GEM-CAR FAQ

How to Generate an Invoice without Putting it in Receivable or Taking a Payment

In the GEM-CAR system it is possible to generate a sale and then pay it without generating an invoice or placing it as a receivable.

Below, we'll explain the steps for setting up this method and how it can affect Accounting.

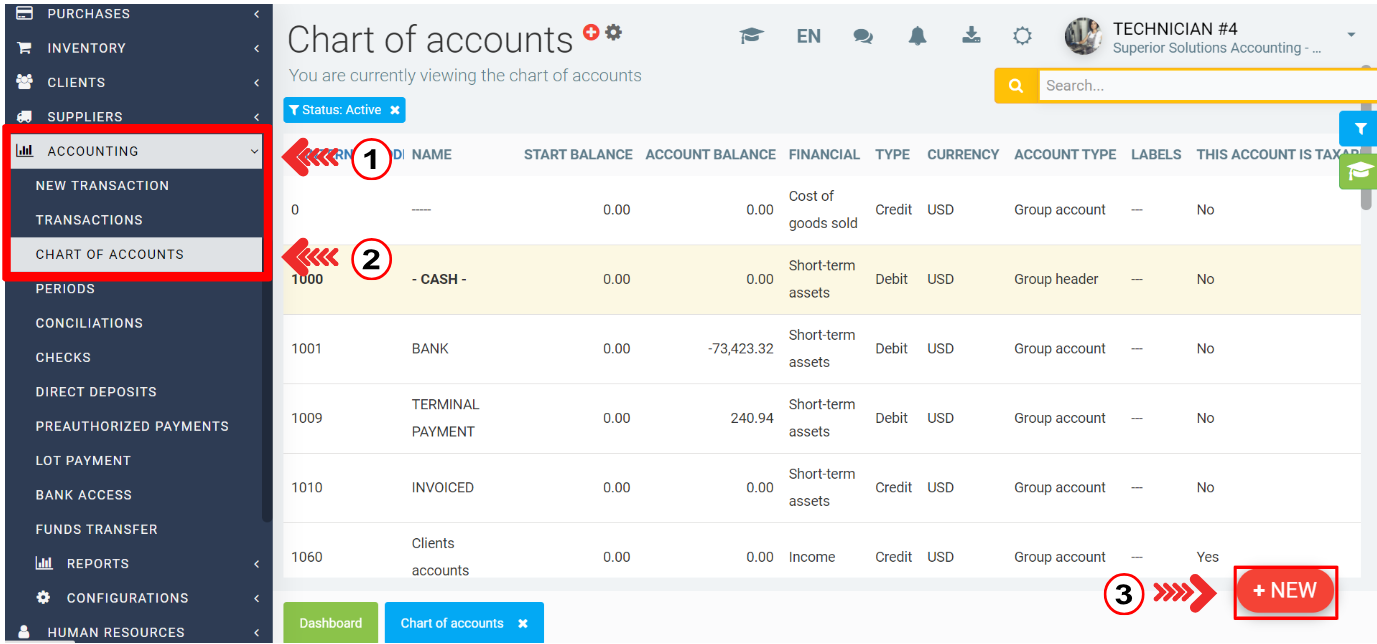

1. Create a new account in the Chart of accounts

- Click on Accounting > Chart of Accounts > +New.

Make sure to use a number before 1099 and does not duplicate an existing internal code.

Click on Financial > Assets > Short-term assets.

Then click on Save.

