GEM-CAR FAQ

Deposit with Taxes vs. Deposit with No Tax

Taking deposits with GEM-CAR

With GEM-CAR, you have the option to take deposits with or without taxes.

Taxed deposits

Taxed deposits are less commonly used because they should be considered non-refundable.

They are treated as a sale by the government.

Since it's considered a sale, accounting entries are necessary in case a refund needs to be issued.

Additionally, explaining the taxed deposit amount to customers can be challenging.

Therefore, it's almost always preferable to take deposits without taxes.

Non-taxed deposits

Non-taxed deposits are refundable.

The sale is only considered complete when the invoice is paid in full.

Taking a deposit

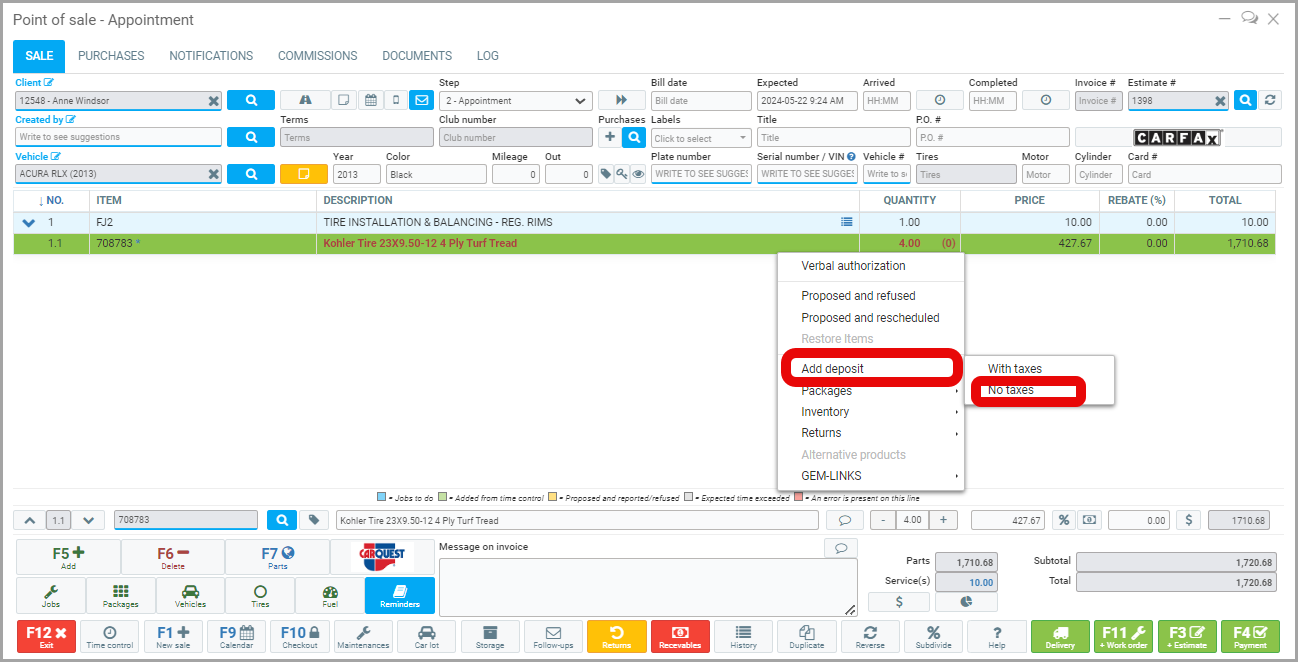

To take a deposit, from the Point of sale, right-click on the item for which you want to take a deposit.

Select Add deposit, and choose With taxes or No taxes.

Note: Most workshops choose not to tax deposits.

More details on non-taxed deposits

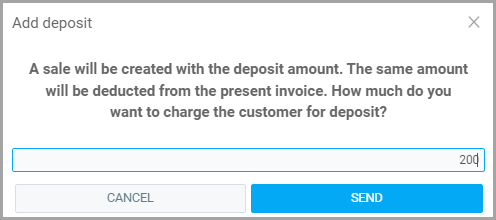

You can choose the amount you want to take as a deposit.

