GEM-CAR FAQ

Configuration of Human Resources for Payroll

1) Payroll Module Configuration

Attention! This tab will only appear on your Human Resources file if you subscribe to the Payroll module and the company processes employee payroll internally, rather than using external payroll services.

To use the GEM-CAR payroll module to pay an employee, it is necessary to configure the human resource.

- Create a Human Resource under the employee's name. See Creation and Configuration of Human Resources for more details.

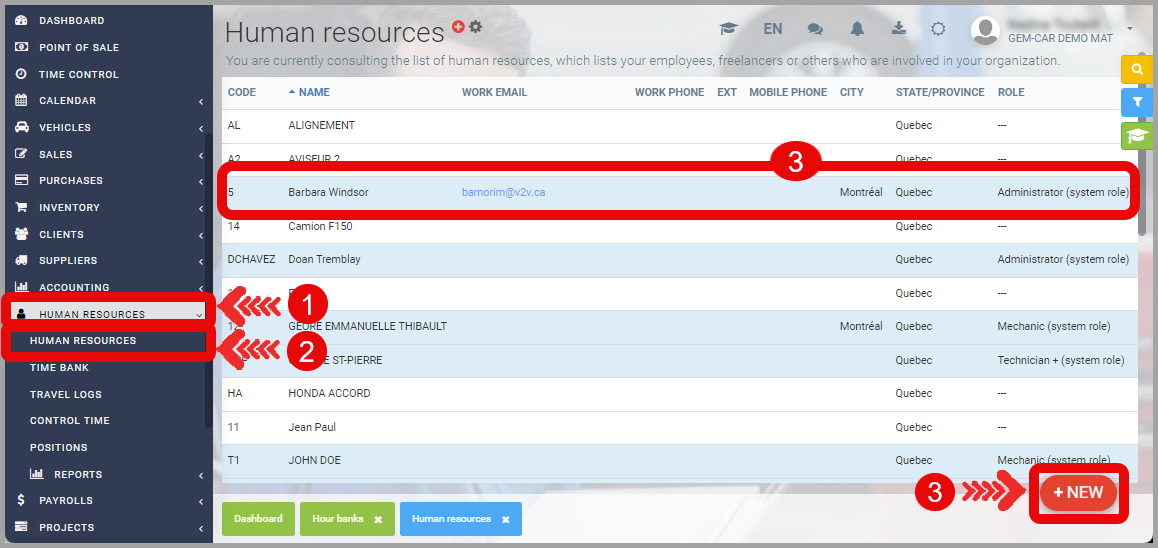

- From the main menu on the left side of the application, click on Human Resources > Human Resources > Select a Human Resource or click on +New to create a new one.

- Click on the Payroll tab.

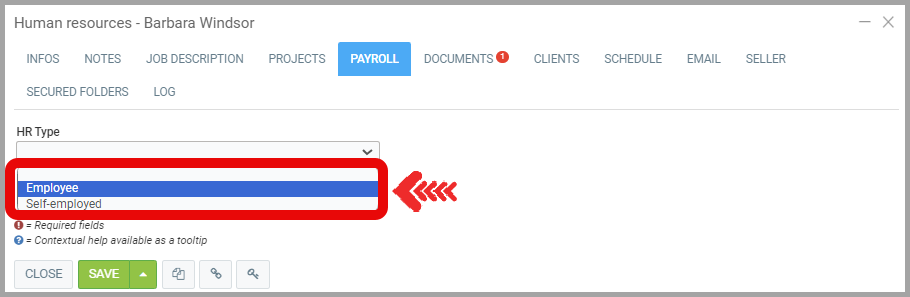

The preparation of the Payroll file varies depending on the choice of Human Resource Type:

- Employee,

- Self-employed worker.

