GEM-CAR FAQ

Modify the Tax for a Specific Sale

Adjusting the tax rate for a specific sale is an operation that can be necessary in a variety of business situations.

Whether due to special promotions, local tax regulations or special agreements with a customer, adjusting the tax rate enables the company to comply with legal requirements while meeting specific market needs.

Accurate adjustment is essential to avoid errors in tax returns and to maintain compliance with accounting obligations.

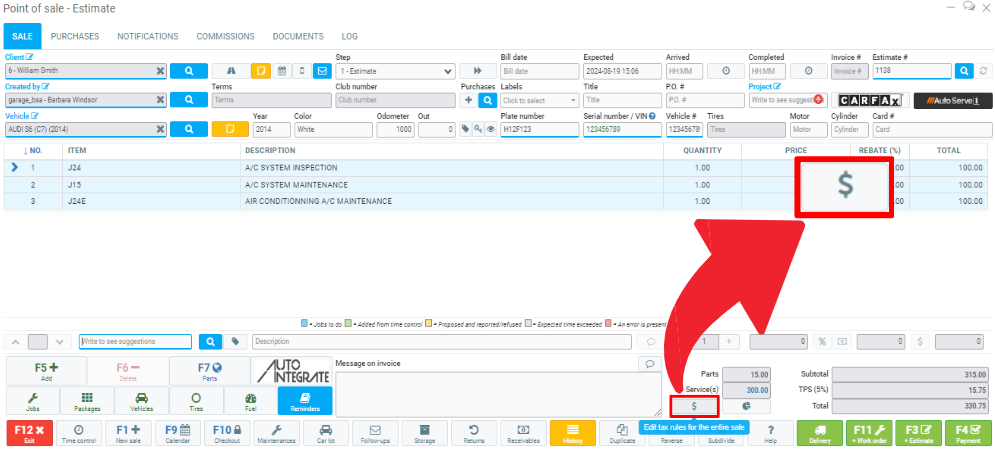

In your GEM-CAR, click on the Point of Sale, enter the customer and the products or services to be performed.

Then click on the $ symbol in the right corner of the Point of sale, below the Parts and Services prices.

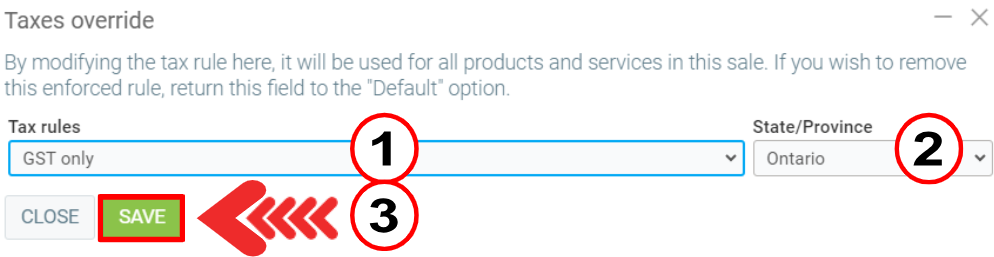

A window opens for you to select:

- Tax rules

- State/Province

Click on Save.

If the desired option does not appear, you need to configure the tax rule in your GEM-CAR. To do this, consult the FAQ: How to Configure Tax Numbers

Other articles on the subject:

Charge Taxes According to Branch or Customer Address

Deposit with Taxes vs. Deposit with no Tax

How Does GEM-CAR Calculate Taxes on Estimates and Invoices

Posted

7 months

ago

by

Bianca da Silveira De Amorim

#1928

95 views

Edited

7 months

ago