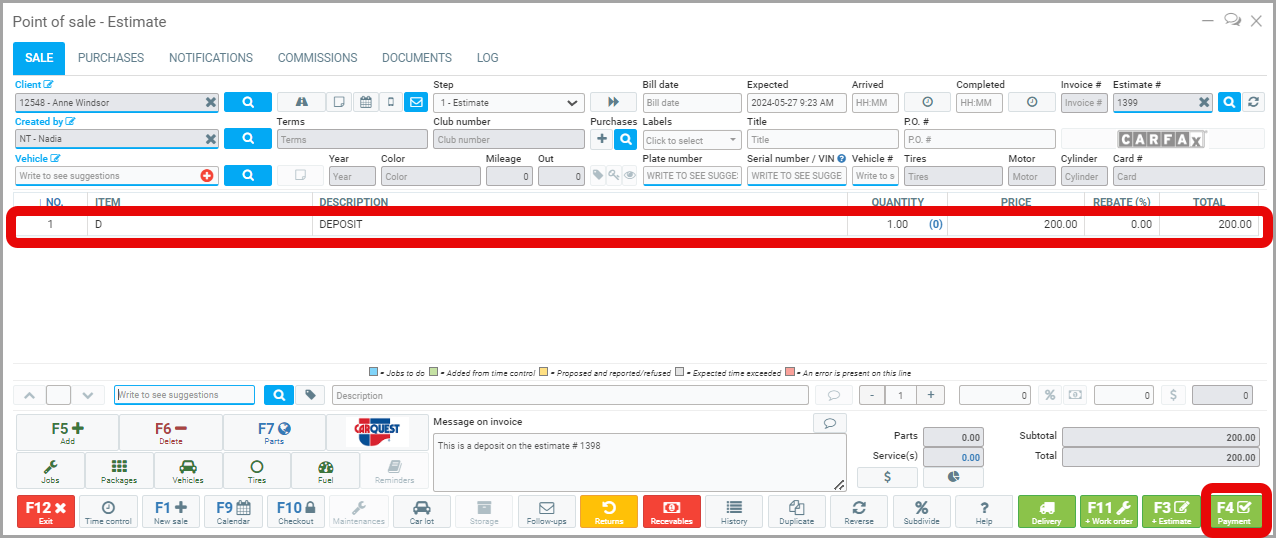

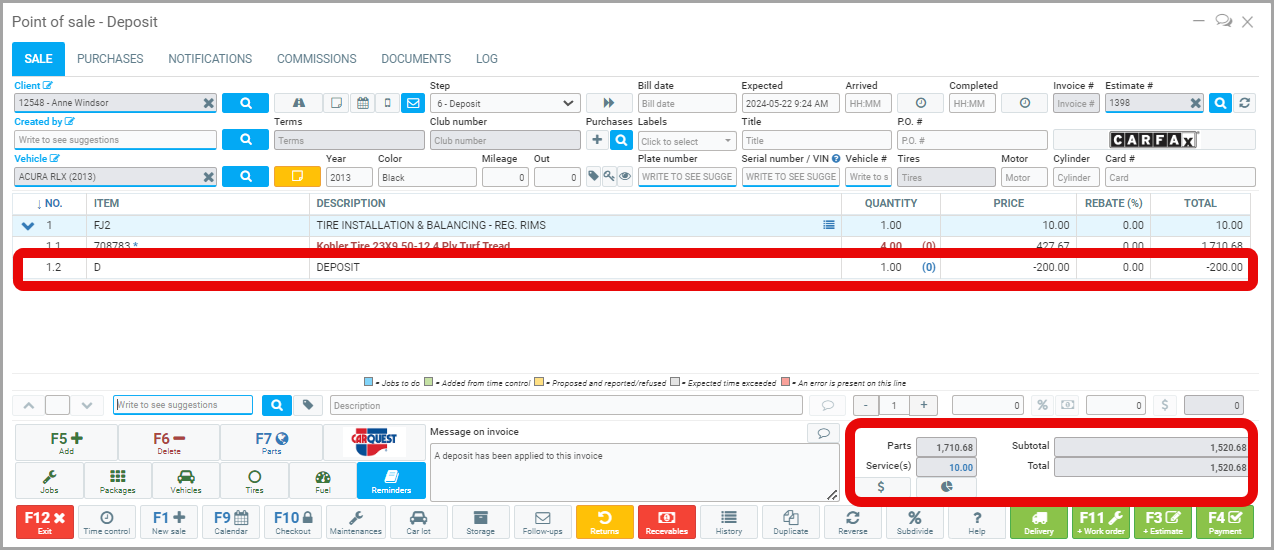

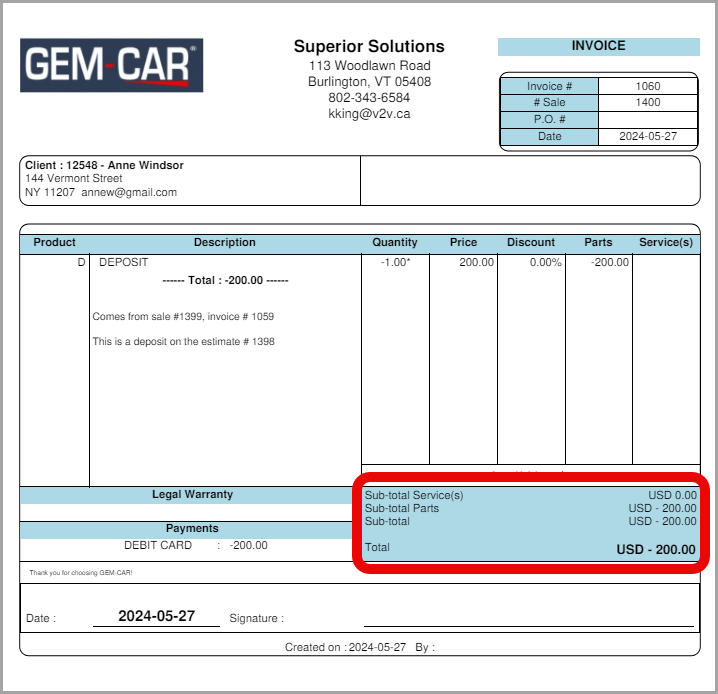

As mentioned, a new invoice is created with the deposit amount, which is then deducted from the current invoice.

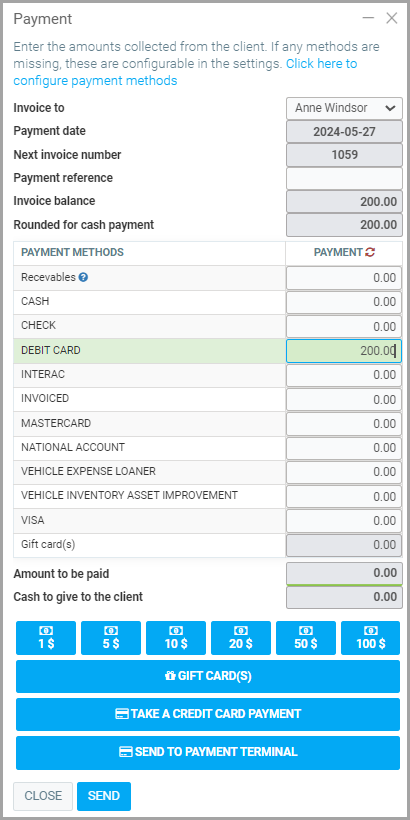