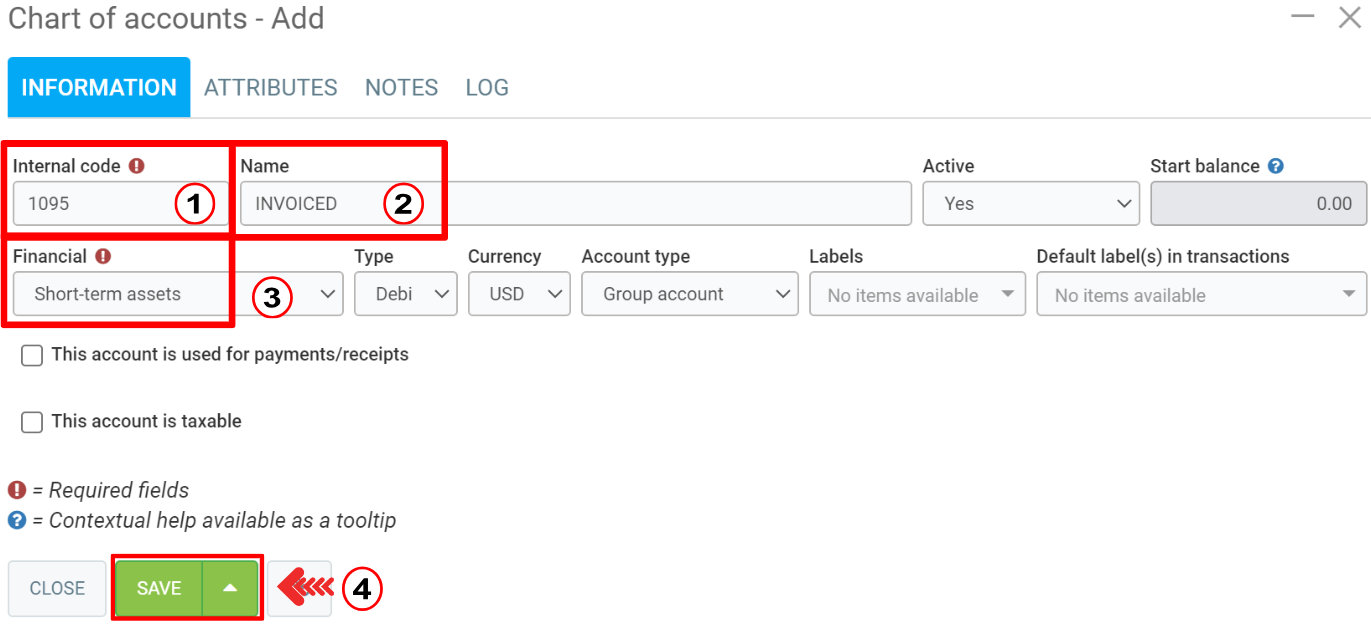

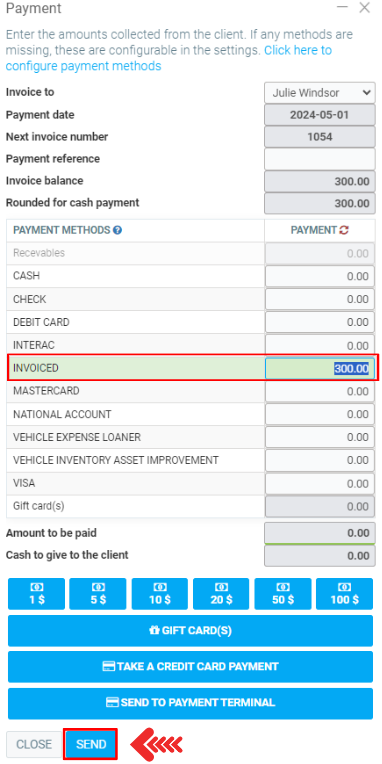

2. Create a new payment method

- Click on the tab Sales > Configurations > Payment methods > New.

- Choose the name, the account number (in this case 1095 - Invoiced dummy), the type of payment on the terminal as none and click on Save.

