GEM-CAR FAQ

Pay - Adding Other Deductions

As with other types of income, it is possible to set up additional deductions.

- Alimony,

- Life insurance,

- Health insurance,

- Dental insurance,

- Social club,

- Others.

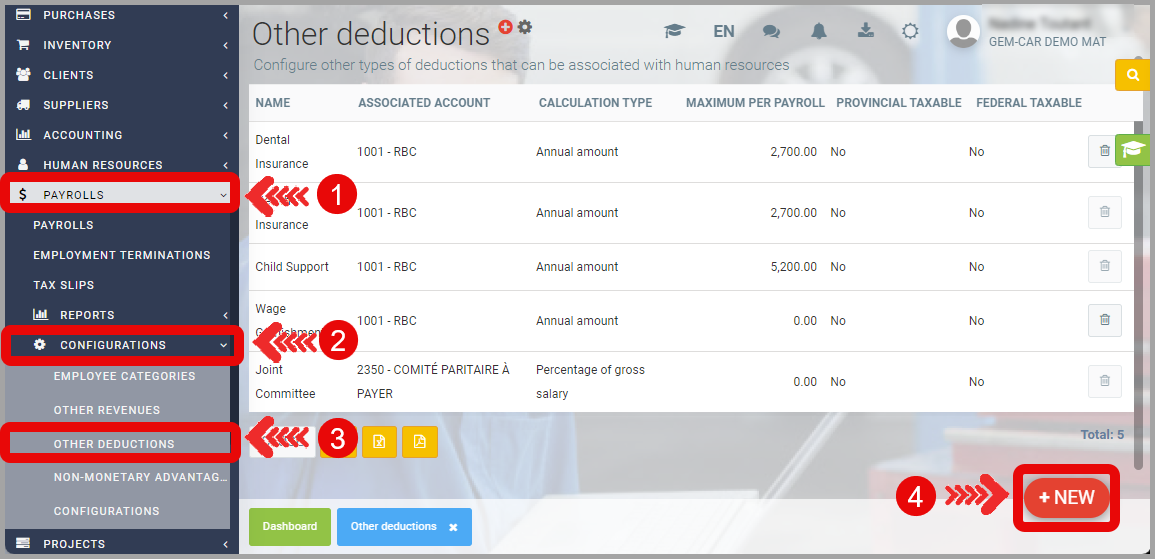

1) Setting Up Other Deductions

You can decide whether the employee pays tax on these deductions and which accounting account it is associated with.

