GEM-CAR FAQ

Indigenous Client: Modify Tax Rules

In Canada, under certain circumstances, Indigenous peoples may be exempt from paying GST/HST. For more details, refer to the GST/HST and First Nations Peoples webpage.

To apply the tax exemption for eligible customers in GEM-CAR, follow these steps:

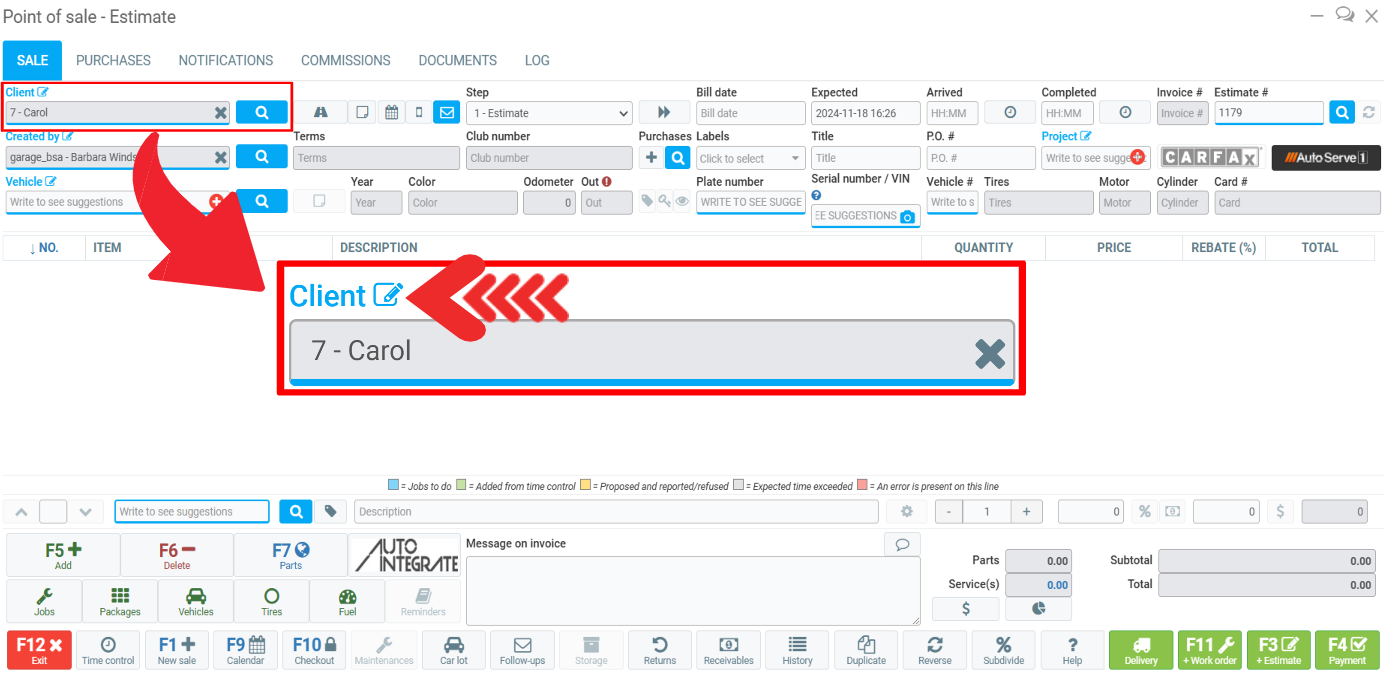

In the Point of Sale, open the client's folder by clicking on the icon next to Client.

