GEM-CAR FAQ

Payroll Configuration

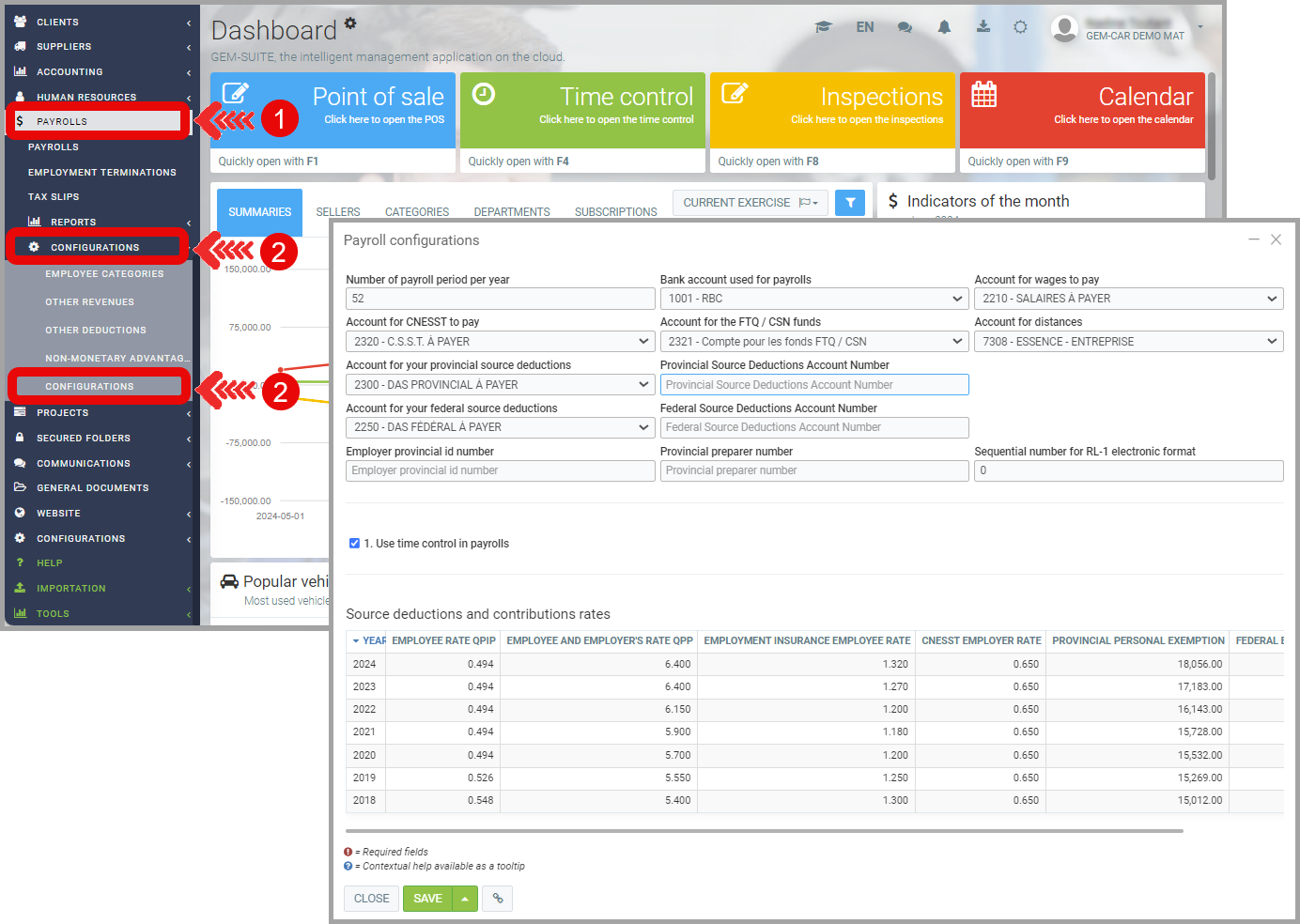

In order to use the payroll module, it is necessary to perform some basic configurations.

From the main menu located on the left side of the application, click on Payrolls > Configurations > Configurations.

Make sure to correctly enter all the required accounts so that payroll transactions are created in the correct accounts.

The Number of pay periods per year is important to enter because GEM-CAR calculates the annual income for tax calculations based on this. For example, if an employee's current pay is $500 and the number of pay periods per year is 52, GEM-CAR will understand that the employee has an annual salary of $26,000.

- Bank account for payroll

- Account for salaries payable

- Account for CNESST payable

- Account for FTQ/CSN funds

- Account for travel expenses

- Account for your provincial source deductions (In the Chart of Accounts)

- Provincial source deductions account number (From your institution)

- Account for your federal source deductions (In the Chart of Accounts)

- Federal source deductions account number (From your institution)

- Provincial employer identification number

- Provincial preparer number

- Sequential number for Relevés 1 electronic format

Under these configurations, you will see a table titled Withholding Tax Rates and Contributions. This table shows the rates in effect by the government each year. It is recommended not to modify these figures as they are governed by the government.

Learn More?

Configuration of Human Resources for Payroll

Creating Employee Categories

Payroll Configuration

Pay Employees

Posted

10 months

ago

by

Olivier Brunel

#820

187 views

Edited

7 months

ago