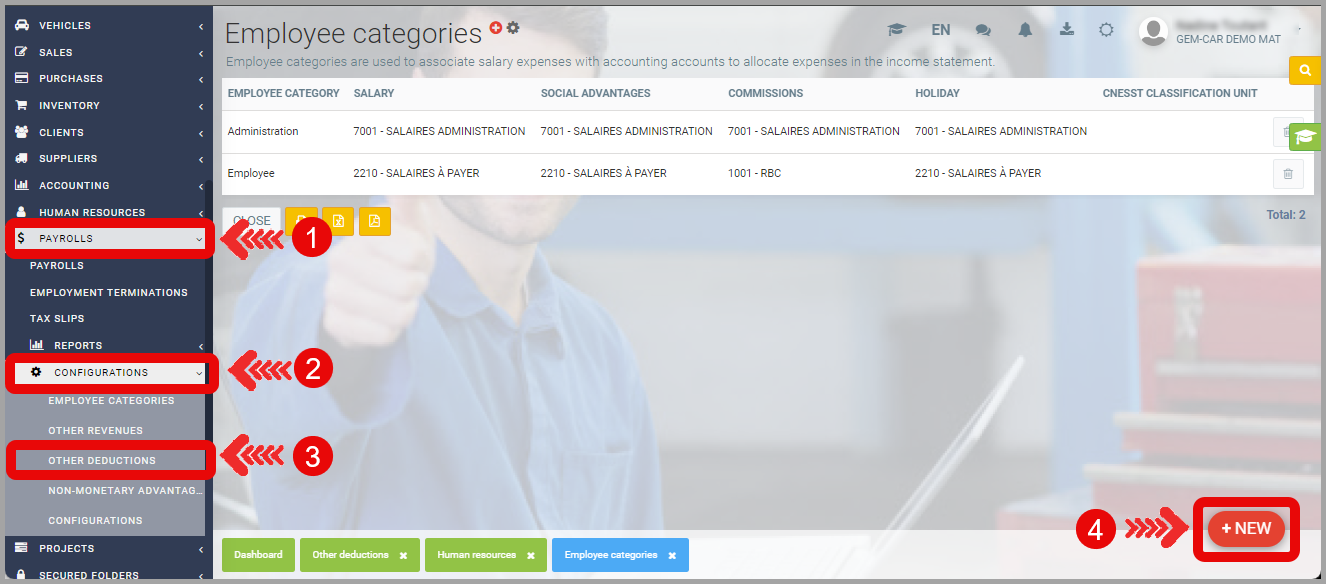

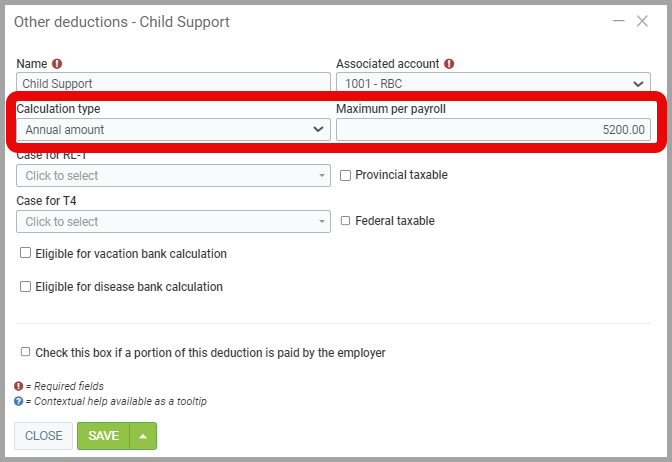

From the main menu on the left of the application, click on Payroll > Configurations > Other Deductions > +New or select one of the Other Deductions from the list to modify it.

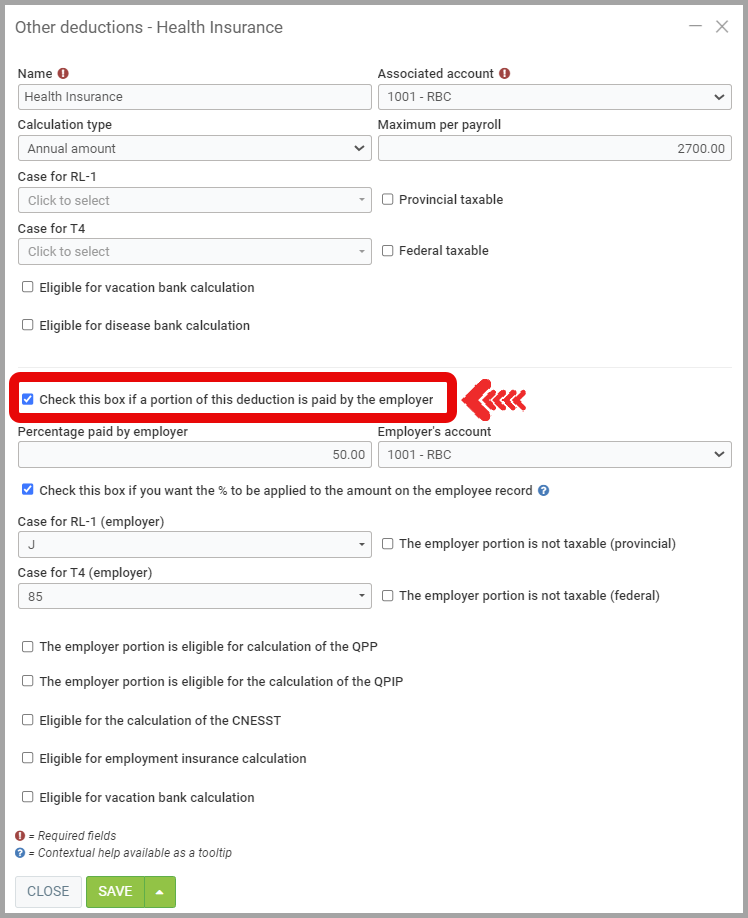

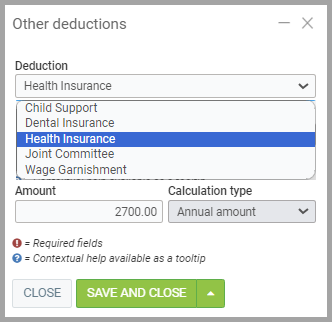

- For a deduction, it is possible to configure whether it is calculated annually, hourly, or as a percentage of the gross salary. When setting up payroll for a human resource in the next step, you can enter the amount in money or percentage according to the configuration specified here.

