GEM-CAR FAQ

How to Create a Supplier Credit Note

Each part is guaranteed for time and labor. To create a supplier credit note, follow these steps:

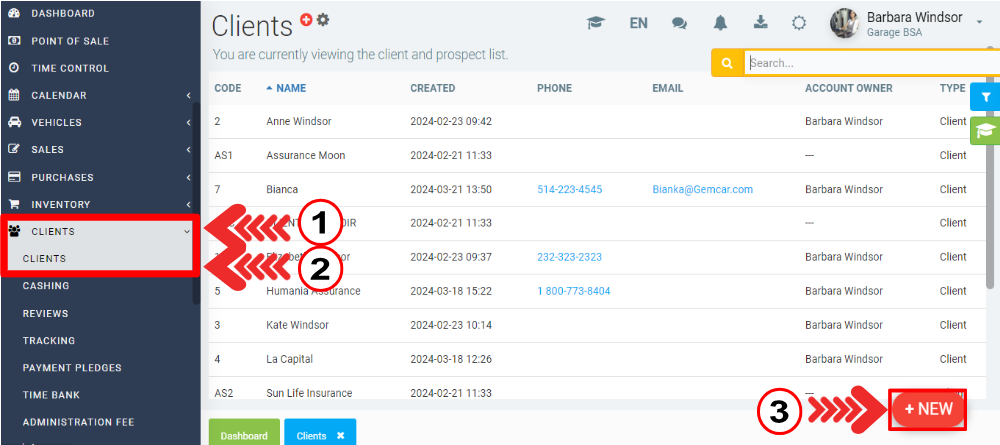

1) Create a customer in the supplier's name

Click on Clients > Clients > +New.

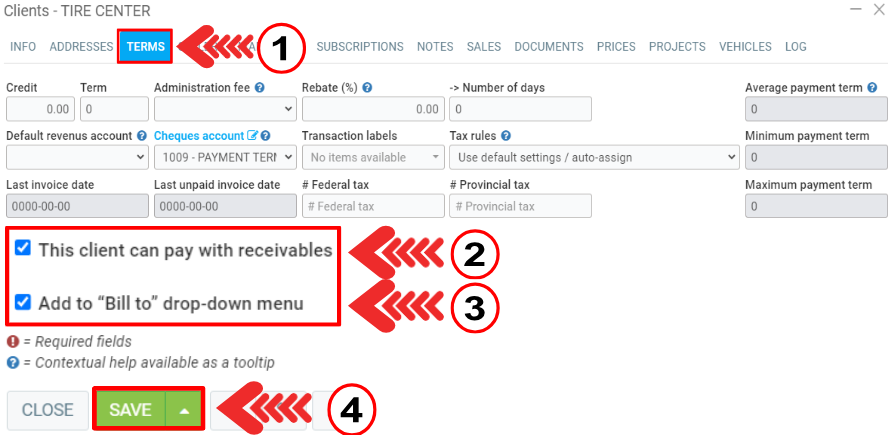

After completing the necessary information in the Info tab, click on the Terms tab.

In the Terms tab, check the following boxes:

- This customer can pay by receivable

- Add to 'Bill to' drop-down menu

Click on Save and close.

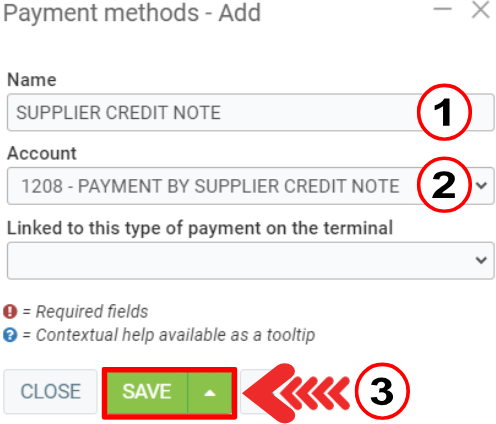

2) Payment method

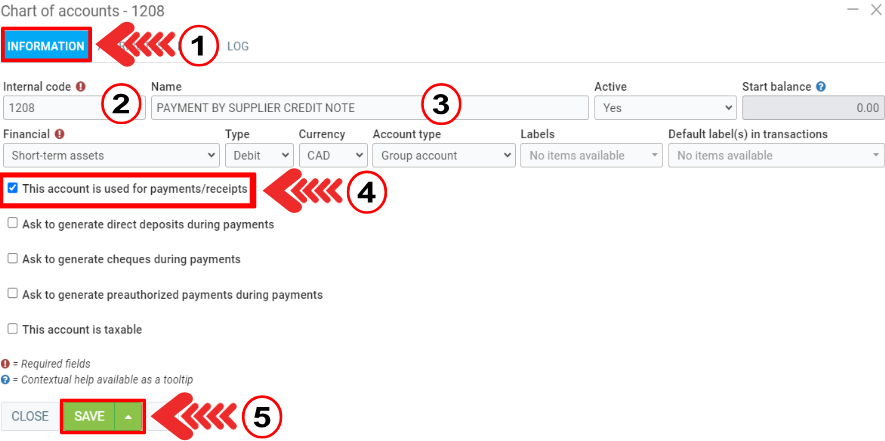

Before creating the payment method, click on Accounting > Chart of accounts > +New.

Create GL account:

- Code: 1208

- Name: Payment by supplier credit note.

Check the box “This account is used for payments/cash receipts”.

Click on Save.

