CAR FAQ

How to Configure Tax Numbers

Tax Configuration

The first time you use GEM-CAR, the system will help you set up your taxes according to your province. There is no need to change the tax settings after this step. When you generate a quote from a sale, you should see your tax numbers next to the total at the bottom. However, if you made a mistake and want to change your settings, here is the procedure.

This step is particularly important if you have activities in other provinces or countries than your province and/or if you have particular activities that require special configurations such as hosting or tire sales.

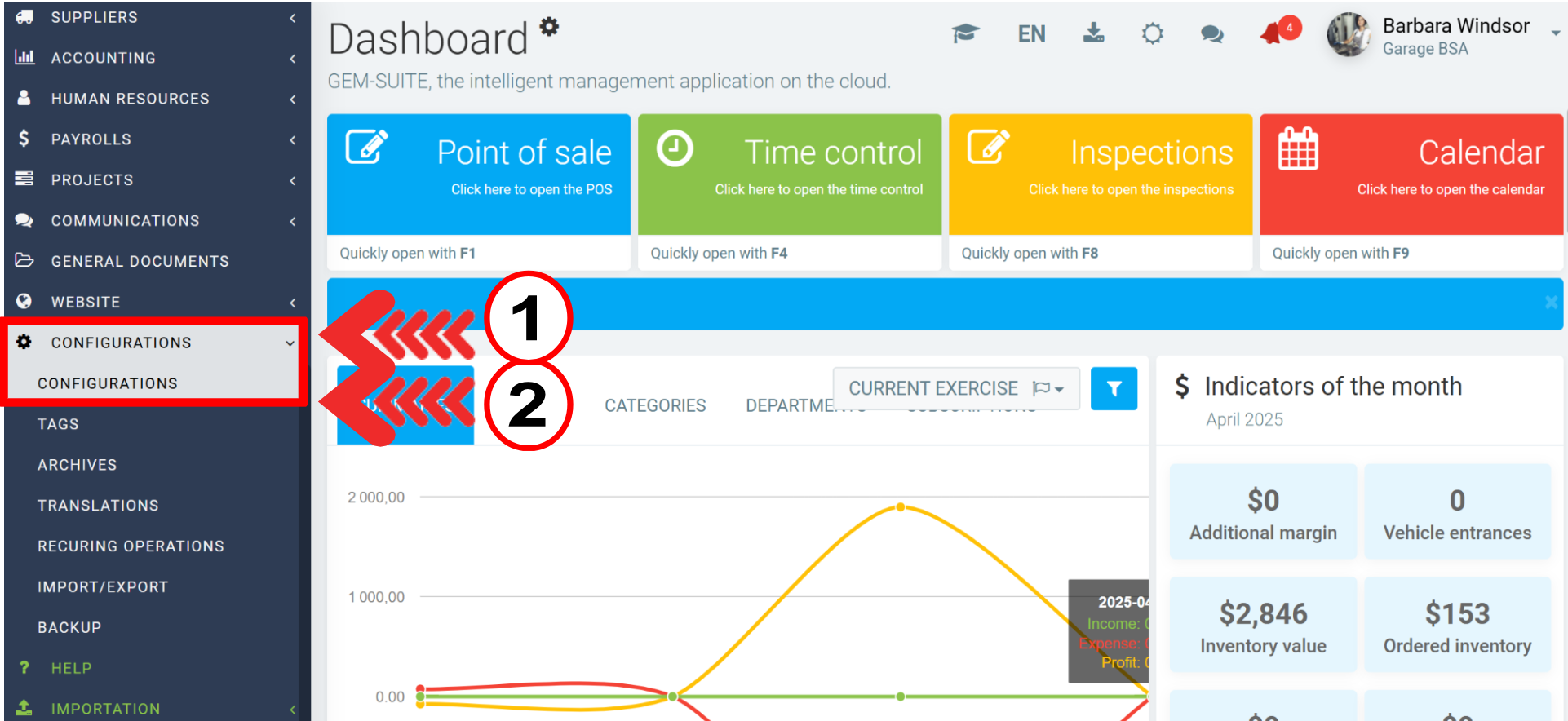

To check the taxes, click on Configurations > Configurations.