- You will then need to specify a name for the deduction and an associated accounting account.

- Next, you need to define the type of calculation for this deduction: Annual Amount, Percentage of Gross Salary, or Hourly Amount.

- Identify the accounting account associated with this deduction.

- Decide if the employee pays tax on this deduction, meaning whether the tax will be calculated before or after the deduction.

- There is also a checkbox to indicate if the employer is the one who pays the amount instead of the human resource.

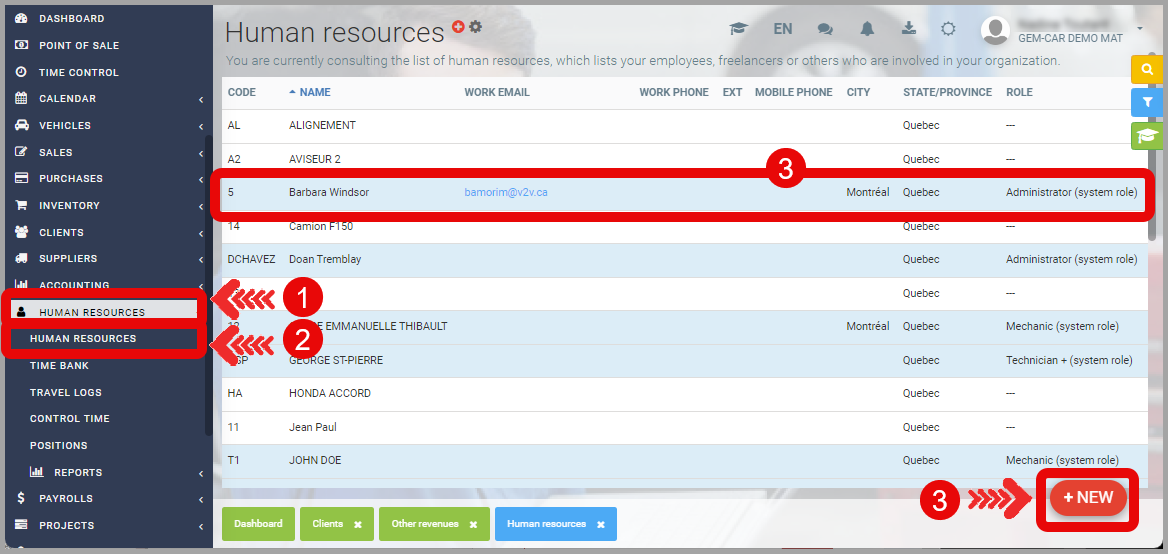

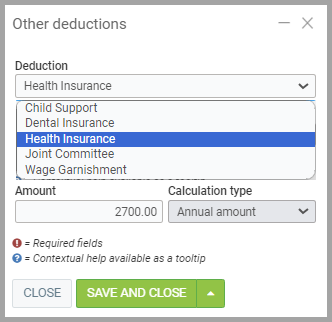

2) Adding Other Deductions to the Employee

From the main menu on the left of the application, click on Human Resources > Human Resources > +New or select the human resource you wish to modify.