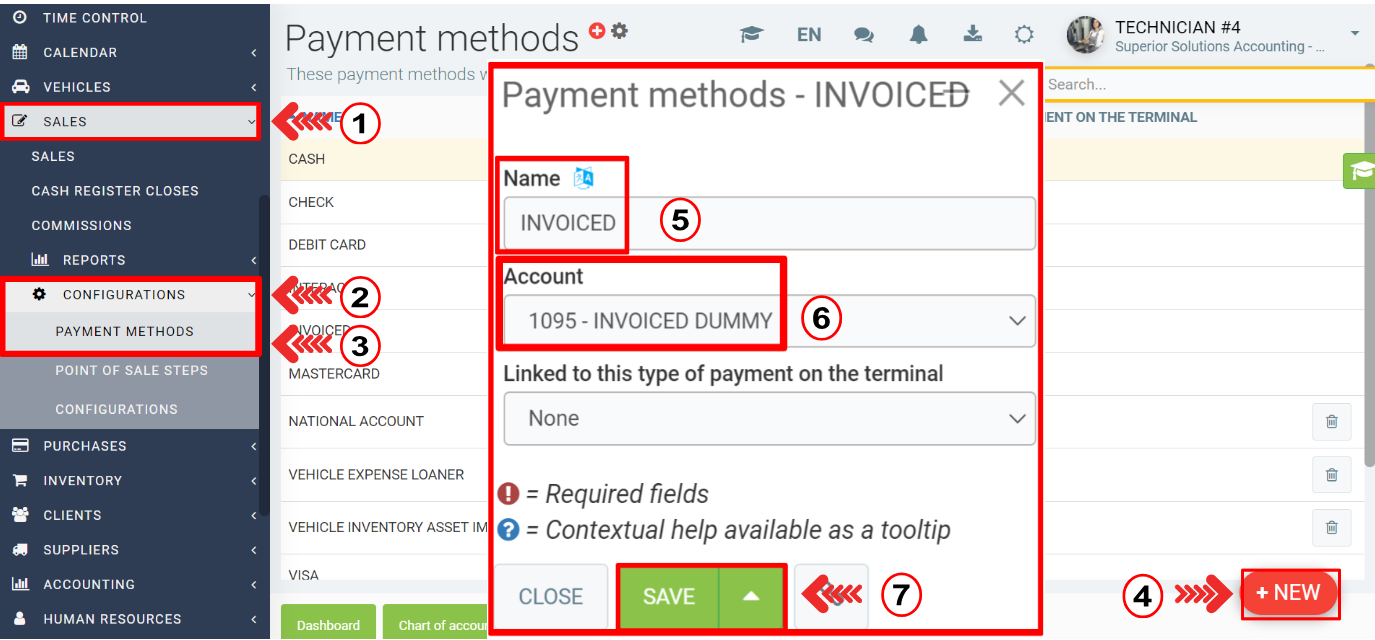

3. Create an Estimate in the Point of Sale

- In making payment for the said estimate, use the "INVOICED" as the method of payment.

- Then click on Send.

On the Documents tab, it is possible to visualize the invoice and the payment method: INVOICED.

This kind of transaction requires specific steps regarding the Accounting. Click on the following link to access the explanation:

4. Make sure this will not be forward to Accounting.

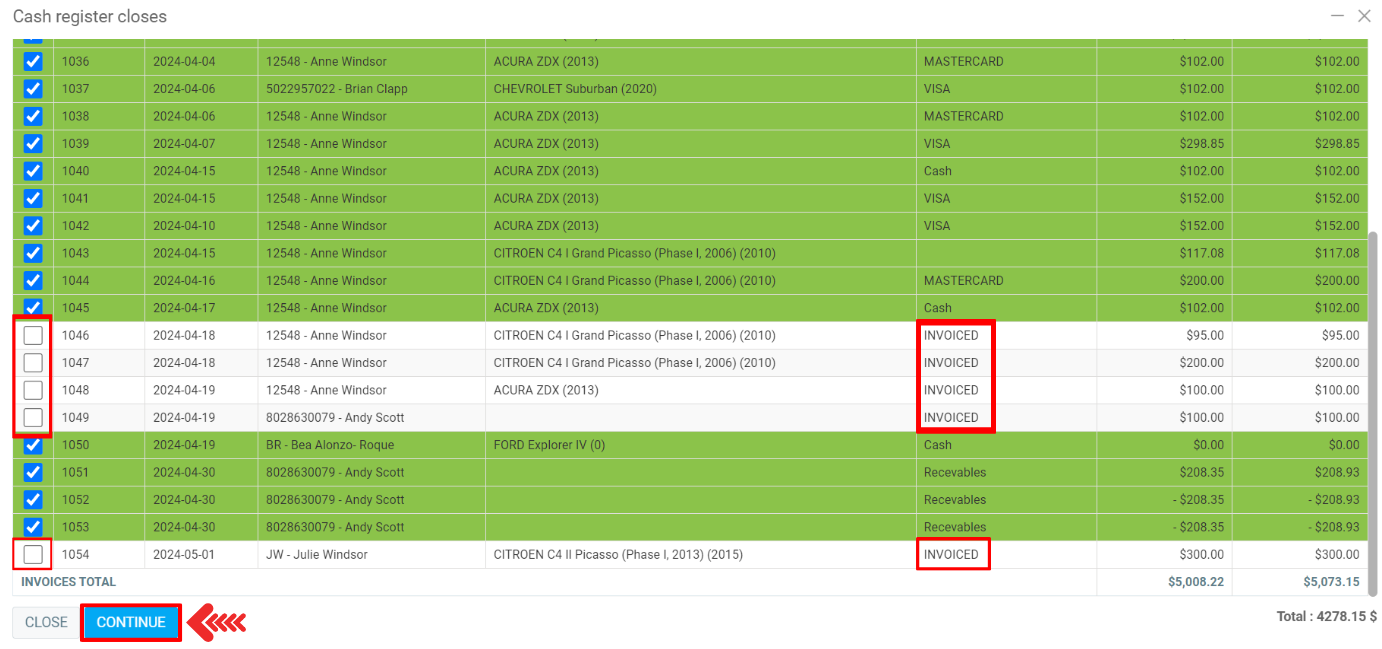

- Since we do not want this invoice to be forwarded to Accounting, uncheck this invoice in the Cash register closes at the end of the day (or push the F10 button in the Point of Sale page).