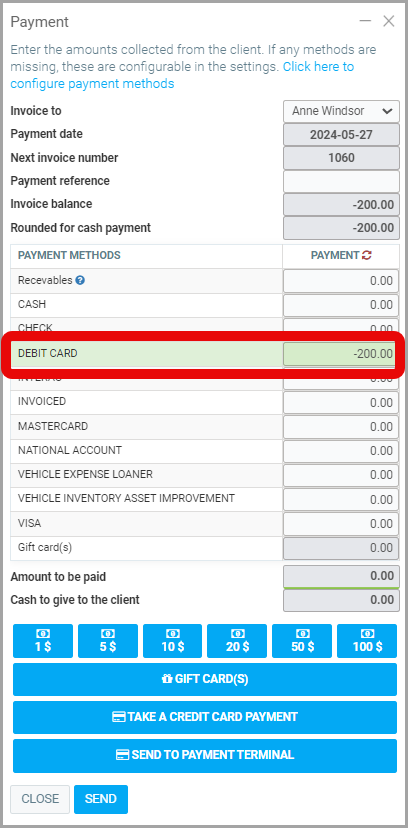

Process the customer's payment by clicking Payment as for a regular sale and selecting the payment method.

The tax amount payable remains unchanged despite the deposit being taken and is subtracted from the invoice.