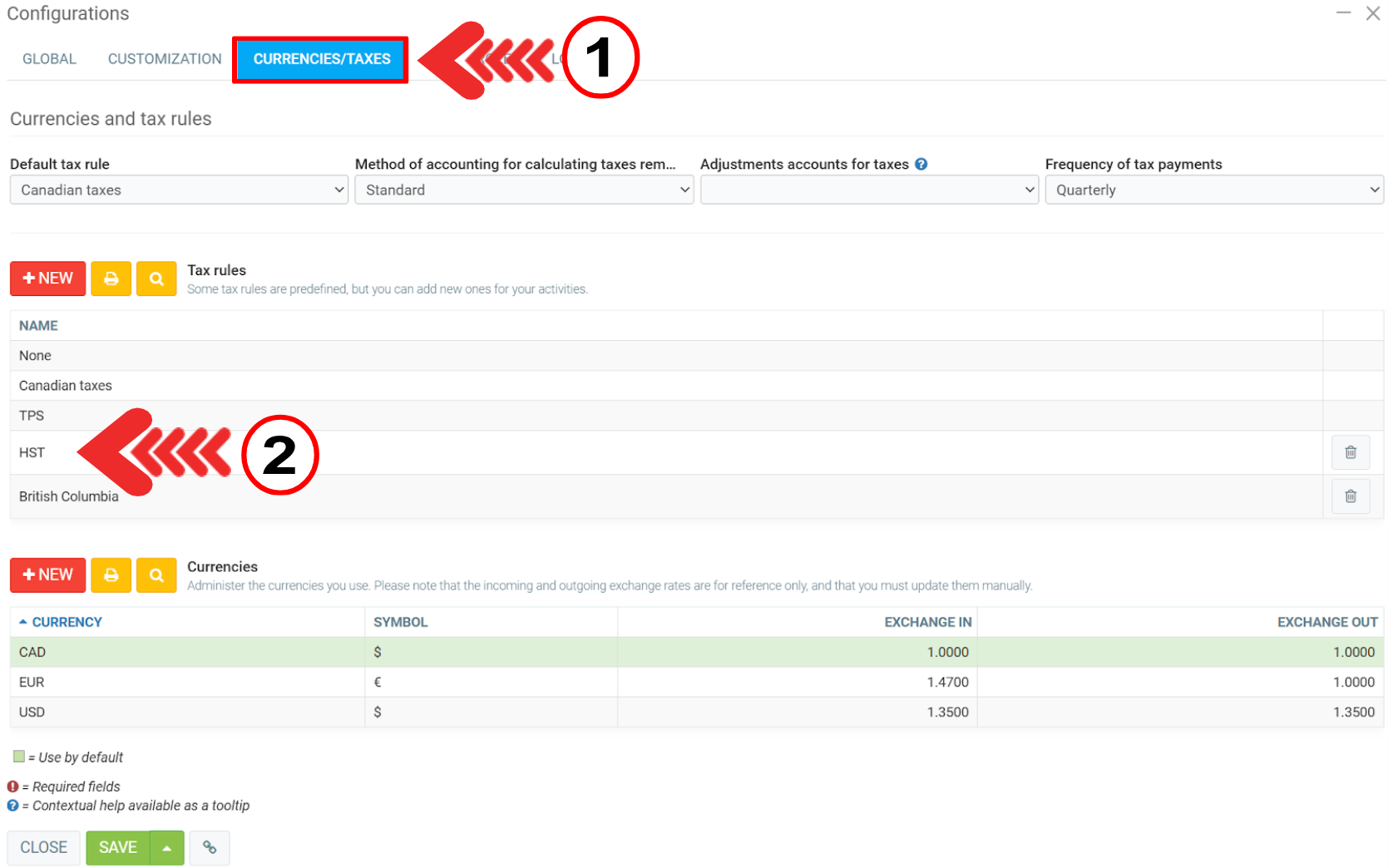

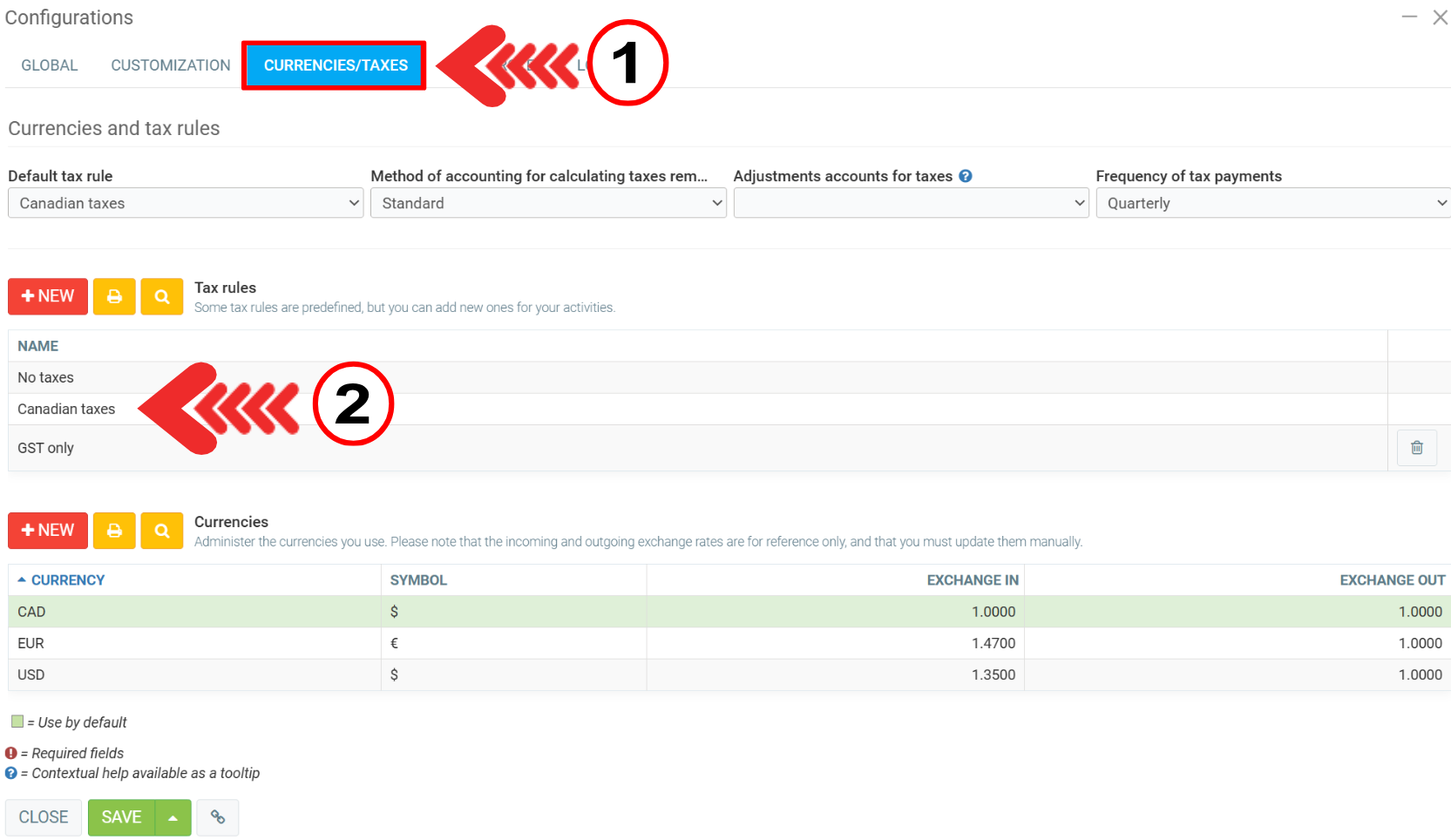

Then click on Currencies/Taxes tab and search for the taxes you want to include or click on +New beside Tax rules.