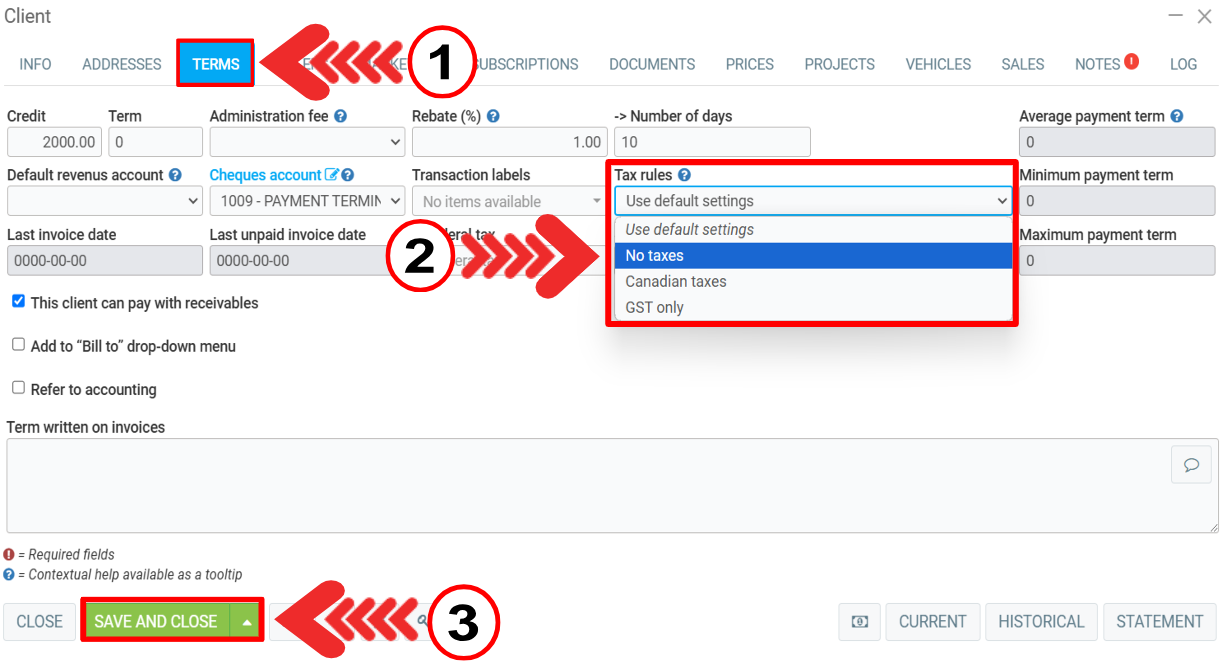

Click on the Terms tab and under Tax rules, select No taxes.

Click on Save and close.

If the None tax rule does not exist, you need to create it.