2) Employee

Human Resource Type: Employee

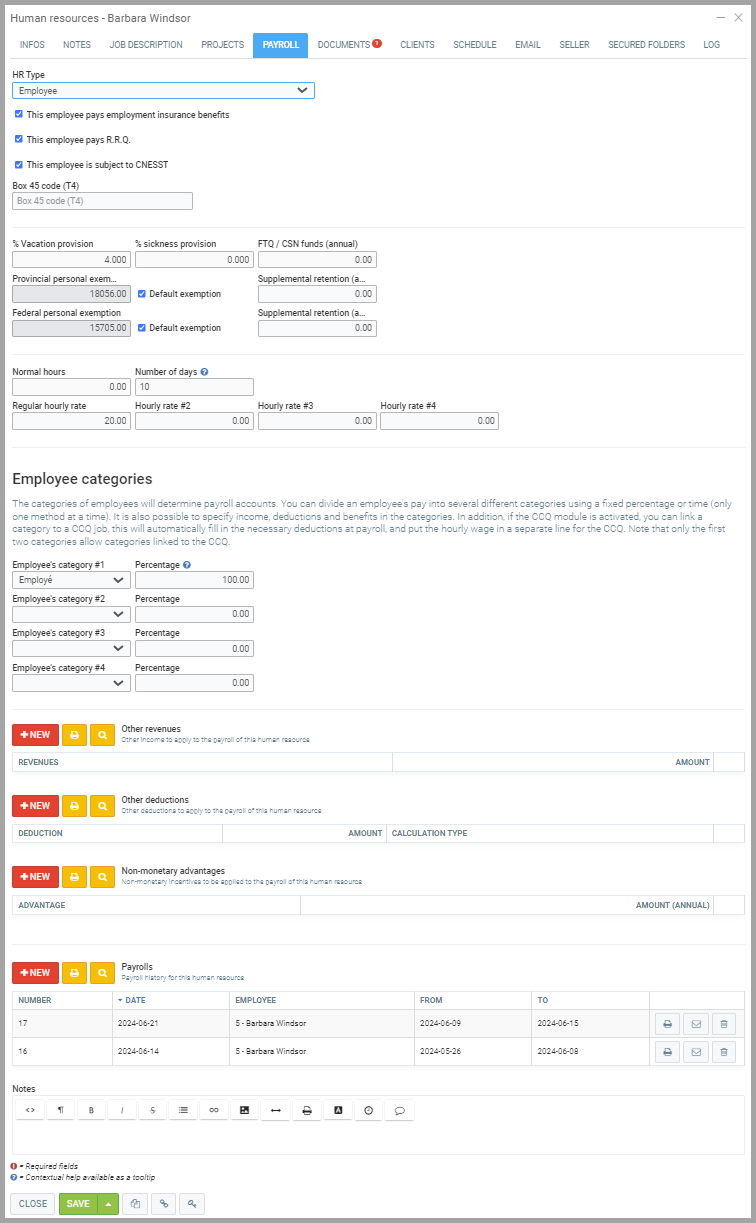

For a human resource working for you as an Employee, payment for their services will appear on your payroll list, and their complete file must be filled out with all the necessary data by your payroll department staff.

When selecting Employee, a form to be filled out will appear.

Employment Insurance, QPP, and CNESST

In Quebec, employees must by default contribute to Employment Insurance (EI), the Quebec Pension Plan (QPP), and CNESST. Therefore, all three elements should be checked unless the law provides an exception for the employee. For example, if an employee owns a certain percentage of the company's shares, the Employment Insurance box should not be checked. Also, due to age, an employee may not have to pay QPP.

Vacation and Sick Leave Provision

To better understand how Sick Leave Provisions work, see Management of Human Resources Hours Bank: Sick Leave, Vacation, and Hours in Bank.