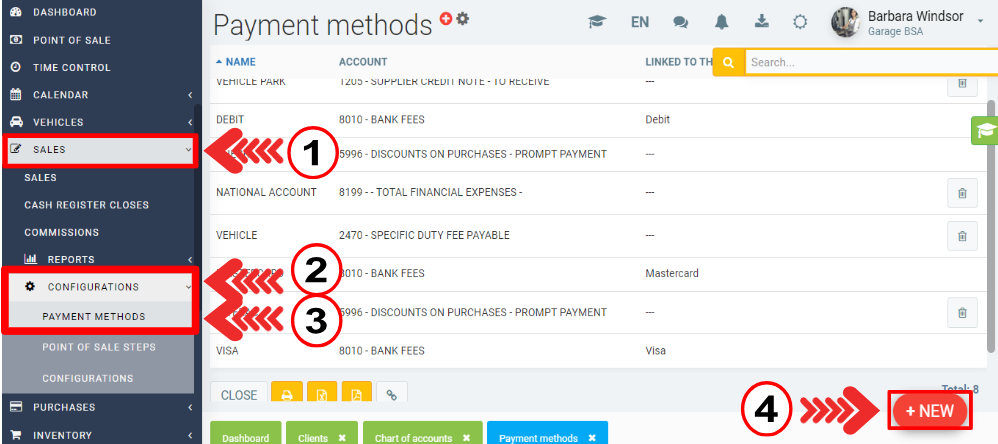

Go to Sales > Configurations > Payment methods > +New.

Create payment method: Supplier credit note, and link to GL account “1208 Payment by supplier credit note”. See more about Chart of accounts.

Click on Save.

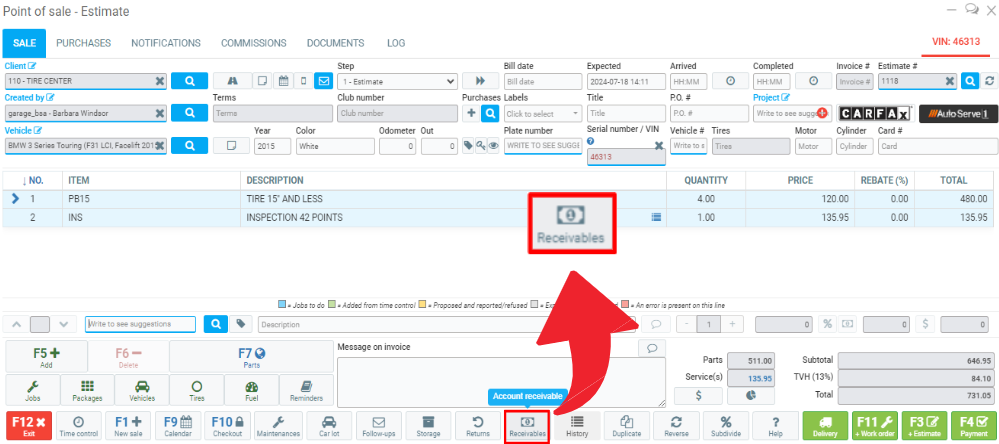

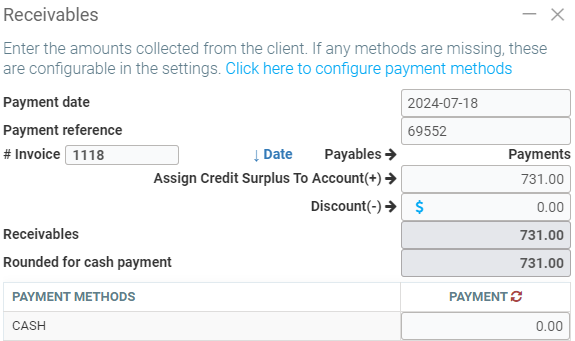

3) Invoice the customer with the supplier's rates

Open Point of sale to create a sale, invoice the supplier, and make the transaction receivable.

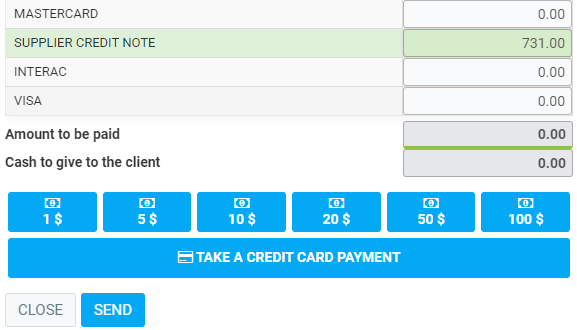

Select Supplier credit note as the payment method and press Send.

4) When a supplier sends a credit note as a method of payment

When a supplier sends a credit note as a method of payment, it's crucial not to enter it as an invoice. Otherwise, the garage risks paying taxes twice. To avoid this problem, the credit note must be correctly recorded in the accounting system, ensuring that it is identified as a credit note and not as an invoice.

5) Pay supplier invoices using GL 1208 credit

By following these steps, you can effectively manage the supplier credit note linked to the part warranty.

Other articles on the subject:

Add Notes to a Vehicle and Access Them via Point of Sale

Leave Internal Comments and Notes

Add a Product Note to the Point of Sale and/or Work Order

Add or View Client Notes at the Point of Sale

Add a Product Note to the Point of Sale and/or Work Order

Posted

1 year

ago

by

Bianca da Silveira De Amorim

#1877

446 views

Edited

4 months

ago