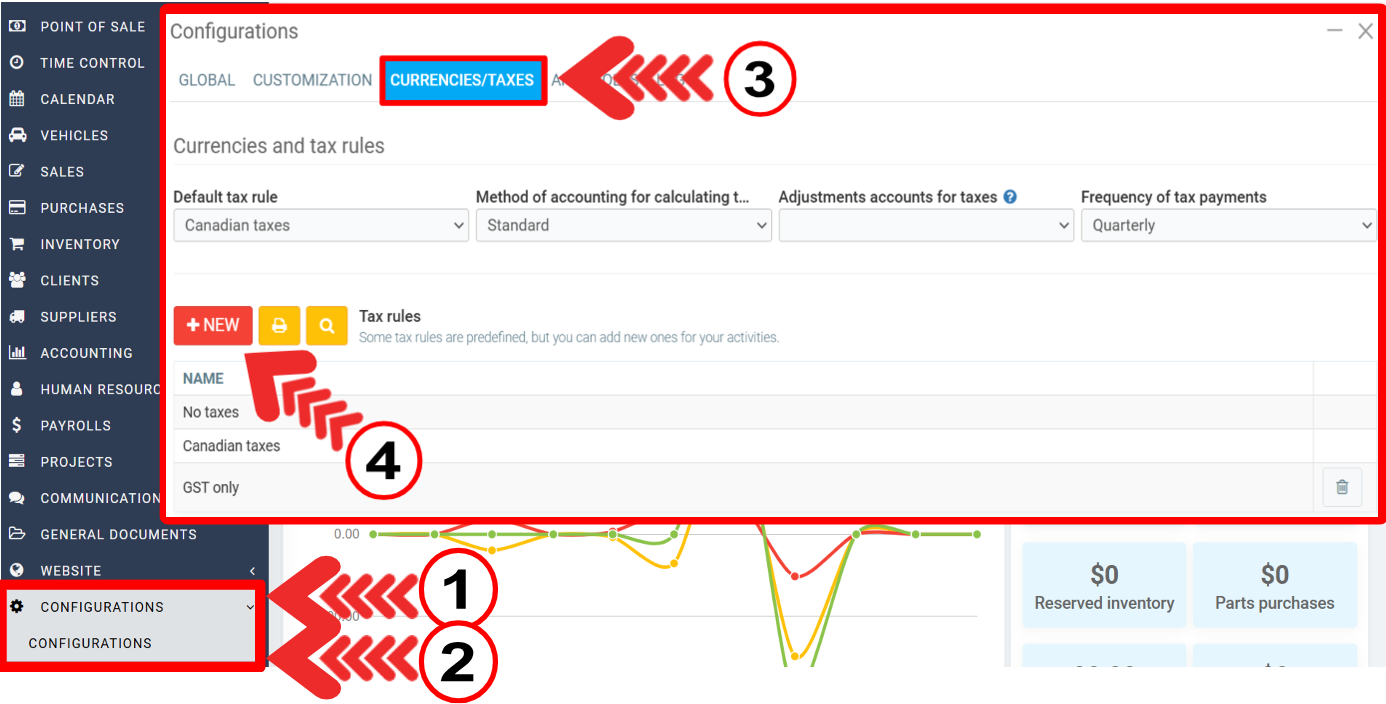

Exit the Point of Sale. From the main menu on the left of the application, click on Configurations > Configurations > Currencies/Taxes tab > +New to add a new tax rule.

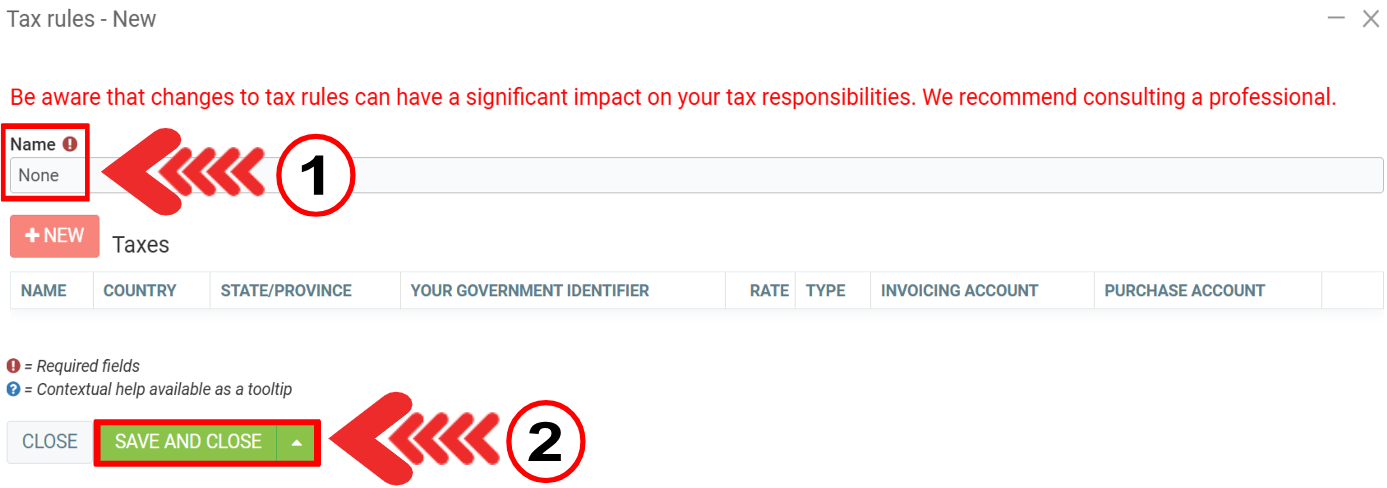

You can name it None and since you want it to be at 0%, simply click on Save and Close.