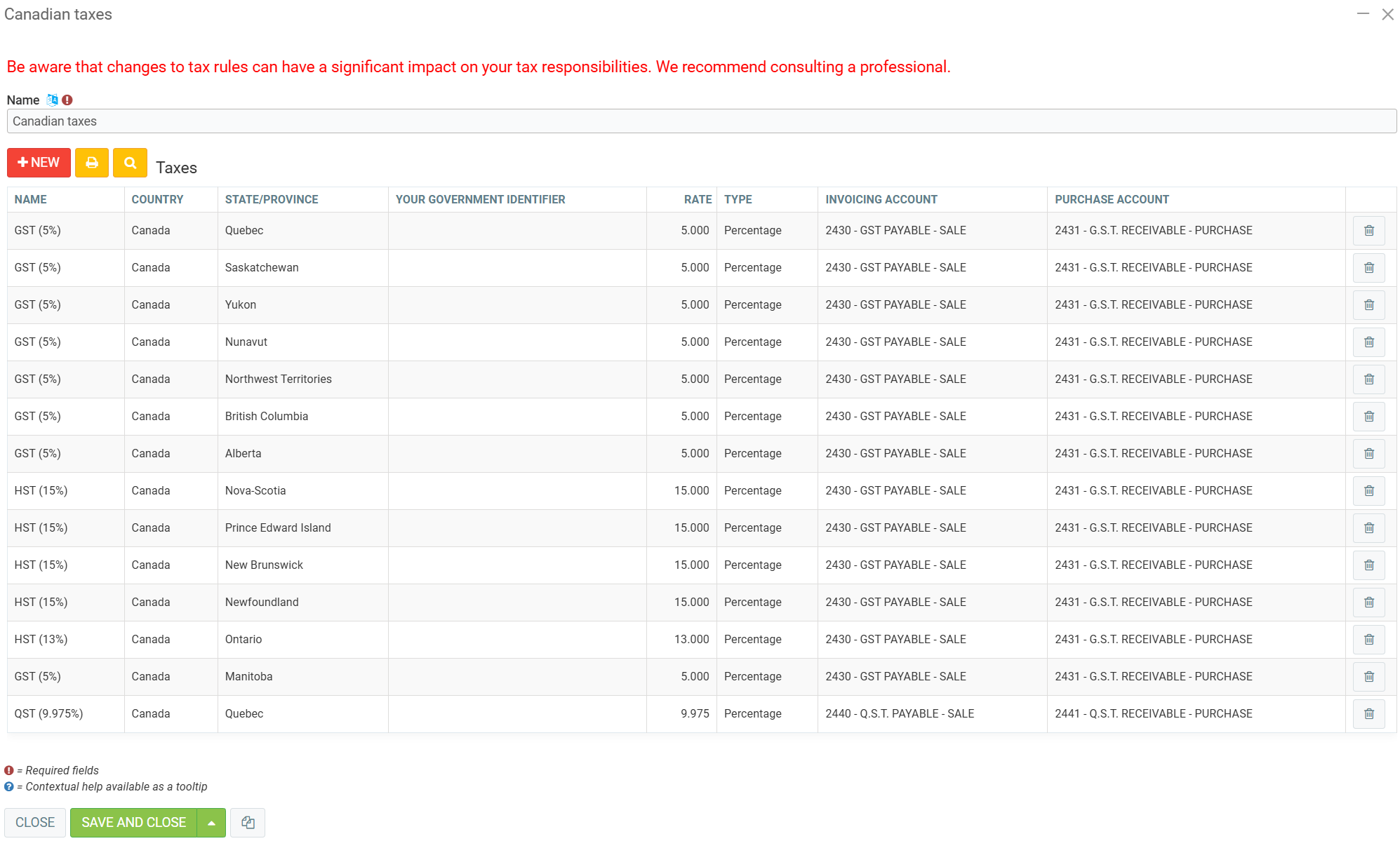

If you want to specify your tax numbers, click on the Canadian taxes. If you have the module, Carrier, Broker, or Courier, you will have to do the same thing in "Taxes Canada - Freight transportation" and "Taxes Canada - Freight transportation in Quebec".