Refunding a deposit

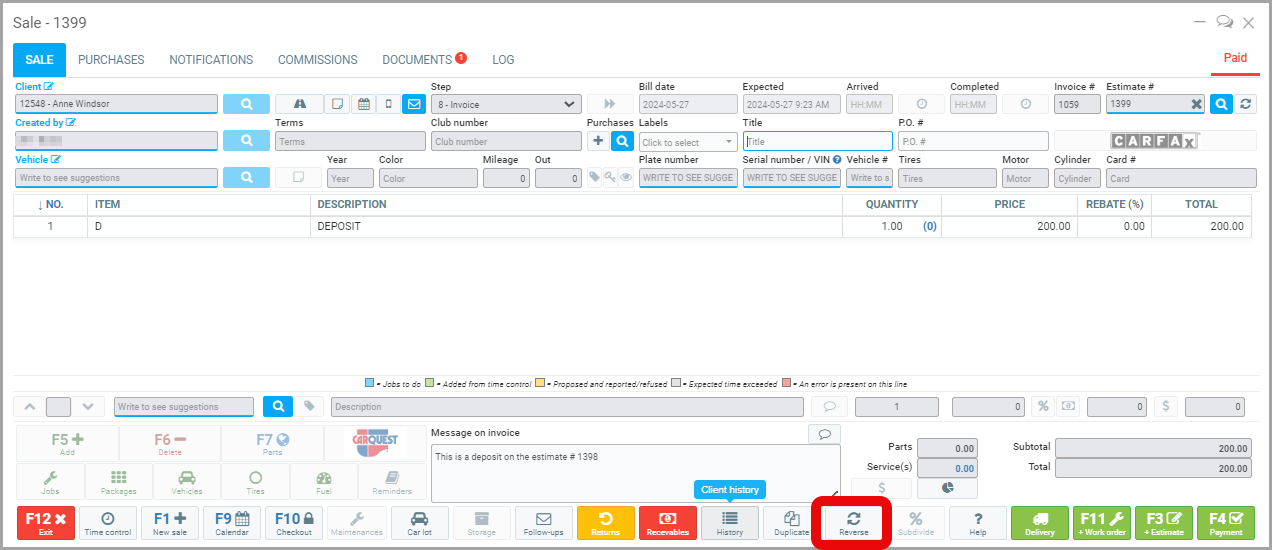

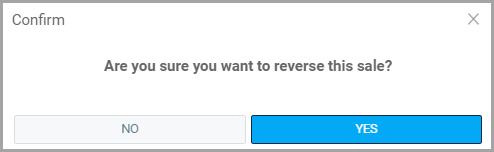

To refund a deposit, you must first Reverse the deposit invoice from the Point of sale.

Confirm that you want to reverse the sale.

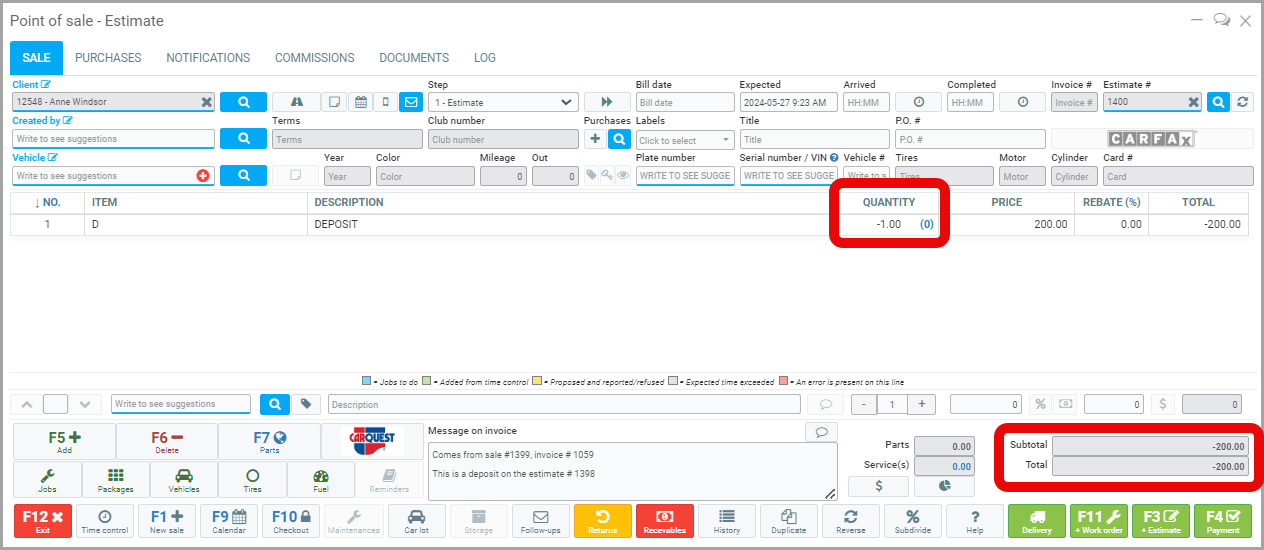

A new invoice is created with the negative deposit amount.

Click Payment and Send.

The default payment method is the one used for the initial payment.

Important note: The deposit is not automatically removed from the original sales invoice.

In other words, if a deposit is taken for a tire purchase, a second sale is created just for the deposit, and the deposit amount is subtracted from the tire sale price.

When the deposit invoice is reversed, the deposit must be manually removed from the tire sale.

Other articles on the subject:

Management of Currencies and Taxes

How Does GEM-CAR Calculate Taxes on Estimates and Invoices

Charge Taxes According to Branch or Customer Address

Configure an Accounting Account so that Taxes Are Automatically Calculated on Transactions

Posted

10 months

ago

by

Victor Elie

#127

227 views

Edited

7 months

ago