Return to the customer's file under the Terms tab. You should now be able to select the None tax rule as instructed above. Click on Save.

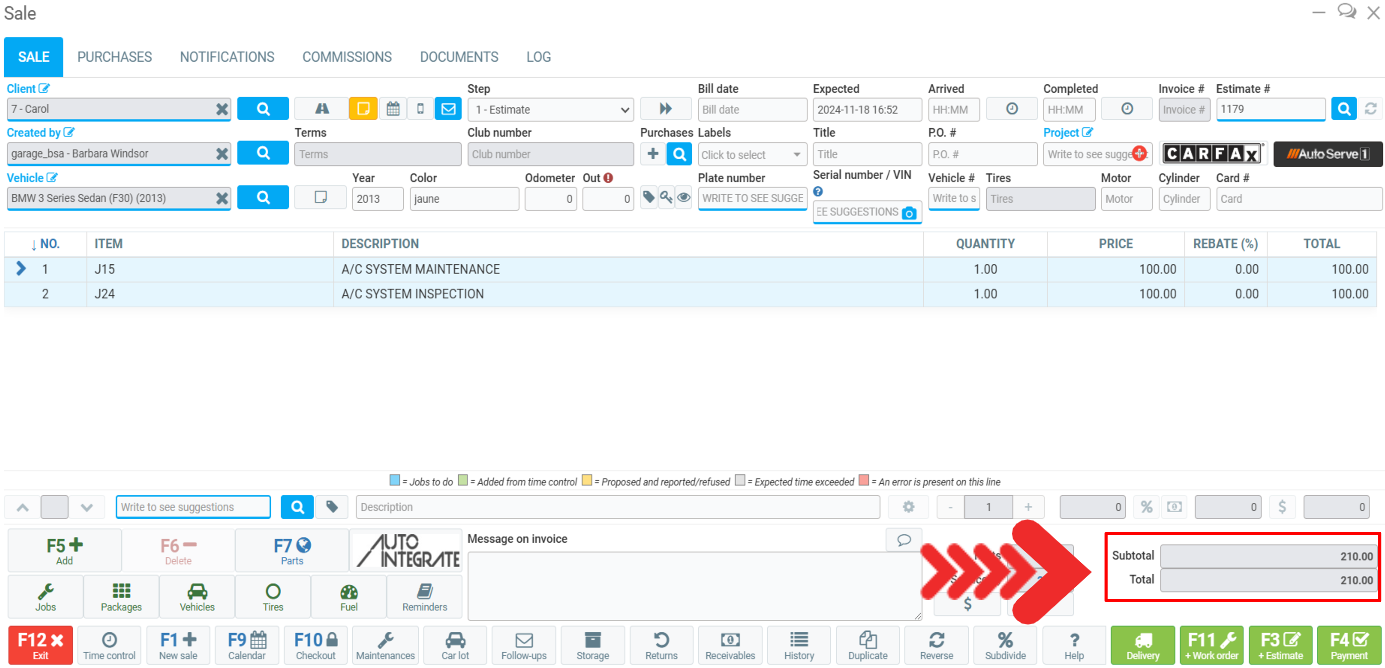

Now, verify that no taxes are now applied to the sale. Open a new sale at the Point of Sale.

The values should be set to zero in the bottom right corner of the screen.

Other articles on the subject:

How to Handle a Customer's Bad Debts

Add a Customer Name to a Business File

Adding a Group Discount to a Client's File

Posted

1 year

ago

by

Olivier Brunel

#375

274 views

Edited

7 months

ago