- Uncheck the invoices with the method payment ''INVOICED''. Then click on Continue.

- By doing this, you are not forwarding the invoices in the Accounting. This will not be reflected as payments nor accounts receivable.

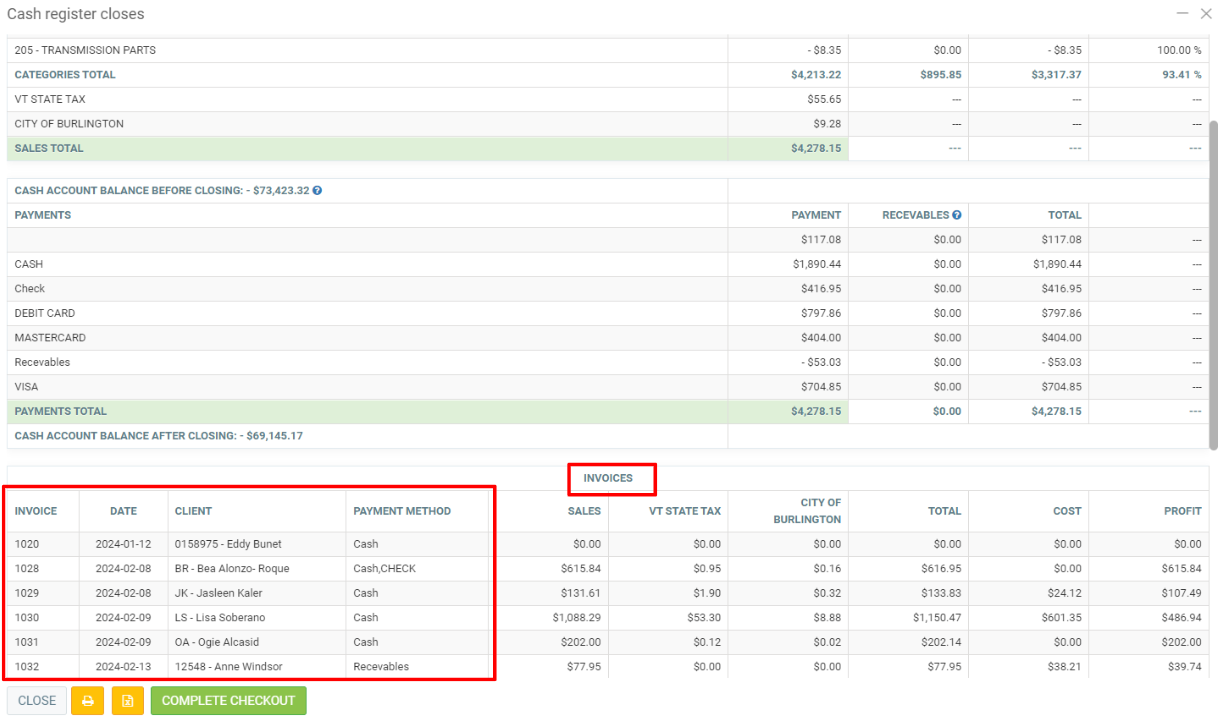

The ''INVOICED'' invoices do not appear in the invoices at the Cash register closes.

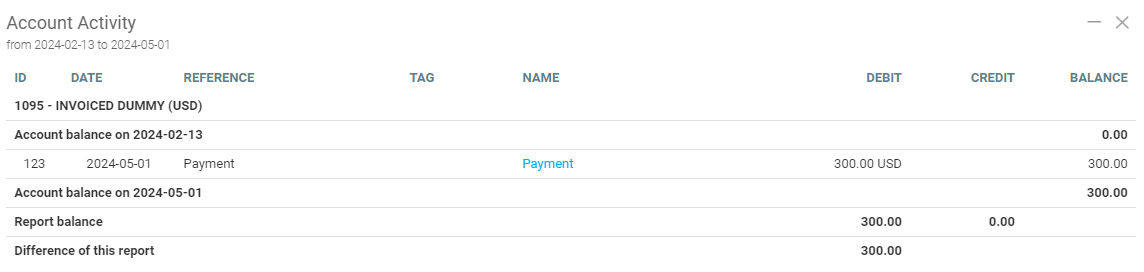

Validate on the Account Activity of 1095 if the dummy invoices did not appear.

Go on the menu and click on the tab Accounting > Reports > Account Activity.

- Account from: 1095 INVOICED ACCOUNT

- Account to: 1095 INVOICED ACCOUNT

Select the correct periods and click on Send.

The dummy invoices made on April 30 did not appear here but the one produced on May 1st is showing because it was not unchecked during the Cash register closes. Hence, it was forwarded to the Accounting module.