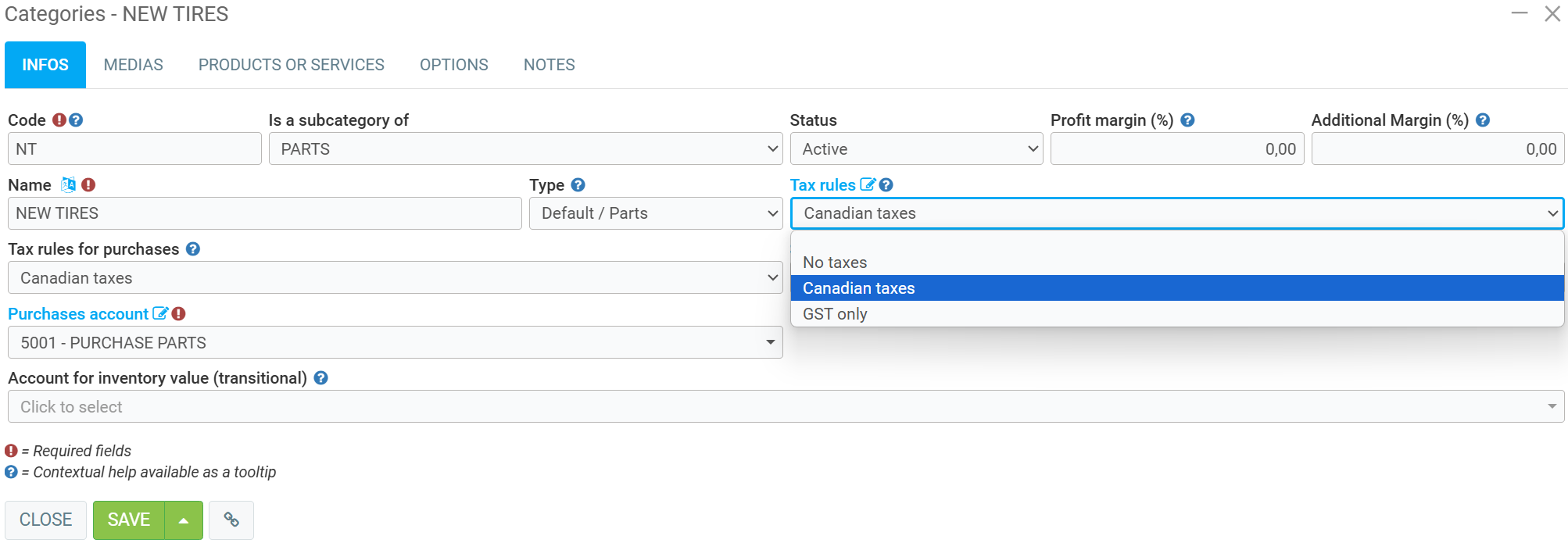

Note: If you want to sell products without taxes, you don't need to add a tax rule. Simply specify the tax rule No taxes to be used in a category or manually during a sale in the fields related to taxes.

However, a special tax rule may be created to avoid charging provincial taxes.

In this section, all taxes are specified by province. You can click on each province to insert your tax numbers. It is important to insert your numbers in each province because if you invoice a customer in a province where the tax number is not listed, it will not appear on the invoice.

Configuration of Your Tax Numbers

Click on Configurations > Configurations > Currencies/Taxes tab. Then click on British Columbia in the Tax rules menu.

You can enter a new tax and within it you can include which taxes are charged in the given province.

If you wish to include another tax, click on +New.