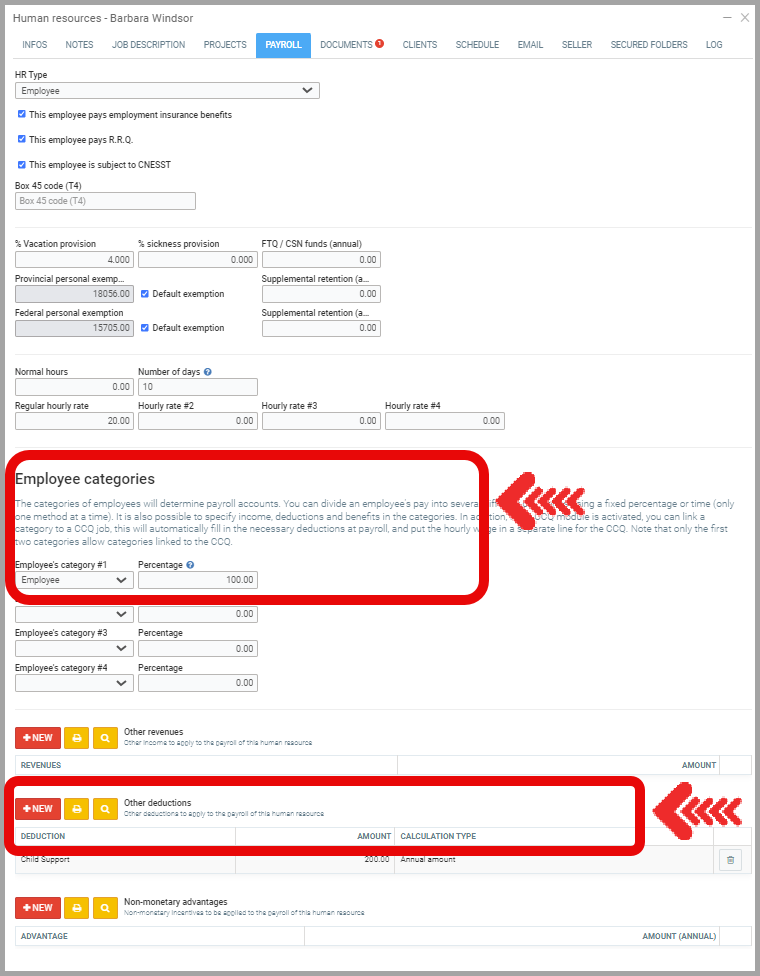

Under the Payroll tab, for Other Income, click on +New.

Note: Do not forget to consider that Other Deductions may already apply based on the Employee Category. If an alimony deduction, for example, already applies to the category (we will see how to apply a deduction to a category in point 3) and you also add it to the resource, it will be applied twice.

To add the Deduction, select the income from the drop-down menu. The displayed incomes are those created following the procedure in point 1. Enter the amount corresponding to what you want added each period.

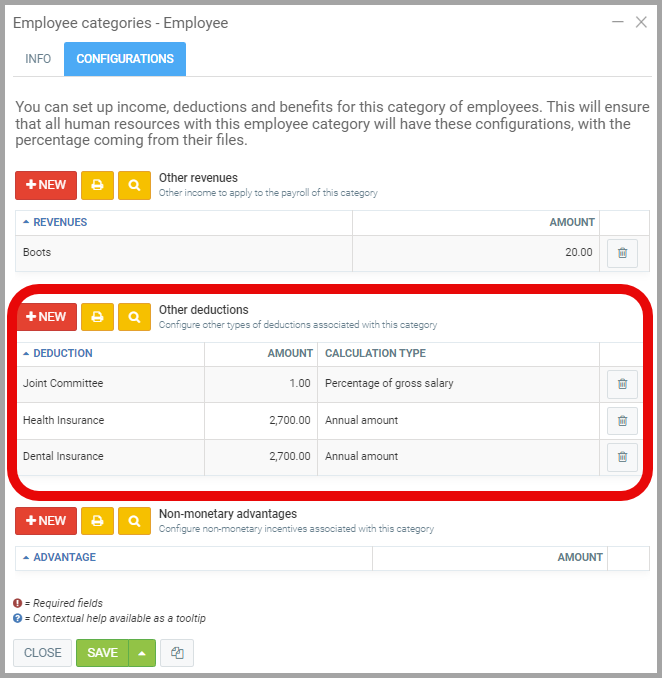

3) Adding Other Income to an Entire Employee Category

From the main menu on the left of the application, click on Payroll > Configurations > Employee Categories > +New or select the category you wish to modify.

Under the Configurations tab, for Other Deductions, click on +New.

To add the income, select the income from the drop-down menu.

The displayed deductions are those created following the procedure in point 1. Enter the amount corresponding to what you want added each period.

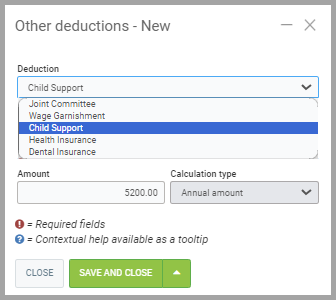

3) Example of Adding an Child Support Deduction

- In the case of a fixed Child Support amount deducted from each pay, use Annual Amount. If you want $200 to be taken from each pay, enter $5200 for bi-weekly pay.

- In the left menu, click on Human Resources > Human Resources > +New or select the human resource you wish to modify.

- Under the Payroll tab, for Other Income, click on +New.

- Select the Deduction Alimony, $5200 for the Amount and Annual Amount.

Learn More?

Configuration of Human Resources for Payroll

Creating Employee Categories

Payroll Configuration

Paying Employees

Configurations for Paying Commissions to Sellers

Posted

1 year

ago

by

Nadine Toutant

#1812

338 views

Edited

1 year

ago