Do not forget to validate this on the Accounting reports.

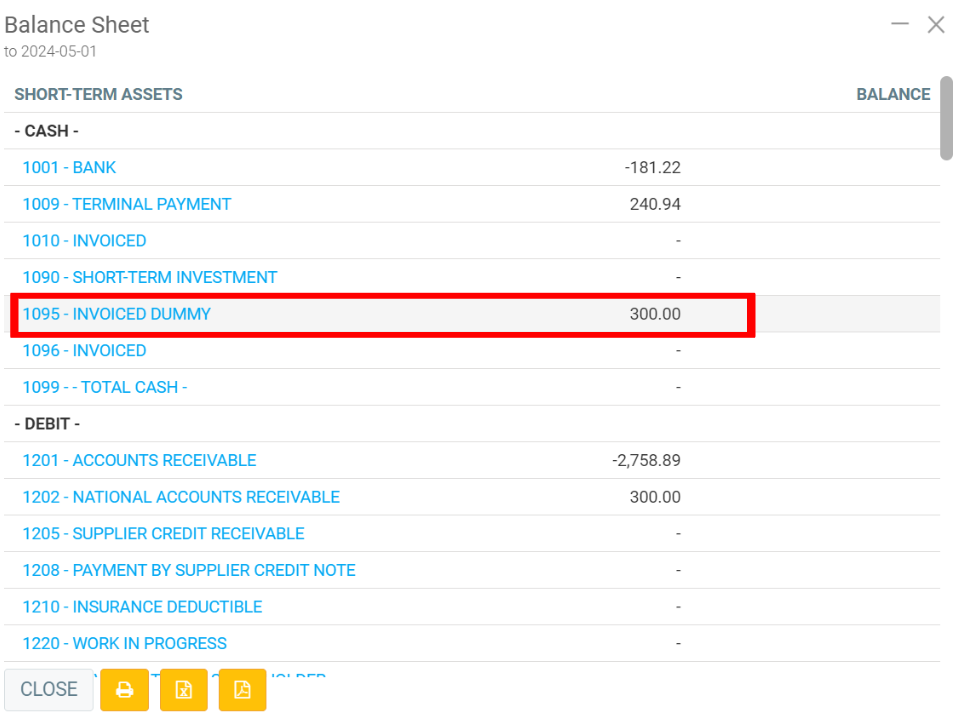

There should be zero value in 1095 when generating a Balance sheet, otherwise, this will make the company's assets incorrect (overstated) because in reality these payments were not really received.

To do it so, click on Accounting > Reports > Balance sheet.

The 1095 - Invoiced dummy should be zero or must not appear at all, depending on the options you selected while generating the report.

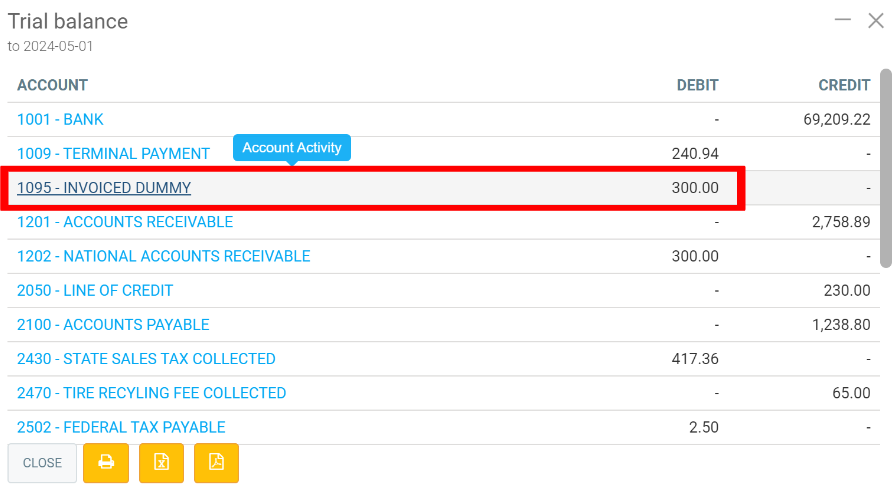

The value in this case is 300, because it was not unchecked and it is irreversible.

Another Accounting report to check is the Trial balance. 1095 must be zero, or must not appear at all.

Click on Accounting > Reports > Trial Balance.

NOTE: invoices with the invoiced payment method will continue to appear on every cash register closing until they are sent to Accounting (the invoices must be checked as part of that day's cash) or are reversed.

Posted

11 months

ago

by

Olivier Brunel

#433

247 views

Edited

8 months

ago