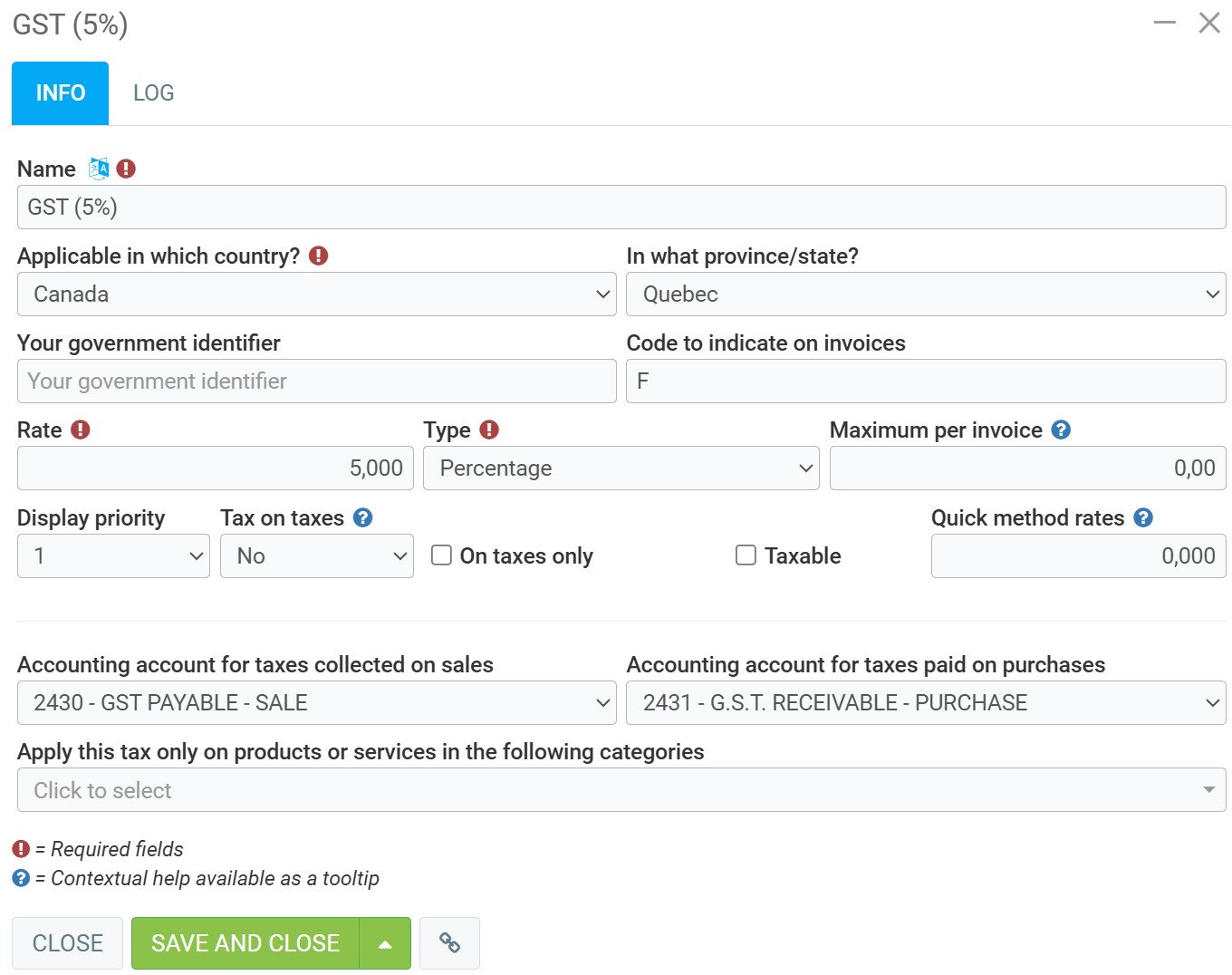

On the next page, enter the following information:

- Name

- Applicable in which country?

- In what province/state?

- Your government identifier

- Code to indicate on invoices

- Rate

- Type

Click on Save and Close.

Note: If your sales volume exceeds the provincial exemptions, don't forget to register and add your tax number. Ex British Columbia taxes.

Other articles on the subject:

How Does GEM-CAR Calculate Taxes on Estimates and Invoices

Change the Tax for a Single Product in a Sale

Modify the Tax for a Specific Sale

Charge Taxes According to Branch or Customer Address

Posted

1 year

ago

by

Olivier Brunel

#257

412 views

Edited

7 months

ago