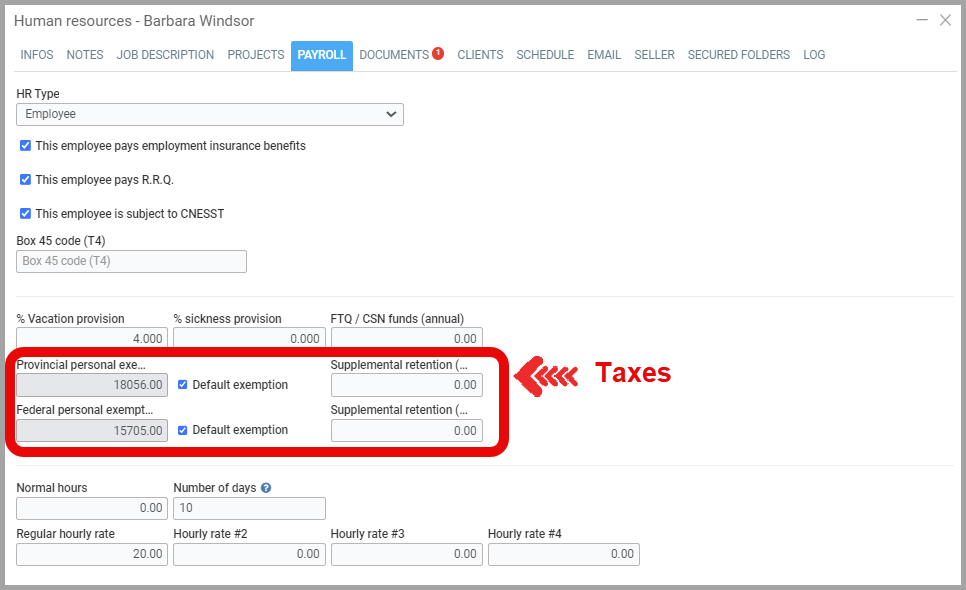

Taxes

Under certain circumstances, an employee may be exempt from paying tax on a certain amount. This could be the case, for example, for an indigenous employee. See the laws in effect on this matter. By default, in Quebec and Canada, employees are exempt from paying tax on the first $18,056 and $15,705 of earned income.

An employee could also request additional deductions from their salary for provincial and federal taxes.

Hourly Rate

It is possible to use different hourly rates for the same employee. Overtime could justify this. So, you could enter the regular rate, time and a half rate, or even double time rate.

In Quebec, Employment Insurance requires knowing the hours worked by an employee. You must now enter the normal number of hours and a normal hourly rate. If an employee is paid a fixed amount per week, indicate a number of hours and an hourly rate that will correspond to their salary.

Employee Categories

An employee can divide their time by percentage into two employee categories, so that financial statements reflect this information.

See Creation of Employee Categories for more information on this subject.

Other Types of Income

See Other Types of Income for more information.

Other Deductions

See Other Types of Deductions for more information.

Non-Monetary Benefits

See Non-Monetary Benefits for more information.

Payroll

Find all the payrolls generated for the employee here. You can generate a payroll by piece by clicking on +New.

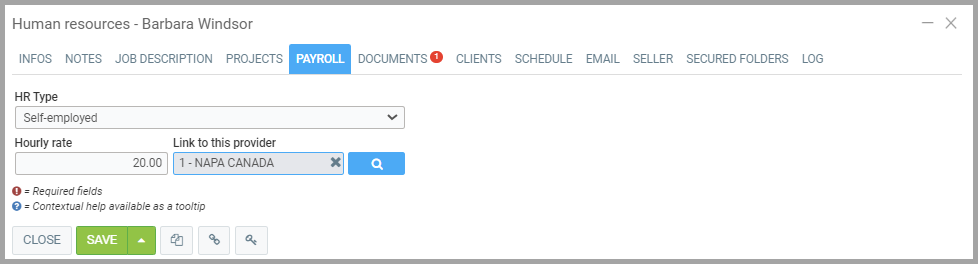

3) Self-Employed Worker

For a human resource working for you as a Self-Employed Worker, payment for their services will appear on your payroll list.

- You will then select Self-Employed Worker in the dropdown list of the Human Resource Type field.

- Indicate the hourly rate payable to this freelancer for their services.

Want to know more?

Configuration of Human Resources for Payroll

Creating Employee Categories

Payroll Configuration

Pay Employees

Posted

1 year

ago

by

Olivier Brunel

#826

512 views

Edited

1 year

ago